This post was originally published on this site

U.S. Treasury bonds aren’t a bad place to be when global tensions heat up. Investors over the past month have rediscovered this truth, as Treasurys have rallied in the wake of Russia’s invasion of Ukraine. This came as a surprise to some, who had otherwise written off bonds because of rising inflation. But when geopolitical worries lead to a flight to safety, Treasurys are a prime beneficiary.

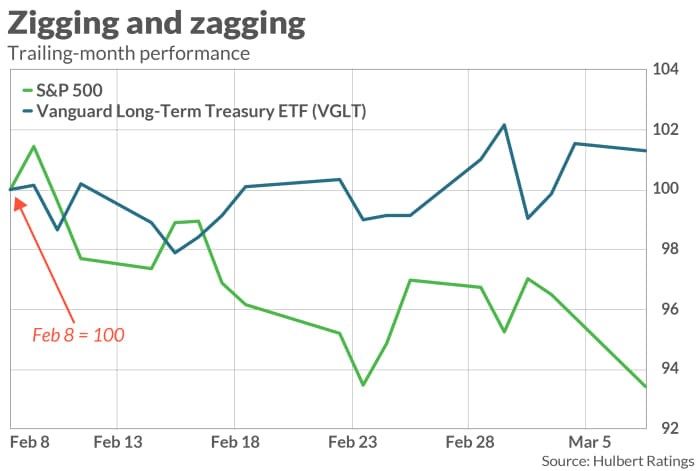

Over the past month, for example, while the S&P 500

SPX,

was losing more than 6%, intermediate-term Treasurys gained 0.8% and long-term Treasurys gained 1.2% (as measured by Vanguard Intermediate-Term Treasury

VGIT,

and Vanguard Long-Term Treasury

VGLT,

ETFs). As a result, the long-maligned 60/40 portfolio lost only about half as much as the all-equity portfolio.

This doesn’t mean that the inflation-is-bad-for-bonds narrative is wrong. Treasurys have lost significant ground over the past year, but inflation is only one of the risks against which you might want to hedge your stock holdings. Another is a flight to safety when risky assets suffer.

Bonds’ recent experience is consistent with what market historians have found from past crises. Consider a 2020 study published in Oxford University’s Review of Financial Studies, entitled “Flights to Safety.” Its authors were Lieven Baele of Tilburg University; Geert Bekaert of Columbia University; Koen Inghelbrecht of Ghent University, and Min Wei of the Federal Reserve. They created a database of extreme “flight to safety” episodes in 23 countries, and found that during these times, bonds outperformed stocks by an average of 2.79% per day.

You might say this is all well and good for the (thankfully) rare flight to safety episodes, but is of little help the rest of the time. Such criticism may be unfair. You don’t stop buying fire insurance on your house just because the insurance company rarely (hopefully never) pays you anything in return.

Another comeback might be that bonds only provide this insurance in extreme situations. That is true. History contains many other, less extreme, situations in which stocks and bonds suffer in tandem.

But the inability to hedge against all bad outcomes is not a reason to discount bonds’ ability to hedge against certain ones. Think of it as catastrophic insurance or reinsurance — for which you will have to pay a premium.

The broader point is that there is nothing which will hedge against all types of risk. No such hedge has ever existed. Even if one were invented, you wouldn’t want it, since the expected return of a completely-hedged portfolio is zero. That’s because, over the long term, your investment return is compensation for incurring risk. Eliminate risk and you eliminate expected return.

The bottom line? Don’t give up on bonds just because inflation has heated up. They still have the ability to hedge potentially terrible prospects — like what we’re facing now.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com

More: The end (of the stock market correction) may be near

Also read: Warren Buffett says never to hold money during a war. Here’s a stagflation playbook for stocks.