This post was originally published on this site

The Kraft Heinz Company (KHC) is one of the largest packaged food enterprises in the world. Ever since Kraft and Heinz merged in 2015, the new stock creation has had a tough time gaining traction. Almost insurmountable debts and the lack of hard asset backing through a tangible book value have made it difficult to achieve any type of sales growth. However, the coronavirus shelter-in-place orders all over the globe play right into Kraft’s portfolio of assets and sales. If our new reality is the vast majority of Americans will be staying at home to eat, more than ever before in modern times, the company will benefit on a number of fronts.

The company offers its products under the Kraft, Oscar Mayer, Heinz, Philadelphia, Lunchables, Velveeta, Planters, Maxwell House, Capri Sun, Ore-Ida, Kool-Aid, Jell-O, Classico, McCafe, Tassimo, TGI Fridays, Taco Bell Home Originals, Plasmon, Pudliszki, Honig, HP, Benedicta, Karvan Cevitam, ABC, Master, Quero, Golden Circle, and Wattie’s brands. Heinz ketchup, Kraft macaroni & cheese, Planters nuts, Ore-Ida frozen potatoes, Smart One frozen meals and others have been huge sellers under U.S. quarantine orders and consumer stockpiling trends since February.

Image Source: Company Website

Image Source: Company Website

To be honest I have had a steadfast bearish rating on the stock for years. Here is a link to one of my pessimistic reads of Kraft Heinz when it was trading at $63 a share in July 2018. The company still holds more debt than the typical S&P 500 selection, and excessive interest expense will still weigh on future shareholder upside for years. However, bearish attitudes and lack of interest by analysts and investors alike may have opened up an opportunity for contrarian thinkers. Given the uptick in sales from the COVID-19 situation remains, additional gains for defensive-minded investors may materialize the rest of 2020.

Bullish Data Points

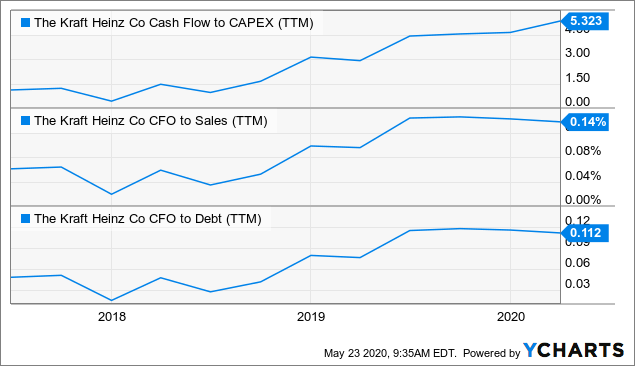

Kraft Heinz has been slashing costs, selling assets and taking goodwill impairment for several years, trying to find the right operating balance with stagnant sales trends and competition in the food industry. Early last year, Warren Buffett of Berkshire Hathaway (BRK.B) (BRK.A) even admitted his significant 27% holding in the company failed to properly account for the debt overhang on long-term results. Kraft slashed its dividend and capital expenditures in 2019 to help unlock cash flow for debt reduction. Below you can review some metrics witnessing improvement from lower investment in plant/equipment and the acquisition of smaller brands under Kraft’s umbrella. Cash flow to capital expenditures, sales and debt have been moving in the right direction since 2018.

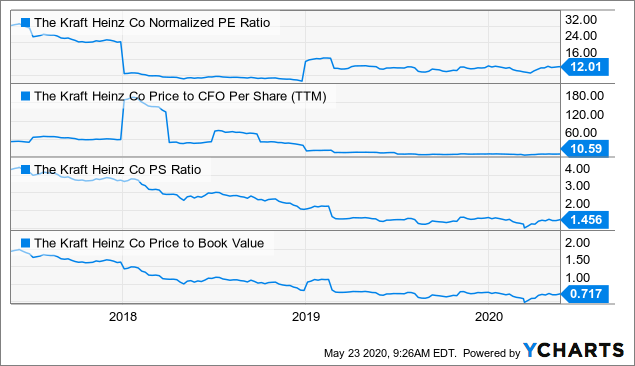

In addition, stock valuations on steady (albeit slow to grow) operating results have also improved as a function of the large price slide from $92 in early 2017. Below you can see price to trailing earnings, cash flow, sales and book value in combination reached for five-year lows in March. At $29 a share today, Kraft looks to be a stronger buy candidate vs. a few years ago based on valuations.

The biggest reason Buffett likes Kraft is its brand-name consumer staple ownership of stable and defensive revenues, even during recession. Plus, a high dividend return of capital, rising with money printing and inflation rates in the U.S., translates into better long-term total returns vs. income generated in the bond market. For yield hungry retirees or those searching for total returns outside of fixed income investments, Kraft could be a viable and smart option at prices under $30. The trailing dividend yield of 5.3% is a well above the alternative S&P 500 average of 1.9%, or the entire U.S. Treasury yield curve under 2%. Then consider a prolonged recession and stay-at-home future could force S&P 500 dividend cuts and even lower bond rates later in 2020. Conversely, Kraft’s dividend payout should be safe or possibly rise into 2021 from a stronger than expected profit picture.

Technical Momentum Turnaround

Kraft Heinz may have bottomed in March on the appearance of coronavirus and its positive influence on packaged food demand. Signs of a reversal in fortunes for the company have popped up in April-May. The common equity price is only down -3% year-to-date against a -15% return for the Wilshire 5000 or -10% drop in the S&P 500. Below you can review Kraft’s strong outperformance trend against the S&P 500 blue-chip average marked with a green line. From the middle of February, Kraft gained 25% better than the market into May.

The red circle highlights the super strong accumulation trend on falling volume days (buying on weakness) in the Negative Volume Index (NVI). Since early April, high volume selling has all but disappeared, represented by the rising On Balance Volume (OBV) line. Lastly, Kraft is trading handily above its simple 200-day moving average and well above its 50-day creation. My read of the technical setup is a move above $32 a share, nearer its 52-week high, will be confirmation the tide is turning bullish for Kraft owners.

The red circle highlights the super strong accumulation trend on falling volume days (buying on weakness) in the Negative Volume Index (NVI). Since early April, high volume selling has all but disappeared, represented by the rising On Balance Volume (OBV) line. Lastly, Kraft is trading handily above its simple 200-day moving average and well above its 50-day creation. My read of the technical setup is a move above $32 a share, nearer its 52-week high, will be confirmation the tide is turning bullish for Kraft owners.

Final Thoughts

I am hoping to buy Kraft Heinz shares on short-term weakness, especially if correlated with a comparable decline in the S&P 500 into June. A price target of $35-40 by December seems reasonable. Together with a high dividend yield, Kraft’s 15-25% total return potential for calendar 2020 would be a great result for most investors. I rate Kraft Heinz as a solid income and defensive choice for long-term owners, if the coronavirus pandemic recession worsens or lingers throughout 2020-21.

Looking forward, the current recession effect of lower interest rates could potentially help Kraft refinance debts at less expense. Given more robust organic sales, the bond rating agencies might even put a better score onto Kraft’s debt. For the company, a 1% drop in total borrowing costs would shave $300 million in annual expense. For investors, the expanding spread between rising sales and declining fixed costs could translate into much higher operating cash flow and income next year.

Insiders have made 19 equity purchases against zero sales the last six months, according to SEC filings. Management believes Kraft has a bright future, despite trying to downplay the 2020-21 outlook to analysts. It sounds to me like the foundation has been laid for strong sales/earnings beats the rest of the year, just like the latest quarterly report.

I would rank Kraft as another smart food-related buy, with inflation hedge characteristics like others mentioned during 2020 on Seeking Alpha. JM Smucker (SJM), Kroger (KR), Coca-Cola (KO), Archer-Daniels-Midland (ADM) and MGP Ingredients (MGPI) are good targets to research and contemplate holding in a diversified portfolio design. You can find stories on each by clicking through my name at the top of this article.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Want to read more? Click the “Follow” button at the top of this article to receive future author posts.

Disclosure: I am/we are long KR, SJM. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only. All opinions expressed herein are not investment recommendations, and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. This article is not an investment research report, but an opinion written at a point in time. The author’s opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information, and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. Any and all opinions, estimates, and conclusions are based on the author’s best judgment at the time of publication, and are subject to change without notice. Past performance is no guarantee of future returns.