This post was originally published on this site

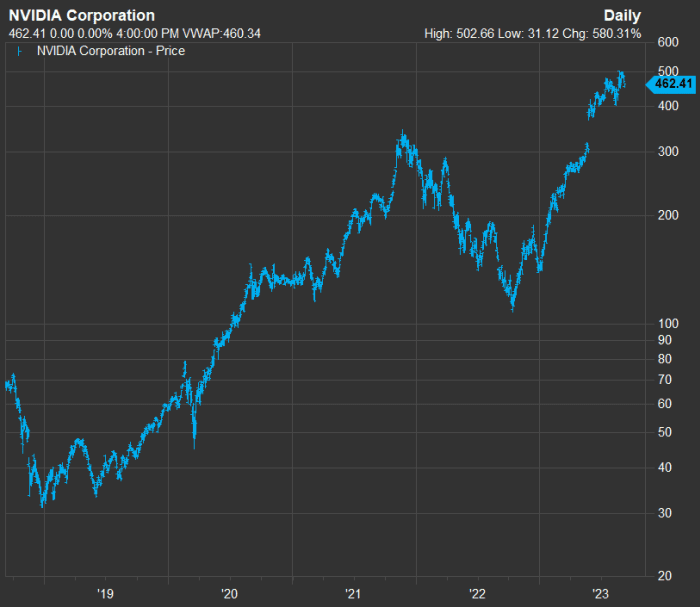

Let’s begin with a 10-year price chart for Nvidia Corp.

NVDA,

:

FactSet

Nvidia’s stock has more than tripled this year, closing at $462.41 on Thursday, after rising from $146.14 at the end of 2022. This movement has been driven by a dramatic increase in the company’s revenue as it has little competition for the graphics processing units data centers are installing to support their customers’ efforts to adopt artificial-intelligence technology.

Here’s an analysis of Nvidia’s growth and profitability and a look at valuations and sales estimates for dozens of semiconductor manufacturers.

On the chart, you can see that despite a generally upward slope, Nvidia can be a volatile stock. The share price dropped 50% during 2022 — and if you would like a more extreme illustration of volatility, the price fell 66% between the market close on Nov. 19, 2021 and Oct. 13, 2022.

This week, Wallace Witkowski looks into recent arguments on social media in favor of short-selling Nvidia’s stock. The problem is those suggestions (or conspiracy theories) can be based on accounting fallacies or other bits of illogic. Here are the factual counterarguments against those short theses.

Airbnb runs into red tape

New red tape might may block your short-term rental plans.

Getty Images

Shares of Airbnb Inc.

ABNB,

have risen 70% this year, and so far have shrugged off bad news in an important market. This week New York City put in place several restrictions on short-term rental hosts, which has led to many rental cancellations.

Similar restrictions in various cities might interfere with plans by homeowners to rent out their homes, which can be especially important if locked-in low-rate mortgage loans make them reluctant to sell the properties, as Aarthi Swaminathan reports.

More market distortion: How the U.S. housing market got stuck in the ’80s

Could there be a surprise from the Federal Reserve?

Consensus has been building that the Federal Open Market Committee will decide not to raise interest rates after its next policy meeting on Sept. 19-20. Here’s a sampling of related coverage from Gregg Robb:

Then again, the latest third-quarter real GDP growth forecast from the Federal Reserve Bank of Atlanta is for an annualized growth rate of 5.6%. That would be up from a revised estimate of a 2.1% growth pace during the second quarter. More data will be incorporated into the Atlanta Fed’s revised forecast, but such a high figure could portend further interest rate increases as the Federal Reserve continues to push back against inflation.

Inflation, high interest rates and how investors are affected

China is among countries trying to defend their currency against the strong U.S. dollar.

AP

When the world’s largest economy has high interest rates in response to inflation, investors aren’t surprised to see the dollar strengthening relative to other currencies. But there are ripple effects.

William Watts looks into how the dollar’s rise might affect the stock market.

Here’s how a money manager running nearly $6 billion for clients is positioning for years of inflation, as Vivien Lou Chen reports.

More on inflation, high rates and a strong dollar:

- China’s onshore yuan weakens to 16-year low versus dollar as sentiment darkens

- Stock-market investors just got reminded that the inflation fight isn’t over

Oil follows suit

Joe Raedle/Getty Images

West Texas Intermediate crude for October delivery

CL00,

rose for nine straight sessions through Wednesday, before taking a breather. This was the longest daily streak of gains since 2019. Here’s why investors shouldn’t ignore the action.

More coverage:

- This oil chart will scare the socks off you

- Energy ETFs are outshining the S&P 500, but it isn’t just because of the oil rally

Is it time for investors to give cannabis another shot?

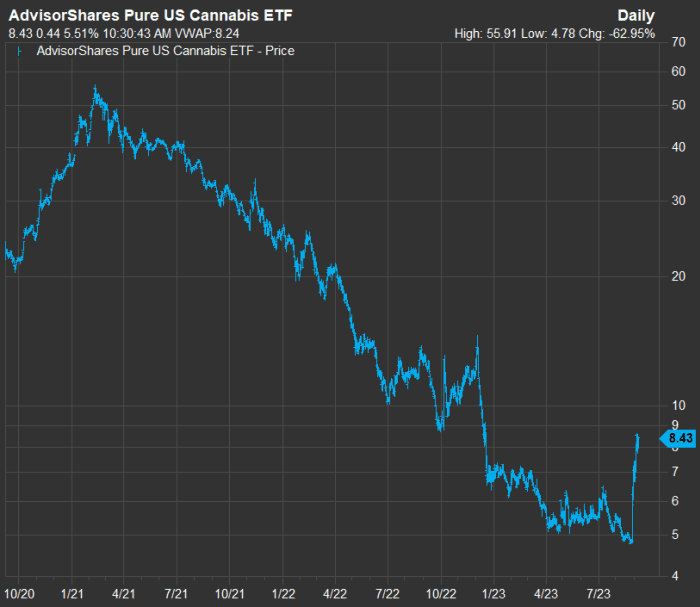

Time for another chart. Here’s a look at three years of price movement for the AdvisorShares Pure U.S. Cannabis ETF

MSOS

:

FactSet

The recent upward move shows investors’ reaction to the recommendation by the Department of Health and Human Services to the Drug Enforcement Administration that cannabis be reclassified as a Schedule III controlled substance.

Michael Brush believes that the DEA is unlikely to reject the HHS proposal. Here’s why he believes cannabis stocks should still be bought despite their recent gains.

Retirement planning: time = money

In case you were wondering…

Getty Images/iStockphoto

If you have access to an employer-sponsored tax-deferred retirement account, such as a 401(K) or 403(B), one of the most attractive features is the employer’s matching contribution. If your employer matches up to 3%, for example, and you contribute 3% of your pretax salary each pay period into your retirement account, the employer matches the contribution and you just gained 100% on your investment.

You may want to hare this information with other people you care about who might resist taking advantage of this type of opportunity.

Beth Pinkser shares a fascinating set of information that can make it much easier to understand how much of a difference that 3% contribution now can make during retirement years.

Apple, China and something to look forward to next week

Scott Olson/Getty Images

Shares of Apple Inc.

AAPL,

pulled back on Wednesday and Thursday after the Wall Street Journal reported that China would ban the use of iPhones for work purposes by government officials.

In the Ratings Game column, Emily Bary looks into another threat to Apple’s dominance: phones made by Huawei. She also shares Morgan Stanley’s assessment of Apple’s worst-case scenario in China.

On a brighter note, here is Bary’s summary of everything to expect from Apple on Tuesday as it rolls out new products.

Want more from MarketWatch? Sign up for this and other newsletters to get the latest news and advice on personal finance and investing.