This post was originally published on this site

Despite its name, Cabot Oil & Gas (COG) is basically a natural gas producer (NG) not an oil company. In 2019, COG had zero revenue from oil and NGLs (natural gas liquids).

COG is one of the most efficient and lowest-cost producers of NG in the country. As such, it is now speculated that with oil drilling being cut back as a result of the diminished demand, NG produced as a byproduct of oil drilling will be reduced to the point that NG prices overall will rise considerably, to the great benefit of an efficient NG producer such as COG.

I agree that COG is an efficient, conservative, low-cost producer of NG and may indeed benefit from the potential of higher NG prices driven by reduced production in oil fields.

But here are 5 reasons I think they may be overpriced at the moment.

1. COG is reducing CAPEX by 27% for 2020

Current 2020 CAPEX is set at $575 million vs. $788 million last year, indicating a cautious approach to the projected uncertainties of NG pricing going forward in 2020 and 2021.

CEO Dan Dinges during the Q4 2019 Investor Presentation:

“Earlier this month, we announced our official 2020 plan, which included the adoption of previously disclosed maintenance capital program of $575 million, representing a 27% reduction in capital spending year-over-year. Our corporate strategy has always been centered around the acute focus on disciplined capital allocation, and we believe this reduction in capital further demonstrates our commitment to that philosophy.”

The CEO’s “disciplined” is my “not sure how good things are going to be in 2020”.

2. COG projects Q1 and Q2 2020 production decline because of weak pricing

You better hope prices go up if you produce less in 2020’s first half than you did in 2019’s first half.

CEO Dinges:

“Our guidance for 2020 includes modest sequential production declines in the first and second quarter, which we believe is prudent given the weakness in pricing we’ve experienced during the first quarter and expect to experience in the spring shoulder season.”

And more “prudence”:

“We are at a maintenance level of capital because we don’t think it is prudent to drill up all your core inventory and push it out at a losing proposition. We don’t think it’s prudent to drill even at a marginal return profile and use it all up in this particular environment.”

So, if you buy COG shares now, you probably should expect to wait until at least the 2nd half of 2020 to see some positive results.

That’s not exactly fireworks and champagne material.

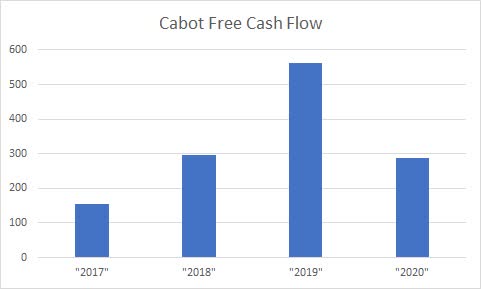

3. COG is projecting FCF (free cash flow) to decrease 46% from $563 million in 2019 to $300 million in 2020

Another rather unexciting projection is COG’s FCF. As you can see, management projection for 2020 is uninspiring, but again, prudent. But is it a reason to buy shares now?

CEO Dinges:

“At a $2.25 average NYMEX price, the plan is expected to generate $275 million to $300 million of free cash flow.”

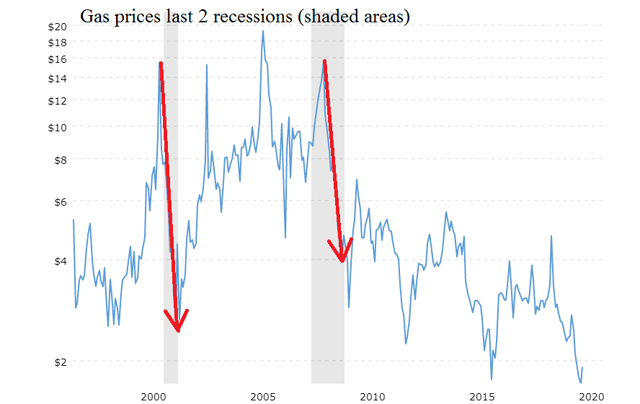

4. NG prices have not done well in previous recessions

If you feel as many do that we are headed into a recession of some type and some length or the other, then this chart may be of interest.

5. In an average environment, COG should be worth about $18

If you track the average price of COG’s stock and the average price of NG over the same period, you get about an 8 to 1 price for COG shares versus NG prices.

Since management repeatedly uses $2.25 as the average price for 2020, you could multiply that by 8 and get $18.

But I don’t know of anyone who thinks this is an average environment.

Conclusion

I really like COG in spite of the reservations I have for its future price. I like conservative, experienced, successful management, but when they repeatedly tell me to be “prudent,” I am going to take them at their word.

In a normal environment, COG would certainly be on my radar screen at $18. But this is not a normal situation. With extremely volatile commodity prices, a worldwide pandemic and a recession in the offing, I am going to want a much lower entry price to make up for the extra risk.

If COG breaks beneath $16, I will take another look. But right now it looks too risky for me.

Risks, alarm bells and cautionary tales

With the vagaries of oil and gas prices, any company associated with the quote “oil market” is subject to volatile price movements as can be seen in the price chart above.

Meaning extraordinary caution is required for all investments including this one.

And remember, there is nothing wrong with being in cash at this point in time until the market shows less volatility and more firm direction. Cash is a viable alternative.

In addition, there could be a recession coming or even a depression according to several economists.

“Economic data in the near future will be not just bad, but unrecognizable,” Credit Suisse economists led by James Sweeney wrote last week. “Anomalies will be ubiquitous and old statistical relationships within economic data or between market and macro data might not always hold… There is no blueprint for the current shock, and uncertainty about the extent of contagion and the economic consequences is overwhelming.”

Caution is the word of the day.

If you found this article to be of value, please scroll up and click the “Follow” button next to my name.

Note: members of my “Turnaround Stock Advisory” service receive my articles prior to publication, plus real-time updates.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.