This post was originally published on this site

“The merit of all things lies in their difficulty.” ― Alexandre Dumas, The Three Musketeers

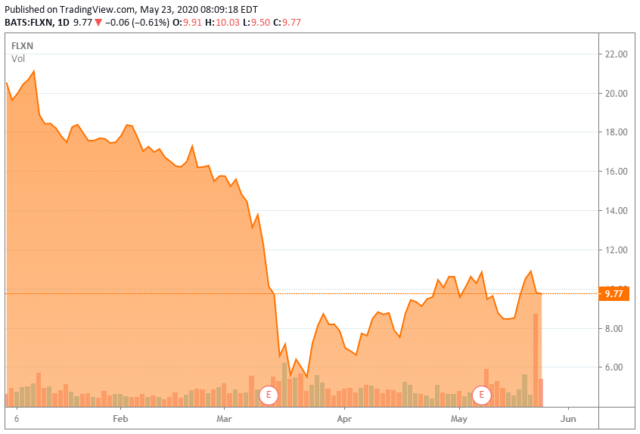

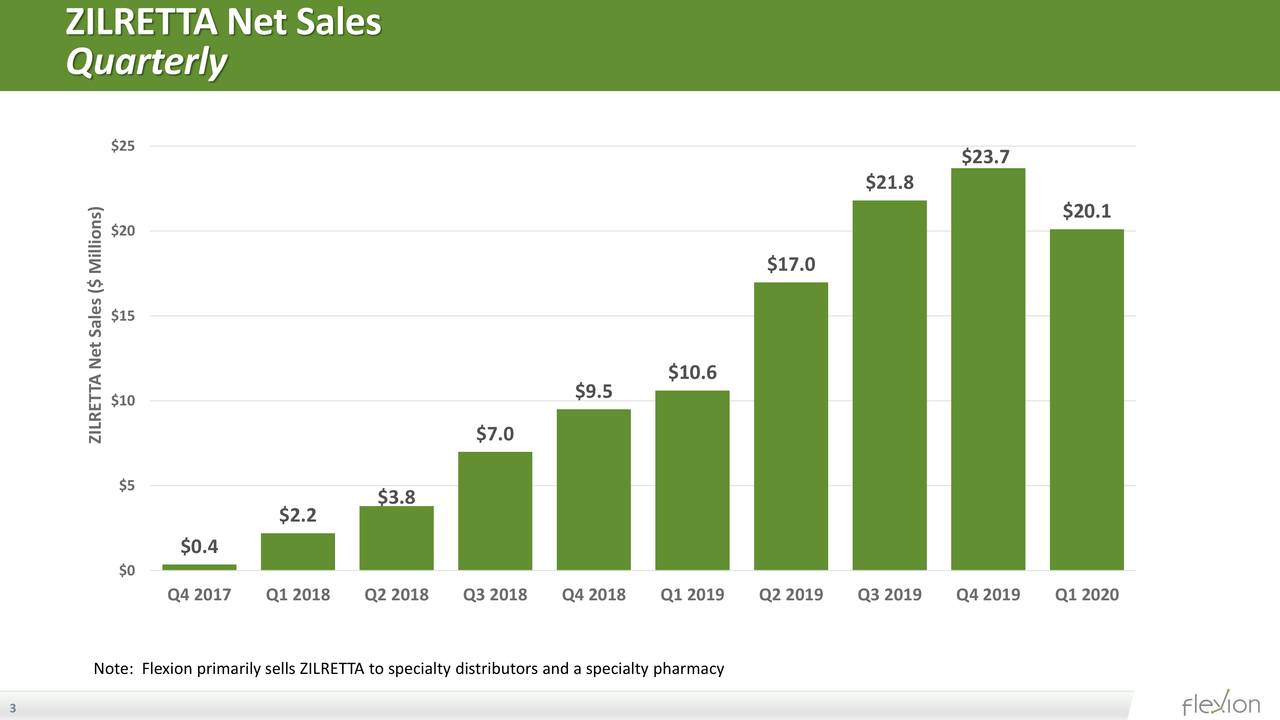

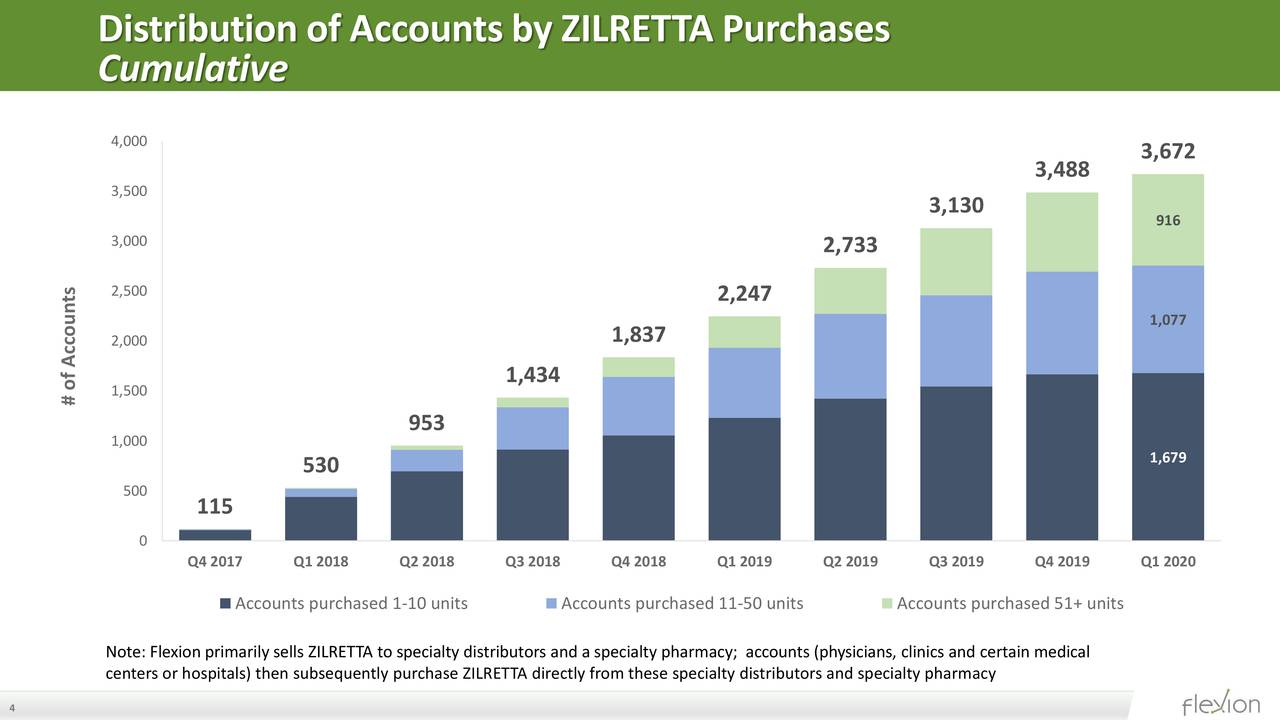

It has been a disappointing 2020 so far for Flexion Therapeutics (FLXN) shareholders to date. The company was riding high late in 2019 when the FDA approved Zilretta for multiple injections for osteoarthritis of the knee. This was going to be the key catalyst for ramping up sales of the company’s flagship compound as afflicted individuals could now easily be on scheduled injections to help alleviate this chronic condition.

Unfortunately, the COVID-19 outbreak and the subsequent shutting down of most of the nation in an ill-considered countrywide virtual ‘lockdown’ had significant impacts to Flexion Therapeutics and its plan to ramp up Zilretta, which was doing very nicely until this coronavirus blindsided the globe.

However, as the country starts to reopen on a state by state basis, and non-COVID-19 doctor visits and procedures come back online, the prospects for Zilretta should be much better in the second half of the year. The company just addressed its funding needs by executing a secondary offering that raised some $75 million. We revisit this ‘Tier 3‘ name and how we would add exposure to FLXN in the paragraphs below

Company Overview:

Boston-based Flexion Therapeutics currently trades just under $10.00 a share and sports a market capitalization of approximately $380 million. Its primary compound as noted above is Zilretta. Zilretta received FDA approval to treat the pain associated with osteoarthritis (OA) of the knee in the fourth quarter of 2017. Osteoarthritis affects some 30 million Americans annually with the knee being the most common joint impacted.

Balance Sheet & Analyst Commentary:

The company ended the first quarter with approximately $125 million in cash on hand. Adding in the recently raised $75 million, the cash balance is now up to some $200 million (roughly half of the concerns market cap), not counting an upfront $10 million payment for a new licensing deal (see below). This should push any additional funding needs well into 2021 or longer (depending on how fast Zilretta can ramp back up).

Over the past month, Flexion has been reiterated as a Buy or Outperform at four different analyst firms, including Northland Securities, Needham, and RBC Capital. Price targets proffered have ranged from $18 to $35 a share.

Verdict:

Flexion should return to revenue growth starting in Q3, has solid analyst support and just addressed its funding needs. In April, the company announced an exclusive license agreement with a marketing partner to get Zilretta into the greater Chinese market. This agreement provided Flexion a $10 million upfront payment. The company can also earn just over $30 million in additional in aggregate development, regulatory and commercial sales milestone payments as well as royalties on further sales.

The company suspended a Phase 2 trial using Zilretta to treat OA of the shoulder. I would imagine that study should resume soon after normalcy returns to its business. Given the volatility of the market which has increased option premiums significantly, the best way to add exposure to Flexion is via a covered call strategy in my opinion. One such strategy is outlined below.

Option Strategy:

I added a tad of exposure to Flexion on the dip in the stock due to the secondary offering. Using the January $10 call strikes, I fashioned some Buy-Write (also known as covered call) orders with a net debit in the range of $7.40 to $7.60 a share (net stock price – option premium). This strategy provides just over 20% of downside projection and would provide an approximate 33% return over 8 months even if the stock barely edges back up to the $10 level. Liquidity is just okay in this name right now, so you may need to enter the order more than once before it is filled.

“The world more often rewards outward signs of merit than merit itself.” ― La Rochefoucaul

Bret Jensen is the Founder of and authors articles for the Biotech Forum, Busted IPO Forum, and Insiders Forum

Live Chat on The Biotech Forum has been dominated by discussion of these type of buy-write opportunities over the past several months. To see what I and the other season biotech investors are targeting as trading ideas real-time, just join our community at The Biotech Forum by clicking HERE.

Disclosure: I am/we are long FLXN. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.