This post was originally published on this site

You probably regret having missed the opportunity (on March 23rd) to buy stocks at extremely undervalued prices. If so, you still have an opportunity to buy certain stocks at prices lower than their intrinsic value. If you want to select a great stock, operating in undervalued industries, you need to pay great attention to the balance sheet safety and underlying business sector conditions. For this reason, I have chosen a wonderful stock which might rise in price by more than 50%, as soon as the USA overcomes the coronavirus threat. I am, of course, referring to Yelp Inc. (YELP).

Balance Sheet

The first thing I like about Yelp Inc. is its great balance sheet. The company carries zero debt in its balance sheet and only $230 million operating lease liabilities. Its liquid assets, cash and short-term investments stand at $487 million; which is sufficient to cover its total liabilities 1.54 times and current liabilities 3.63 times.

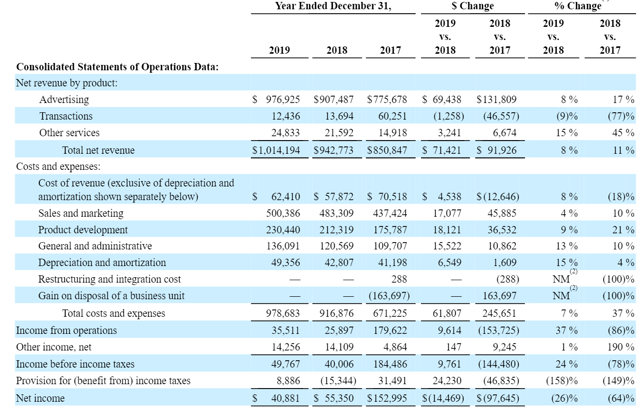

In 2019, total operating costs were $978 million. This comprises $62 million of COGS, $500 million in sales and marketing expenses, $230 million product development costs and $49 million in depreciation and amortization expenses. All these costs are either variable or non-cash expenses, thus the management can easily cancel this spending temporarily to protect the company’s liquidity. Only $136 million of general and administrative costs are (fixed and therefore) essential to the operation of the company. Therefore, even in a worst-case scenario, if the company generates zero revenue and suspends all non-fixed costs, it can cover its fixed costs and current liabilities for more than 3 years.

This impressive cash buffer gives me confidence that the company can continue to trade for the next 3 years even if it is impacted by the effects of the coronavirus pandemic over that period. I do not believe the coronavirus threat will impact for that long, especially as we have already witnessed lots of encouraging news about the development of vaccines. Moderna (MRNA) has already announced that its vaccine has shown positive results in the early stages of development.

Thus, we should not be overly concerned about the company’s liquidity and must focus on the long-term growth opportunities it provides.

Revenue Structure

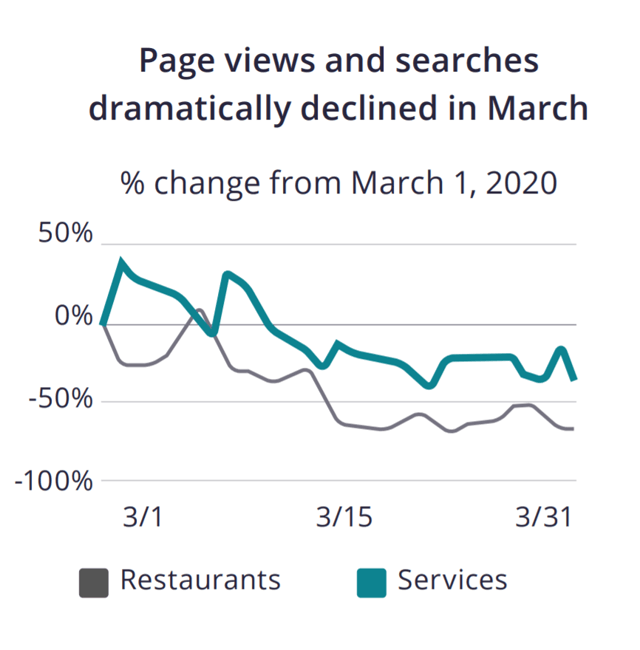

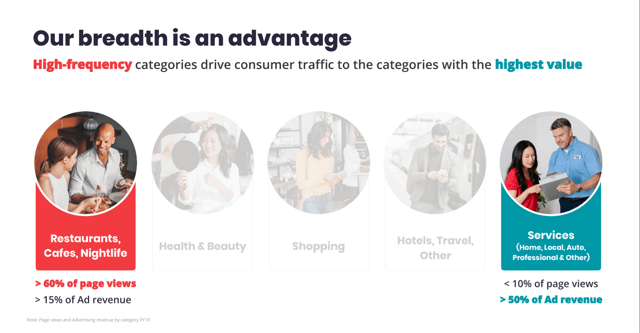

Yelp’s revenue consists of 3 main income streams: advertising revenue, transaction-based revenue and non-advertising subscription fees. Its advertising-income represents more than 96% of the company’s total revenues. Two main sectors bring Yelp its traffic and income. Over 60% of its page views come from the restaurant sector, although it only brings 15% of its ad revenues. At the same time, the services sector, which represents less than 10% of its traffic, brings more than 50% of revenues. The company emphasizes the importance of the restaurant sector because it is the gateway to engaging with home and local service consumers.

Source: Yelp Investor Presentation

Short-term prospects

For the next few months, we can expect poor performance from Yelp stock. Its clients are predominantly small to medium-sized businesses which will have been massively impacted by the coronavirus crisis. Governments are telling people to stay at home. Many people are frightened and are therefore likely to stay at home even after lockdown rules are relaxed. During these times businesses will begin cutting their non-essential expenses like advertising. A number of these S&M businesses will close their doors permanently, which will also impact Yelp’s revenues.

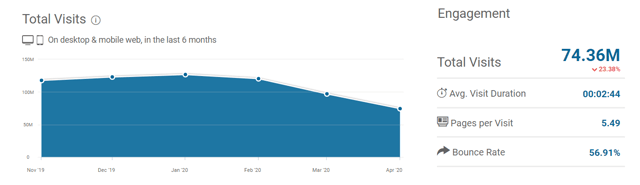

Yelp traffic has declined substantially in April 2020 with only 74 million visits. This is 41% lower than the 127 million visits in January of this year. It is worth mentioning that up until January, its traffic was steadily increasing. In other words, it was a fast-growing company up until the beginning of this year.

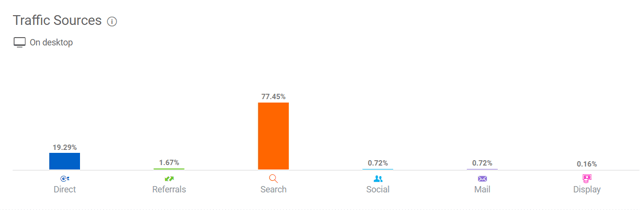

Another statistic from SimilarWeb indicates that 77% of yelp.com visitors enter the site via search engines. This allows us to use Google Trends to try and predict future visitor numbers.

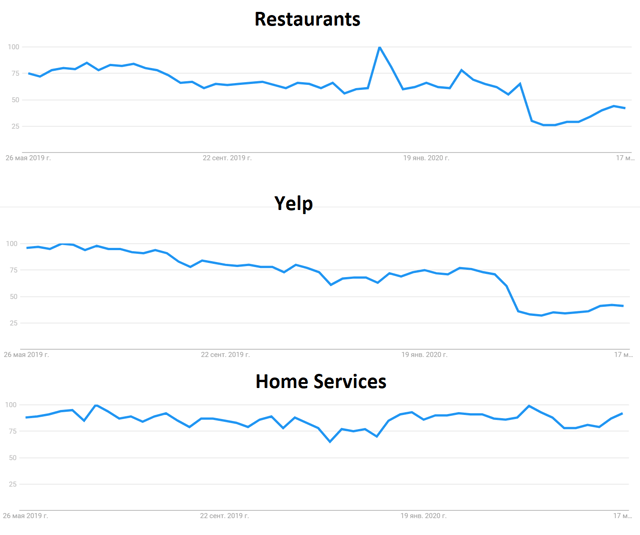

There has been a 60% decline in the number of “Yelp” searches based on the figures for March and April of this year. However, there has been a recovery of about 30% from the lowest April figures. On the other hand, “Restaurant” searches have recovered by more than 60% from April lows. It is a sign that in upcoming months “Yelp” searches might experience similar recoveries to those for restaurants.

At the same time, “Home Services” searches didn’t decline at all and are, in fact, at the highest levels of 2020.

Even though Google Trends indicate that “Home services” searches didn’t fall at all, the company reported that its services searches have declined about 40% overall.

These statistics concern me as it indicates low correlation among overall US trends and Yelp search trends. We see that “Yelp” searches are declining while overall Google searches are stable. This might indicate a market share loss, as the company is underperforming against its peers in the “Services” industry.

Long-Term Prospects

Our assessment is quite optimistic as Yelp was able to record a 35% revenue CAGR during the last 10-year period. The management was able to maintain a profitable position in a very difficult (digital advertising) industry. Because it is competing with giants like Facebook (FB) and Alphabet (GOOG) (NASDAQ:GOOGL) we must appreciate its great achievement. Yelp has managed to accumulate 211 million cumulative reviews and 562,000 paying advertising locations monthly. At the same time, it has more than 5.1 million registered business locations on its platform. These businesses might use Yelp’s analytical tools to better target their audience. The company is enhancing its analytical tools to show advertisers how their ads are performing relative to competitors’ ads.

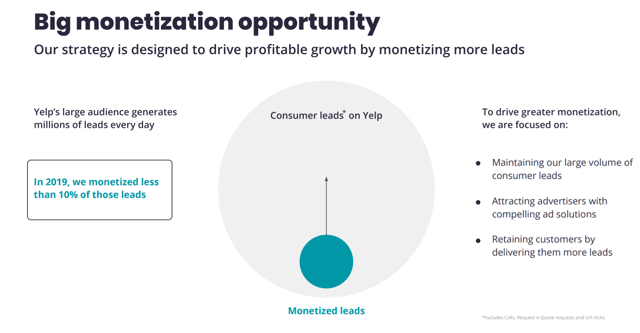

Yelp is developing new technologies to improve the consumer experience on the platform. For example, Yelp Waitlist enables consumers to check the waiting times at local restaurants and book a table in advance. During 2019, Yelp doubled the number of diners it seated through advanced bookings. Innovations like this have improved Yelp visitor engagement and made it more appealing to advertising clients. The company has had difficulties in fully monetizing these consumer leads and is working hard to address this issue. It is estimated that Yelp only managed to monetize 10% of its consumer leads. With an effective management strategy, the company should be able to dramatically improve its conversion rates in this part of its business.

Source: Company Presentation

The company is focused on adding more value to its advertising clients. In 2019, it was able to bring 34% more clicks to businesses at an 18% lower price than in 2018. Yelp ad products are sold (predominantly) on a cost per click basis. This is usually more beneficial for the advertiser than an impression-based pricing model. When you pay per click, you know the person taking action is interested in your business and is more likely to buy or use your services. When a business is charged per impression the client may waste a lot of budget on ignored views. It is also more difficult for a business to evaluate the effectiveness of its paid advertisements.

At the same time, the company is increasing the number of its mobile app users. Yelp already has 35 million monthly active mobile app users. I do consider the mobile app a very important part of the business and its future success. There is a danger that a consumer will download the app when they need to use it and then forget about it in the future. However, by using app notifications, possibly alongside SMS and email notifications, Yelp can create brand loyalty and raise brand awareness.

Yelp’s business and the restaurant industry are closely interlinked. Perhaps, the industry doesn’t have moats as it is too easy to open a restaurant with a small budget. In these difficult times, every restaurant manager wants to attract more customers. Social distancing psychology will certainly decrease the demand for restaurants during this pandemic. However, many restaurants continue to operate in a restricted way such as delivery only, and this may encourage more spending on advertising. I do consider this to be very beneficial for Yelp and believe the company will take full advantage of monetizing the trend.

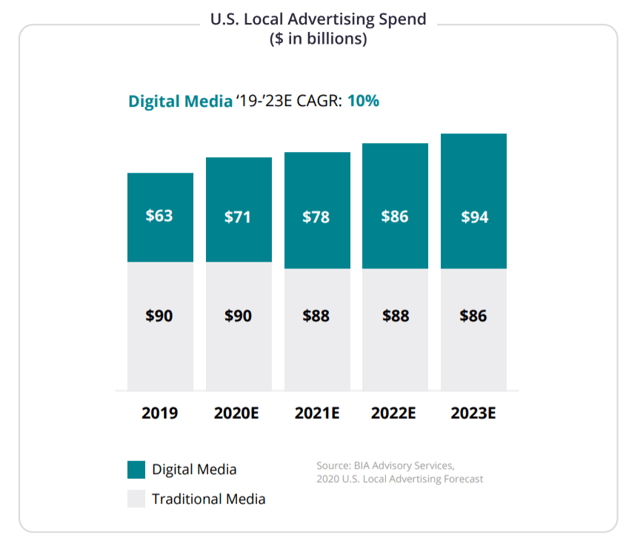

The overall trend also benefits Yelp as digital marketing seizes a market share from traditional marketing operators. According to BIA advisory, digital media is going to grow at 10% CAGR till 2023. It is a huge tailwind as it provides a very good fundamental environment for the company to generate high sales growth.

Competitors

The biggest challenge for the company is its strong competitors. Almost every field where Yelp operates has very strong competition. Online searches are undoubtedly dominated by Alphabet, which has a vast scale and easily wins a great number of its clients. Social networks such as Facebook and Twitter (TWTR) pose a big threat to the business as they provide targeted advertising options, coupled with a much more sophisticated database.

There are also large providers of consumer ratings, reviews and referrals, such as TripAdvisor (TRIP). When it comes to a restaurant reservation, Yelp faces huge competition from OpenTable, which is also a very popular platform.

So, Yelp needs to continue developing new products and investing large sums of money on marketing to stay ahead in such a competitive environment. In 2019, the company spent almost 50% of its revenue on sales and marketing, while 23% of its revenue was spent on product development. The management announced that it expects to lower S&M spending to 40% of revenues. I suspect that it is possible considering the vast scale of competitors and the vital necessity to spend on marketing.

Challenges

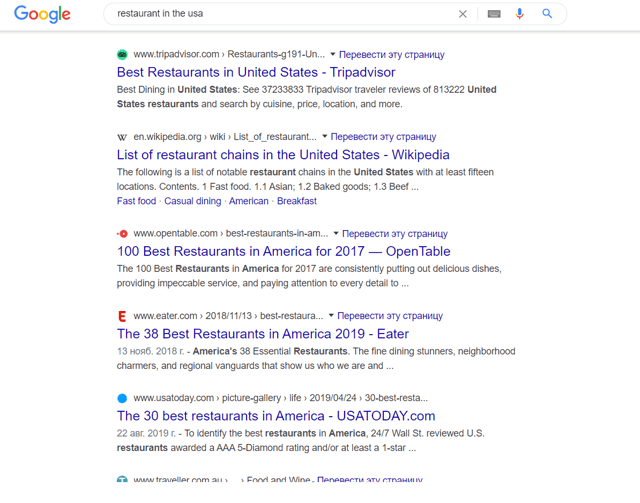

Yelp’s business is highly dependent on internet search providers to bring traffic to the Yelp website. However, certain search engines offer services that compete with Yelp’s products. If links to the Yelp platform are not displayed prominently, traffic to yelp.com could drop and the business would be considerably damaged.

As an investor who is bullish on the stock, I am concerned as my Google search results did not favour Yelp. I have searched “Restaurant in the USA” on Google and could find no Yelp results on the first page. Even more concerning, I saw search results from certain Yelp competitors.

Valuation

The most important part of calculating valuations is an accurate future earnings assessment. This is a very challenging situation for Yelp as the business doesn’t possess considerable moats and its revenues can fluctuate heavily. For that reason, we will need to use rather controversial methods to calculate the intrinsic value.

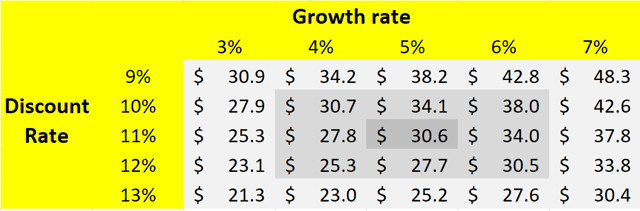

To build a DCF model we will use the 2019 operating cash flow subtracting Capex from it. This results in $170 billion of free cash flow. Using the CAPM model we will have an 11% discount rate, as the beta coefficient is 1.36, the equity risk premium is 7.7% and the risk-free rate stands at 0.7%.

Considering 0% growth and expecting the company to remain a going concern for 30 years we will have about $1.48 billion intrinsic value for the company, which is equal to current market valuation. Considering a 2% annual growth opportunity, we have $23 stock price and 15% price appreciation opportunity. We must admit that these scenarios are extremely controversial for the company, as it is operating in an industry with more than 10% CAGR, and was able to generate 16% CAGR over the past 10 years. I am inclined to believe that in the most controversial scenario the company will generate 4-5% annual growth and decrease its discount rate by 100 basis points. My suggested scenario yields a $30-34 price target range.

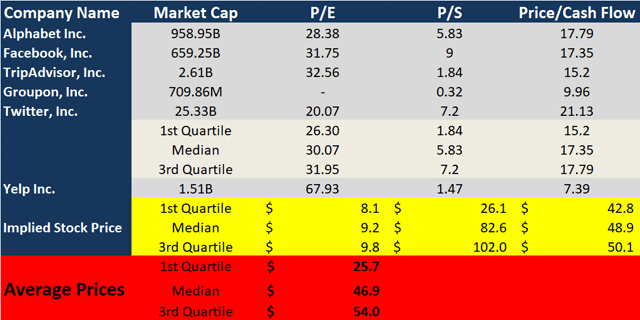

Our Relative Valuation model indicates a huge undervaluation. The 1st Quartile estimate is $25 which is 20% higher than the current price. We will assume that intrinsic value is the average of the 1st quartile result and the median. This gives our estimated average at $36, with a 75% upside potential.

Source: Author’s Spreadsheet

Conclusion

My analysis indicates that Yelp possesses enough cash to withstand the coronavirus crisis and continue its expansion in a very rapidly growing industry. The underlying business is generating healthy revenues. This means that after the crisis we would have a stock value fluctuating between $30 and $36, bringing Yelp investors a 50% to 75% capital gain opportunity.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.