This post was originally published on this site

About

PC Connection, Inc. (CNXN) describes itself as a “value-added reseller” of IT products and solutions. This means that they don’t manufacture computer products; they resell computer systems, software, and network accessories. They also help customers select and setup their IT systems. As their 10-Q describes:

We believe more of our customers are seeking comprehensive IT solutions, rather than simply the acquisition of specific IT products. Our advantage is our ability to be product-neutral and provide a broader combination of products, services, and advice tailored to customer needs.

We are able to provide customers complete IT solutions, from identifying their needs, to designing, developing, and managing the integration of products and services to implement their IT projects… The technical certifications of our service engineers permit us to offer higher-end, more complex products that generally carry higher gross margins.

In Q1:20, 47% of sales came from large enterprise customers, 39% came from small and medium-sized businesses, and 14% came from governmental and educational customers in the public sector. Laptops accounted for 28% of sales and accessories accounted for 18%. The remaining sales were fairly evenly split between desktops, software, hardware, networking products, and displays.

Fundamentals & Valuation

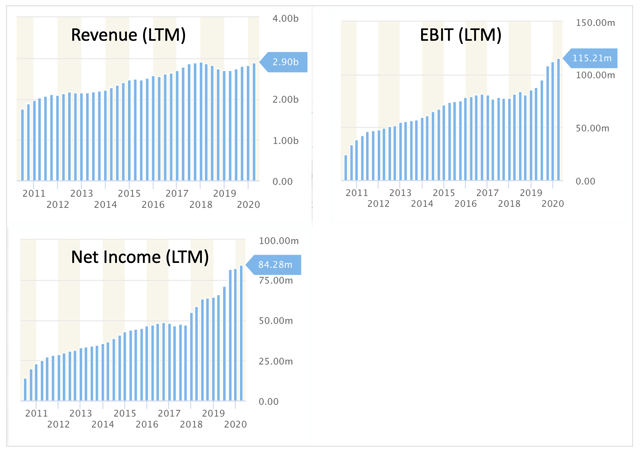

EBIT and net income (NYSE:LTM) have been steadily increasing since 2011 and are currently at record highs, according to data from StockRow. Revenues (LTM) are close to a record high as well, and in Q1:20 increased 12.5% YoY (see below).

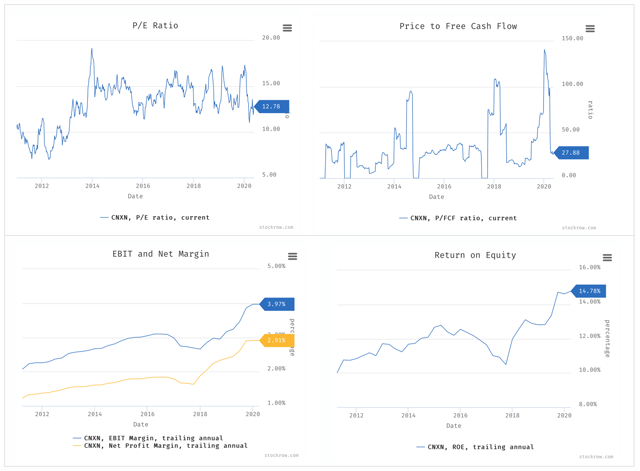

ROE, EBIT margin, and net margin are at record highs since 2012. Meanwhile, the stock’s P/E is near the bottom of its post-2014 trading range, and its P/FCF multiple is essentially unchanged from the middle of 2012 (see below).

ROE, EBIT margin, and net margin are at record highs since 2012. Meanwhile, the stock’s P/E is near the bottom of its post-2014 trading range, and its P/FCF multiple is essentially unchanged from the middle of 2012 (see below).

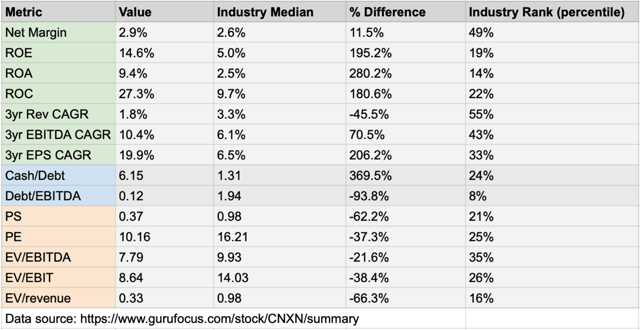

PC Connection also has a healthy cash pile, more than six times the size of its debts. Meanwhile, its ROE, ROA, and ROC are triple the median of its peers in the hardware industry, according to data from GuruFocus. It also boasts an impressively high Altman-Z Score of 7.09, suggesting low risk of bankruptcy.

And while its revenue growth is slower than that of its peers, its EBITDA and EPS growth rates are noticeably higher than those of its peer group. Despite these strong efficiency and growth metrics, many of PC Connection’s valuation multiples are well below those of its peer group (see below).

PC Connection’s business model appears to have responded to COVID-19 fairly well. In its latest 10-Q, the company notes that customers in the hospitality, airline, and retail industries are most at risk, especially small and medium-sized businesses in its Business Solutions segment.

PC Connection’s business model appears to have responded to COVID-19 fairly well. In its latest 10-Q, the company notes that customers in the hospitality, airline, and retail industries are most at risk, especially small and medium-sized businesses in its Business Solutions segment.

Yet, Q1:20 sales actually benefitted from COVID-19 as more companies are allowing employees to work from home, resulting in an increased demand for laptops and other computer accessories. Even the Business Solutions segment, which the firm noted as especially at risk, saw sales increase 10.2% YoY. Sales from large enterprises rose 21% YoY. Public sector sales saw more modest growth, about 4.5% YoY, due to some larger Federal Government projects that started in Q1:19 but did not repeat this year.

The company is preparing for additional headwinds from Coronavirus. As its 10-Q notes:

We may also experience delays in collecting amounts owed to us, and in some cases, may experience inabilities to collect altogether. As a result, we have increased our reserve against uncollectable amounts, which resulted in a significant increase in our operating expenses in the first quarter.

The company hopes to expand margins in the future by shifting its revenue mix, focusing more on the higher-margin IT solutions provided by their skilled service engineers. In the short-term, this could mean that their cost of services will increase as they add more engineers. Management believes that this is worth it in the long run.

Finally, institutional interest in the company has seen a market increase over the years. Institutional ownership has tripled since January 2014, rising from 11% to 34% since then. It’s also interesting to note that influential investor Jeremy Grantham is the 10th largest investor in the company.

Bottom Line

PC Connection is cash-rich, more efficient than competitors, and is reasonably hedged against the economic fallout of Coronavirus. Though the deteriorating economic conditions present a headwind, the work-from-home trend provides a potential source of additional demand for their products and services.

Valuation multiples look attractive on a historical and relative basis, and the share price has recovered from its mid-March lows and has recently broken above the 50-day moving average. Though net margins are still modest (below 5%), the company believes margins could improve as it increases its focus on its higher-margin IT solutions. Overall, the stock will likely interest value investors looking for businesses that are decently hedged against the economic fallout of Coronavirus and have feasible plans for margin expansion.

Disclosure: I/we have no positions in any stocks mentioned, but may initiate a long position in CNXN over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.