This post was originally published on this site

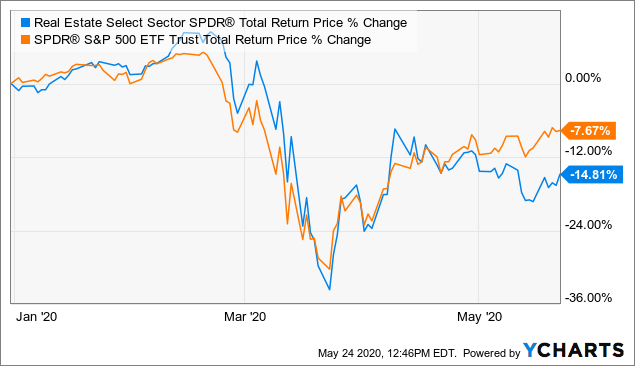

The Real Estate Select Sector SPDR ETF (NYSE:XLRE) with $4.0 billion in total assets tracks the basket of real estate companies that comprise the sector within the S&P 500 Index (SPY). This year, real estate stocks have witnessed historic levels of volatility considering the disruptions caused by the ongoing coronavirus pandemic. XLRE is down by 15% in 2020 compared to an 8% decline in the S&P 500. The potential for long-lasting damages to the economy and a changing landscape for real estate highlight ongoing risks. Retail and office REITs, in particular, are facing unique challenges dealing with new realities of social distancing guidelines which we believe will structurally lower the long term growth outlook. We take a more cautious outlook on shares of XLRE that should continue to be pressured by macro weakness and continued poor market sentiment towards the sector.

(source: finviz.com)

XLRE Background

In contrast to several other “real estate” ETFs available to investors, XLRE is unique in that the strategy focuses on the U.S. large-cap companies which are typically leaders in their segment. The concentrated portfolio of just 31 holdings weighted by market-capitalization is comprised of all the real estate investment trusts within the S&P 500 along with CBRE Group Inc. (CBRE) as the single firm classified as a real estate management and development.

(source: State Street Global)

The group can be further segmented across their varying industries and focus markets of operations including retail, office, industrial, residential, healthcare, hotels & hospitality, and or “specialty”. Specialty in this context refers to REITs that own non-traditional real estate assets such as data-centers and cell-towers.

What the group of stocks shares in common is the core business function of owning and leasing income-generating properties while meeting several regulatory requirements to maintain a REIT classification. Companies classified as REITs receive favorable tax benefits on the condition of distribution a large portion of their income, at least 90%, to shareholders in the form of dividends each year. The allure of steady and consistent income backed by real assets makes this group attractive to income-focused investors.

Factors driving the appreciation of real estate including steady economic growth, stable and low-interest rates, favorable market demographics, and the relaxed tax/regulatory environment have been positive for the sector over the past decade. On the other hand, the emergence of the coronavirus pandemic has represented a major disruption and significant uncertainty for the group evident by extreme volatility in real estate stocks and the XLRE ETF this year.

XLRE Performance

XLRE is down by 15% this year, compared to an 8% decline in the S&P 500, although both have rebounded significantly from lows in late March. XLRE was down by as much as 39% year to date on March 23rd and has since rebounded by over 30% in the period since highlighting the wide trading range.

Data by YCharts

Data by YCharts

Taking a look at the 31 constituents of the XLRE ETF, the distribution of returns shows more widespread weakness among most stocks this year. We note that 27 stocks of the 31 holdings have a negative return year-to-date, while the average stock is down by 24% this year.

The overall performance of the fund has been supported by the top holdings including specialty REITs or “tech-REITs” with a positive return this year. American Tower Corp (REIT)”>AMT), Crown Castle International (CCI), Equinix Inc (EQIX), Digital Realty Trust Inc (DLR), and SBA Communications Corp (SBAC) together represent 43% of the fund. CCR, EQIX, DLR, and SBAC are each up by 7%, 11.3%, 10.1% and 16.9% respectively this year.

EQIX and DLR focus on data centers used for internet connections and cloud computing as segments that have been relatively immune to the disruptions of the coronavirus pandemic this year. In some ways, data center REITs have even benefited given trends during the lockdown restrictions forcing work-from-home and remote computing demands. Cell-tower REITs like CCI, AMT, and SBAC have also been resilient with a belief that the infrastructure demand for the next generation of wireless technology “5G” will continue despite broader economic weaknesses.

(source: data by YCharts/ table by BOOX Research)

(source: data by YCharts/ table by BOOX Research)

The real weakness has been among the other REIT segments like retail, office, and hospitality given the complete shutdown of some industries during the early stages of the pandemic.

Simon Property Group (SPG) with a portfolio of over 200 properties across shopping centers, malls, and outlets is down by 62% in 2020. Some of the underlying retailers who are the tenants of SPG properties have in some cases missed rent payments leading to a weak operating and financial environment currently. Gap Inc (GPS), which is SPG’s largest tenant, in April suspended $115 million in rent payments and announced it would look to renegotiate leases or close stores permanently. An expectation for declining occupancy rates and lower contracted rent values in future renewals continue to drive poor sentiment in the stock.

Other retail REITs such as Realty Income Corp (O), Regency Centers Corp (REG), Federal Realty Corp (FRT), and Kimco Realty Corp (KIM) are down by 29%, 32%, 37%, and 44% each this year respectively are all facing similar pressures to varying degrees. Separately, a hospitality REIT Host Hotels & Resorts (HST) down by 37% this year has similarly bee impacted with its properties closed given the collapse of vacation and business travel.

Office REITs like Boston Properties Group (BXP) down by 41%, Vornado Realty Trust (VNO) down by 46%, and SL Green Realty Corp (SLG) are also directly impacted by the coronavirus pandemic. With social distancing requirements set to be an ongoing reality in the “new normal”, questions have been raised regarding the safety of traditional workplaces and office environment.

Many companies have allowed employees to work-from-home and telecommute leaving many workplaces empty. Facebook Inc (FB), for example, has indicated that they will allow employees to work from home through next year. The biggest risk here is that these trends become permanent which would suggest significant headwinds for office developments and a potential glut of unused space for the foreseeable future.

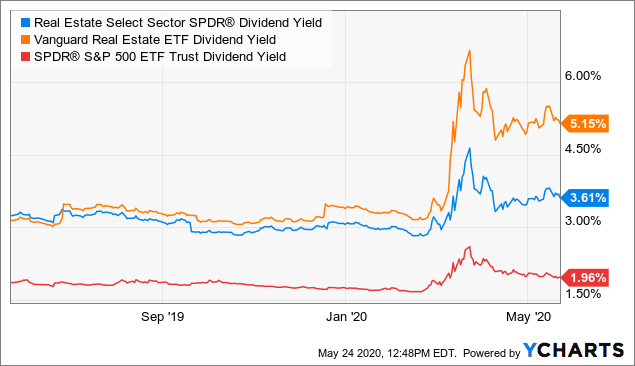

Dividend Yield

XLRE pays a quarterly dividend that is variable based on the underlying aggregate income of the portfolio holdings. The current yield at 3.6% is well above the S&P 500 which currently yields 2%, but modest compared to 5.2% for the Vanguard Real Estate ETF (VNQ). In contrast to XLRE, VNQ is a more diversified real estate fund with 183 holdings including exposure to small and mid-cap stocks. VNQ has underperformed this year down by 21% on a total return basis highlightings its higher risk. XLRE’s lower yield reflects its concentrated portfolio in the tech-REITs among the top holdings that offer lower dividend yields.

Data by YCharts

Data by YCharts

Analysis and Forward-Looking Commentary

We maintain an overall cautious outlook on real estate and the XLRE ETF considering the already significant move higher from the lows in March. Social distancing guidelines expected to remain in place for the foreseeable future continue to represent significant uncertainty. Poor sentiment should continue to be a theme driving volatility. We sense that as we head into the second half of the year, a weaker than expected recovery in economic conditions can be the catalyst for a renewed downside for the fund.

We expect retail and office real estate sectors to remain under pressure with the underlying commercial tenants forced to adjust to new operating realities in a new normal. Accelerating trends towards e-commerce and work from home now fundamentally and structurally lower the long-term growth outlook for the group.

More broadly, it’s important to not lose track of the weak macro-environment. A current recession and surge in unemployment now represent a reversal of the trends that benefited the real estate sector over the past decade. The outlook has deteriorated in our opinion.

While the high concentration of the specialty or tech-REITs in XLRE has supported its total return this year, we think it represents a structural weakness limiting the value of the fund as a long term holding. Cell-tower and data-center REITs may be “hot” right now, but a correction lower during a new market cycle would materially impact XLRE leading to underperformance. We question some lofty valuations in this segment that may already be pricing in a best-case scenario. These stocks are also not immune to a cyclical downturn.

Investors that are particularly bullish on the economic outlook and see a quick containment of the global pandemic may find compelling value across individual REITs. If that’s the case, we think XLRE is not the best vehicle to play a recovery. In a bullish environment, we would expect more diversified REIT ETFs like VNQ to outperform to the upside with more value in beaten-down names. The higher yields in VNQ, along with other REIT ETFs alternatives, may offer more value. To the downside, a deterioration of the global macro outlook and weaker than expected recovery could lead to renewed volatility and further losses among the group.

Are you interested to learn how this idea can fit within a diversified portfolio? With the Core-Satellite Dossier marketplace service, we sort through +4,000 ETFs/CEFs along with +16,000 U.S. stocks / ADRs to find the best trade ideas.

Click here for a two-week free trial and explore our content.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.