This post was originally published on this site

Everyone’s looking for gold. So, I’ll be the one collecting the silver. – Rehan Khan

Source: Yahoo Finance

A couple of weeks ago, I questioned if silver might take some steps to correct its broad underperformance relative to gold. Since then, the former has made some headway in addressing this, with May proving to be a really good month so far. Of course, this outperformance has come over a very small sample size, and I don’t want to jump the gun, but I do think there are some rather interesting conditions brewing for the medium-term prospects of the white metal.

Gold-silver ratio

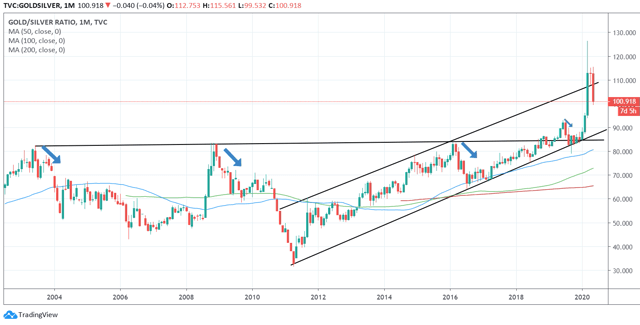

The gold-silver ratio has almost always been a good leading indicator of how things could pan out in the world of silver, although, it’s fair to say that we might have to calibrate our expectations, given how this ratio has zoomed towards unprecedented levels recently. Up until this year, the long-term average of this metric was around 60, with the 85-90 levels being hit only 4 times over the last 20 odd years (2003, 2008, 2016, and mid 2019). At 100-plus levels, currently, this ratio does appear rather stretched with room for more reversion. Even if you think reversion towards the long-term average of 60 might be a bit of a stretch, I do think there are some compelling fundamental factors (which I expand on below) that could help push the ratio down to the bottom end of the ascending price ratio channel, which is around the 80-90 zone (which would still be overbought by historical standards).

Source: Trading View

Broad supply-demand picture

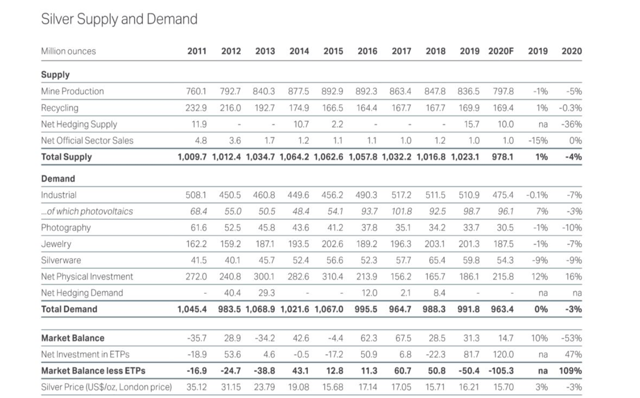

Source: Silver Institute

Over the last four years, the supply-demand equation for silver has not been conducive for silver prices with a surplus being seen every year. However, what’s encouraging is that the imbalance has really come off from the elevated levels of 62-68 million ounces seen in 2016/2017. In 2020, whilst we are likely to have yet another year of surplus, you’re still looking at a whopping 53% y-o-y drop in the market balance at 14.7 million ounces. The key juxtaposition here is between industrial demand and mine production. Whilst industrial demand had grown at a CAGR of 3% from 2015 to 2019, mine production during this same period came off by -2%, and I don’t think we are too far away from having a deficit situation in silver.

Silver supply

Source: Metals Focus

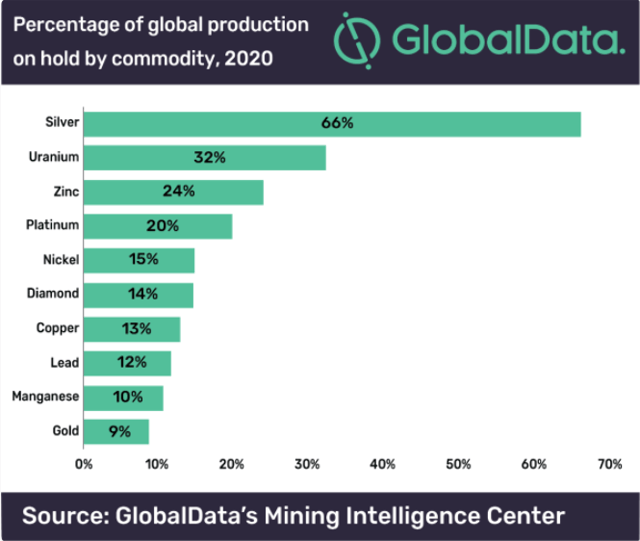

Mexico remains, by far, the largest producer of silver, making up c.23% of global production. Peru is the other dominant country in this space, and even before the pandemic brought things to a standstill, there were some pretty significant production cuts in both these countries last year. This was mainly on account of declining grades at several large mines and disruption-related losses at some major silver producers.

This year, things have turned for the worse since mid-March, with all the key silver producers being impacted by mandated production suspensions, refinery and smelting disruptions, and transport disruptions. Mexico is still in broad health emergency with lockdowns until May 30th, although mining has been permitted since May 18th, provided a certain mine is located in a municipality with no to few active COVID-19 cases. In Peru as well, one has seen a similar theme, although there has been a gradual resumption of activities since the 2nd week of May, with miners operating at 35-40% capacity. All in all, c.66% of total global silver production was put on hold this year, the most for any metal!

Even for the rest of the year, I’m not sure we can expect a significant ramp up on the production front with big silver mining companies, including Pan America Silver Corp. (NASDAQ:PAAS) and First Majestic Silver Corp. (NYSE:AG), all announcing plans to cut capex and exploration activities.

Silver demand

Unlike gold, silver’s utility in the industrial landscape is a lot more pronounced. Key applications include electronics, automobiles, medicine, solar, water purification, window manufacturing, and brazing alloys. I wrote recently about why we could see a pickup in global industrial production by H2-20 and that should bode well for the prospects of silver with industrial demand accounting for c.55% of total silver demand.

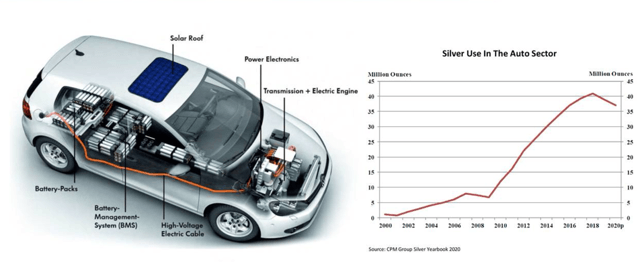

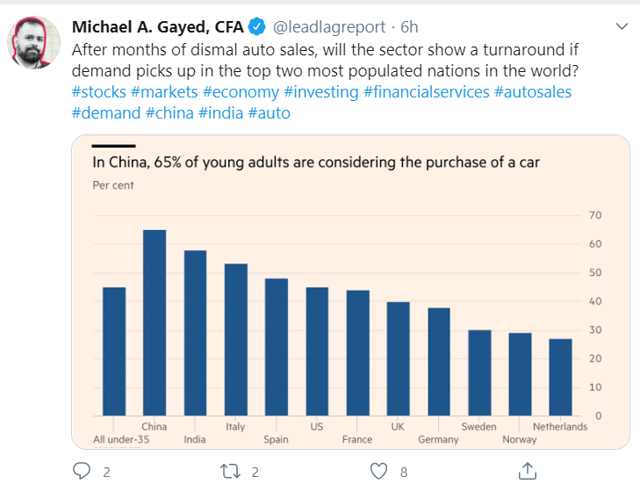

Two silver consumer segments that I am particularly enthused about are the automobile and the photovoltaics segments. Silver’s use in automobiles has gone up considerably over the last decade due to a push towards more electrification (silver is one of the most reflective and best conductors of electricity). Whilst this industry may have been hampered in H1, demand in the large auto markets of the world is preparing for a rebound.

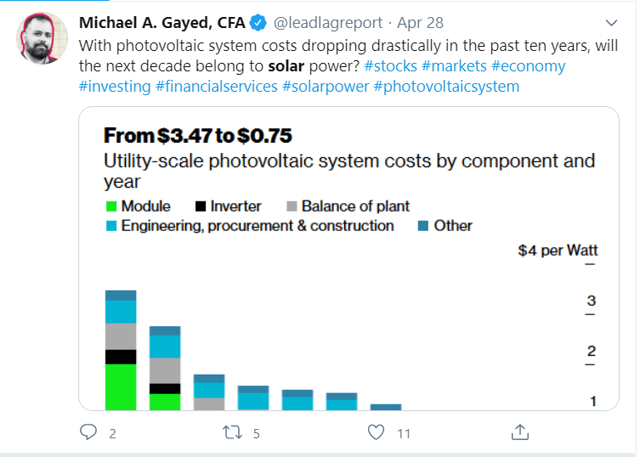

Source: CPM Group

If you look at the supply-demand table above, you can see that industrial demand from photovoltaics has grown very strongly, doubling from 48.4 million ounces in 2014 to 98.7 million ounces in 2019. I believe solar energy is here to stay as it is an inexhaustible fuel source that is pollution-free and one that is fast becoming more versatile and affordable. According to Allied Market Research, we’re looking at a c.21% CAGR industry, poised to hit $223 billion by 2026. An interesting concept that is gaining traction in the US is solar carports. This is one of the most viable options for refueling EVs and is currently in use at several large department stores, federal and state locations. The US Department of Energy has suggested that the country might need c.8000 solar carport stations to provide a minimum level of urban and rural coverage. In addition to a general industrial pickup, as we go greener and vehicle electrification gains momentum, silver demand should inevitably ramp up.

Silver – a less expensive gold proxy for these uncertain times

In addition to the utilitarian value that it offers industries, I’d also like to think of silver as something as a gold proxy. On account of the unprecedented level of recent monetary stimulus that has decimated the value of paper currencies, precious metals such as gold and silver will be increasingly seen as a store of value to mitigate this. Gold, of course, has been the rockstar of asset classes in the recent past, but I think there is greater value to be seen in silver. I expect physical investments in silver to ramp up as investors diversify away from uncertain equities and seek suitable alternatives to cope with a potential reflation scenario. Net physical investment in silver which grew at 12% YoY in 2019 is poised to grow at an even greater rate of 16% this year. Interestingly inflows into silver ETFs have been gaining speed, up 13% YTD. Incidentally, last week, a major ETF – iShares Silver Trust (NYSEARCA:SLV) saw a significant week on week spike of 5.4%, adding 24 million units.

Conclusion and how to play silver

The risk-reward on silver is not as appetizing as it was back in March, and as mentioned at the start of the article, May has been particularly good for this white metal, with silver futures up c.17% on a 1-month basis. That said, as implied by the gold-silver ratio, I still think there is further room for silver to move. Over the medium term, encouraging fundamental factors should keep interest in this metal elevated. If you’re an equity person, you can consider key silver miners such as First Majestic Silver or America Silver Corp. but this would not be my first preference as they also have exposure to other metals and you have to contend with company-specific issues. Besides, these stocks have more than doubled in value since the March lows. My preference would be the ETF iShares Silver Trust that more closely tracks the performance of silver and is still yet to break out of the long-term range.

Source: Trading View

*Like this article? Don’t forget to hit the Follow button above!

Subscribers warned to go risk-off Jan. 27. Now what?

Subscribers warned to go risk-off Jan. 27. Now what?

Sometimes, you might not realize your biggest portfolio risks until it’s too late.

That’s why it’s important to pay attention to the right market data, analysis, and insights on a daily basis. Being a passive investor puts you at unnecessary risk. When you stay informed on key signals and indicators, you’ll take control of your financial future.

My award-winning market research gives you everything you need to know each day, so you can be ready to act when it matters most.

Click here to gain access and try the Lead-Lag Report FREE for 14 days.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This writing is for informational purposes only and Lead-Lag Publishing, LLC undertakes no obligation to update this article even if the opinions expressed change. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. It also does not offer to provide advisory or other services in any jurisdiction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Lead-Lag Publishing, LLC expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.