This post was originally published on this site

Source: Getty image

Investment Thesis

SFL Corporation Ltd. (NYSE:SFL) is the only shipping company that I own in my long-term portfolio.

This shipping company has delivered impressive and steady results throughout the years because of the management’s ability to adapt to the company’s business model to the new requirements. It is an ongoing struggle, and the recent events are not different. I am confident that this bearish cycle will pass.

The fundamental element is called adaptability. SFL must adapt, and it is the primary basis of its steady success so far. The company has done well in this segment. The shift from offshore drilling to liners is one example.

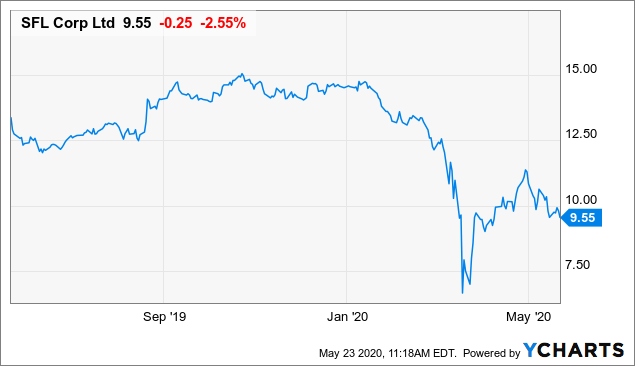

Data by YCharts

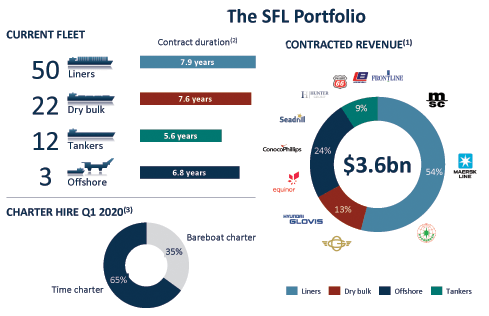

SFL’s business model is composed of four distinct segments highlighted in the presentation below.

Its current fleet is comprised of 87 ships or drilling rigs with a charter hire in Q1 2020 of 35% on bareboat charter and 65% time charter. The actual backlog of the company has remained constant sequentially at $3.6 billion.

Source: From SFL Presentation

Source: From SFL Presentation

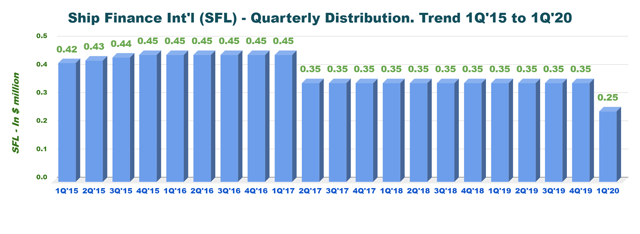

One excellent achievement which characterizes SFL is the dividend yield paid by the company. It is currently 10.4%, with a first-quarter dividend of $0.25 per share.

One excellent achievement which characterizes SFL is the dividend yield paid by the company. It is currently 10.4%, with a first-quarter dividend of $0.25 per share.  I have owned the stock for many years, and I am delighted with the results. Thus, I recommend this company as a long-term investment because it is evident that the company is here to stay and has a solid strategy that will reward its shareholders down the road.

I have owned the stock for many years, and I am delighted with the results. Thus, I recommend this company as a long-term investment because it is evident that the company is here to stay and has a solid strategy that will reward its shareholders down the road.

However, it is essential to trade the stock short term as well. This sector is highly volatile, especially with this Black Swan Event spreading darkness with its massive wings. I recommend using one-third of your holding to trade the stock based on the RSI and a technical analysis approach.

In the conference call, Ole Hjertaker said:

While our business has so far not been materially impacted by the general market disruption caused by the COVID-19 pandemic, the Board believes it is appropriate to review the dividend payout level for SFL with a focus on maintaining a strong balance sheet and investment capacity over the next few quarters in a setting with more expected market volatility. The announced dividend of $0.25 per share represents a dividend yield of around 10% based on closing price yesterday, and this is our 65th quarter with dividends.

SFL – The Raw Numbers: First-Quarter Of 2020 And Financials History

| SFL | 4Q’18 | 1Q’19 | 2Q’19 | 3Q’19 | 4Q’19 | 1Q’20 |

| Total Revenues in $ Million | 118.57 | 116.54 | 110.90 | 111.53 | 119.88 | 121.90 |

| Net Income in $ Million | 3.47 | 33.59 | 28.12 | 3.82 | 23.64 | -87.05 |

| EBITDA $ Million | 69.11 | 97.37 | 94.89 | 71.36 | 78.65 | n/a |

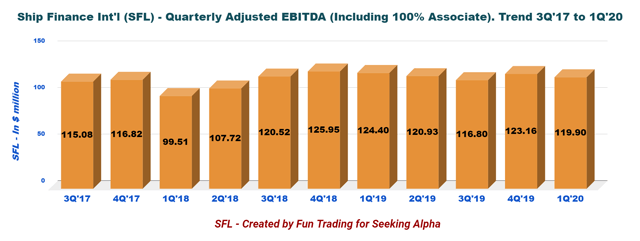

| Adjusted EBITDA in $ Million | 125.95 | 124.40 | 120.93 | 116.80 | 123.16 | 119.90 |

| EPS diluted in $/share | 0.03 | 0.31 | 0.26 | 0.04 | 0.22 | -0.81 |

| Operating cash flow in $ Million | 55.2 | 48.56 | 55.49 | 77.33 | 78.77 | 74.51 estimated |

| CapEx in $ Million | 416.7 | 1.32 | 0.84 | 27.94 | 9.22 | 22.82 estimated |

| Free Cash Flow in $ Million | -362.5 | 47.24 | 54.65 | 49.39 | 69.55 | 51.69 estimated |

| Total cash $ Million | 298.6 |

249.9 |

328.0 |

315.7 |

273.6 |

266.71 |

| Long-term debt in $ Million | 1,437 | 1,410 | 1,463 | 1,489 | 1,608 | 1,594 |

| Dividend per share in $ | 0.35 | 0.35 | 0.35 | 0.35 | 0.35 | 0.25 |

| Shares outstanding (Basic) in Million | 107.62 | 107.65 | 107.61 | 107.61 | 107.63 | 107.63 |

Source: SFL release and Morningstar

Note: Historical data from 2015 are available to subscribers only.

Revenues, Earnings Details, Free Cash Flow, And Backlog Discussion

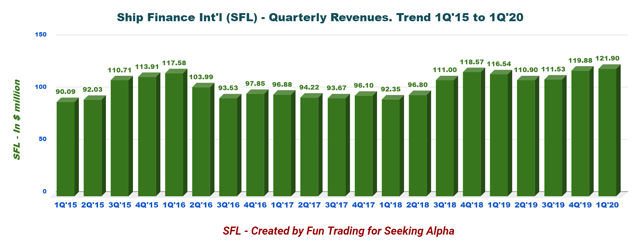

1 – Operating Revenues were $121.89 million in 1Q’20

Operating revenues were $121.896 million compared to $116.64 million the same quarter a year ago and up 4.5% sequentially. The company had a net loss of $87.054 million for the first quarter of 2020 or $0.81 per share – including approximately $114 million in non-cash negative adjustments (notably impairment charges of about $80.5 million in the quarter relating mainly to seven Handysize bulk carriers).

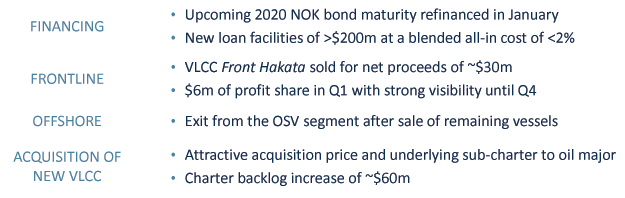

This quarter, the company said it added in the backlog approximately $230 million. It includes charter extensions for ten container vessels, and a vessel acquisition of a 2020-built scrubber fitted VLCC for $65 million with a seven-year charter to Landbridge Group and an underlying three-year sub-charter to an oil major.

Recent Events:

Source: SFL Presentation

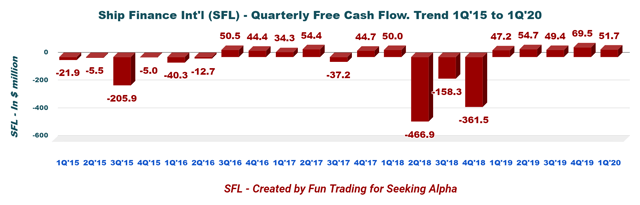

2 – Free cash flow is estimated at $51.7 million in 1Q’20

Note: Calculating SFL organic free cash flow or FCF is a difficult task. The first quarter indicated above in the chart is only a Fun Trading estimate. 1Q’20 free cash flow is estimated at $51.69 million, which represents an annual free cash flow (“ttm”) of $225.278 million.

The free cash flow is showing that the company could have afforded a dividend at $0.35 per share. Still, due to the COVID-19, the company decided to be extra prudent even if no material business interruptions resulted from the COVID-19 pandemic in Q1. Thus, SFL cut the dividend by nearly 29% this quarter. While it is, of course, a disappointment, it is not a significant setback, and the company is still paying a substantial yield of 10.47% now.

The Board of Directors has declared a quarterly cash dividend of $0.25 per share. The dividend will be paid on or around June 30, to shareholders on record as of June 18, and the ex-dividend date on the New York Stock Exchange will be June 17, 2020.

Dividend payout is now down to $108 million annually, based on 107.63 million shares.

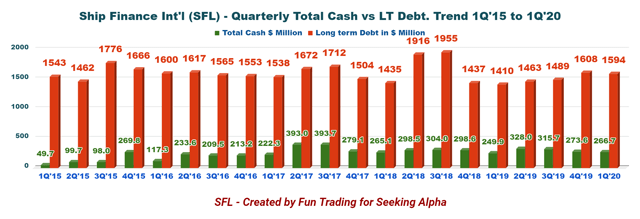

3 – Debt analysis: Net debt is estimated at $1.32 billion in 1Q’20

SFL long-term debt (including current) is $1.594 billion and adjusted EBITDA (“ttm”) is $480.79 million (please see table above). The ratio LT Debt to Adjusted EBITDA is now 3.3x, which is lower than the shipping industry in general. The total cash was $266.705 million, with cash on hand of $217.941 million (including restricted cash).

In the conference call, Aksel Olesen, the CFO, indicated:

Despite a relatively volatile market in 2020, we have already added approximately $230 million to our fixed charter rate backlog and we continue to explore new business opportunities. And while risk premiums on energy and shipping investments have increased with the recent volatility in financial markets, SFL has, at the same time, raised new fleet financings at the all-time low cost of debt and continued to expand its group of lending banks.

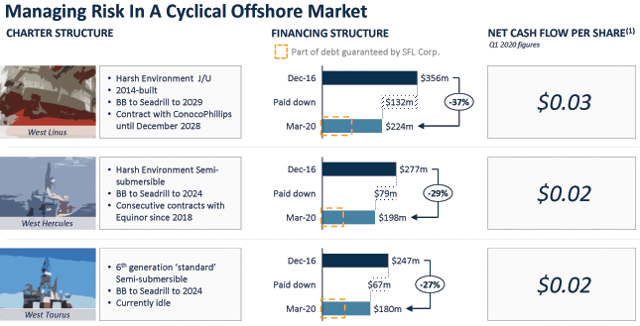

One note about the debt related to the offshore drilling rigs and the possible new restructuring of Seadrill (NYSE:SDRL), which will affect the company. Ole Hjertaker said:

Seadrill has disclosed that they are engaged in discussions with our secured lenders to provide operational flexibility and additional near-term liquidity. We believe it will be in all stakeholders’ interest to have a financially stronger counterparty, and we are in a constructive dialogue with Seadrill to find a sustainable path going forward, particularly for the rigs that are idle, including the West Taurus. But for now, Seadrill keep paying the hire on schedule, and they had more than $1 billion in cash at the end of the last quarter. And any adjustment would, of course, in any case, be subject to approval by the banks in the respective syndicate.

Source: Presentation

The debt remaining for the three rigs is $602 million as of March 20, 2020. However, about half of that amount is guaranteed by SFL, as you can see above. It is too early to elaborate on what will happen next, right now.

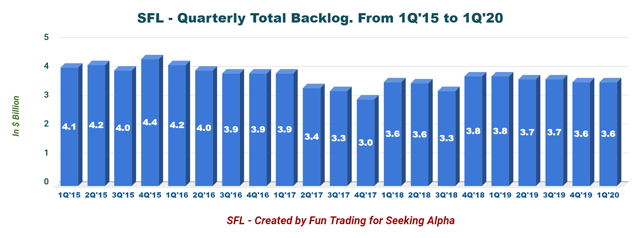

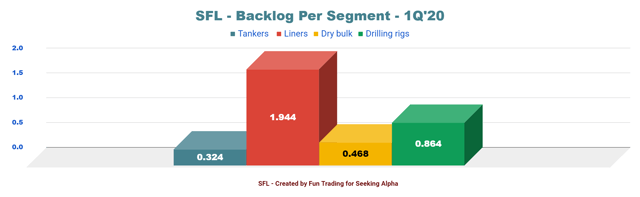

4 – Total backlog is $3.6 billion in 1Q’20 (the company owns a diversified fleet of 87 vessels and drilling rigs)

SFL added $230 million recently through charter extensions and asset acquisition.

1 – The liners fleet

The liner fleet segment made gross charter hire of approximately $78 million. It was mainly derived from our vessels on long-term charters. During the first quarter, the company extended the charter contract for three 10,000 TEU class container vessels until April, July, and November 2024, respectively. After the first quarter, SFL also continued the charters for seven 4,000 TEU class container vessels with MSC until the third quarter of 2025. Altogether, the company added more than $170 million in fixed charter rate backlog this quarter.

2 – The tankers fleet

The tanker fleet made approximately $30 million in gross charter hire in the quarter (including $5.9 million in a profit split from Frontline (NYSE:FRO)). 84% was derived from time and voyage chartering vessels, and 16% derived from variable charters. The daily average time charter rate was much higher than the previous quarter or about $58,000 compared to $33,000 previously.

3 – Dry bulk vessels

During the first quarter, SFL dry bulk vessels generated approximately $26 million in gross charter hire (about 83% was derived from ships on long-term charters).

SFL recorded a non-cash impairment charge of approximately $80 million relating to seven Handysize bulkers in the first quarter, as the estimated future cash flows for each of these vessels did not exceed their book value. This sector is fragile right now, and the company is looking at opportunities to divest the seven vessels later when market conditions are better.

4 – Offshore segment

As I said above, SFL owned three drilling rigs with long-term charters to Seadrill. The rigs generated approximately $26 million in charter hire. The semisubmersible rig, West Taurus, is currently stacked in Norway, but the other two rigs are contracted long term. Also, SFL exited the OSV market this quarter and said in the conference call:

During the quarter, SFL agreed to terminate the charter agreements for 5 offshore support vessels with Solstad. 4 vessels were sold and delivered to unrelated third-parties in the first quarter where 1 vessel has been sold for recycling in Norway at the green recycling facility according to the European Ship Recycling Regulation. Following this, SFL has no offshore support vessels in the fleet, and the book effect of this was neutral.

Conclusion And Technical Analysis (Short Term)

With the world economy battling the coronavirus pandemic and heading rapidly into an unprecedented recession, the shipping industry is already feeling the adverse effects of this terrible mess.

So far, SFL has managed to limit the adverse effects to a minimum, but the shipper is not immune and will have to adapt to the situation continually.

Note: The adjusted EBITDA includes 100% owned associates.

Management is well aware of the challenge, and I believe it will be fine. However, it would be a mistake to think that the situation is now solved.

The COVID-19 pandemic is not the first problem for the shipping industry in 2020. The first hurdle that the company faced was to shift to cleaner fuels due to the introduction of the 2020 sulfur emissions cap by the International Maritime Organization. Then, the ongoing US-China trade war revived again a few days ago.

However, what happened with the virus has created an unprecedented void that may have more profound consequences. Global demand has been shattered and may never fully recover. In short, you will have to be careful and monitor the global situation from oil prices to demand to invest and trade in this industry.

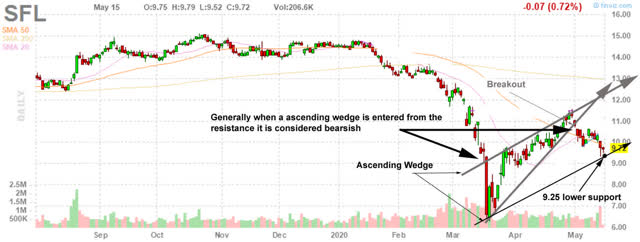

Technical Analysis

SFL experienced a support breakout of its ascending wedge pattern, and I estimate that the downside should find support at $9.50–$9.25, where it would be a good idea to start accumulating. I believe the announcement of a quarterly dividend of $0.25 added some support to the stock.

SFL experienced a support breakout of its ascending wedge pattern, and I estimate that the downside should find support at $9.50–$9.25, where it would be a good idea to start accumulating. I believe the announcement of a quarterly dividend of $0.25 added some support to the stock.

If the shipping industry shows some improvement, I expect SFL to retest its first intermediate resistance at $11.25 and eventually cross the resistance to go to $12.25. It is my bullish scenario that presents a 50/50 chance right now. Conversely, the bearish scenario could push the stock in the range of $7.50-$8.00.

Author’s note: If you find value in this article and would like to encourage such continued efforts, please click the “Like” button below as a vote of support. Thanks!

Join my “Gold and Oil Corner” today, and discuss ideas and strategies freely in my private chat room. Click here to subscribe now.

You will have access to 57+ stocks at your fingertips with my exclusive Fun Trading’s stock tracker. Do not be alone and enjoy an honest exchange with a veteran trader with more than thirty years of experience.

“It’s not only moving that creates new starting points. Sometimes all it takes is a subtle shift in perspective,” Kristin Armstrong.

Fun Trading has been writing since 2014, and you will have total access to his 1,865 articles and counting.

Disclosure: I am/we are long SFL. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade short term the stock regularly.