This post was originally published on this site

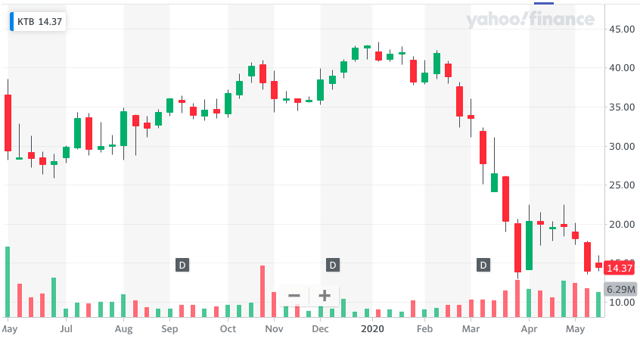

Kontoor Brands’ (KTB) stock has been on a wild ride since V.F. Corp. (NYSE:VFC) spun it off last year. Shares debuted at $36 last May. Forced selling and the usual spinoff dynamics weighted on the shares, which bottomed a month later at $26. Shares then rallied to $42 in January before plunging along with the market.

Source: Yahoo Finance

Predictably, the pandemic has wreaked havoc on the company and its shares. At $14, they’re down almost 70% and sitting at all-time lows.

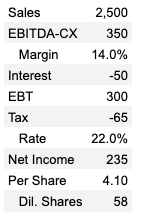

Kontoor has closed stores, reduced salaries, and furloughed employees. It also drew down $475M of its $500M revolving credit facility and amended its debt covenants. In exchange for temporary relief from its debt covenants, Kontoor has temporarily suspended its dividend.

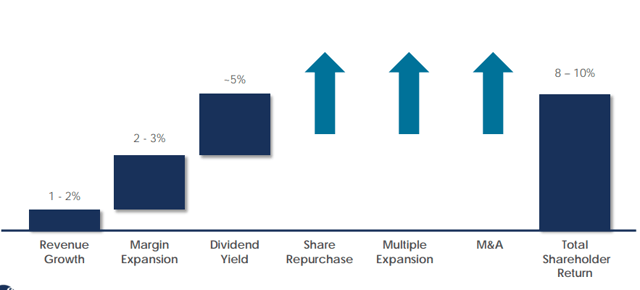

This is important because Kontoor’s dividend was supposed to be the cornerstone of its shareholder return. Management laid out the math last March ahead of the spinoff:

Source: March 2019 Presentation

Since then, revenue has shrunk, margins have compressed, and the dividend has been cut. So much for forecasts!

Ironically, what makes the company interesting is actually Kontoor’s lack of dividend. Most of Kontoor’s investors were presumably in it for the yield (over 5% even at its all-time high north of $40). Those investors are now selling without regard to Kontoor’s actual earnings power. This presents an opportunity to look beyond Kontoor’s yield to its actual earnings power. Long-term investors should always focus on what a company earns, not just the portion of earnings it returns to shareholders.

The most prominent forced seller is the SPDR S&P Dividend ETF (SDY) which owns 17% of Kontoor shares. The fund publishes its daily holdings here. SDY tracks the S&P High Yield Dividend Aristocrats Index which aims to own the highest yielding stocks in the S&P 1500. Per its prospectus, it will sell its holdings by the end of the month if a company cuts its dividend or falls below a $1.5B market cap. Kontoor is guilty on both accounts.

So, SDY will likely sell all 9.6 million KTB shares it owns by the open on June 1st. Kontoor’s average daily volume is only 1.3 million shares, so this sale could meaningfully depress shares for reasons entirely unrelated to Kontoor’s fundamentals. Presumably, SDY will do a large block trade with a bank on Friday, May 29th.

SDY is allowed to deviate from its underlying index by up to 20%, so SDY doesn’t strictly have to sell Kontoor shares at fire sale prices the next few days. Kontoor makes up less than 1% of SDY’s assets, so SDY certainly has room to hold onto them. However, SDY will want to track its index as closely as possible and is likely to sell the majority of its Kontoor shares by the end of the month or soon after. And when that happens, Kontoor could fall even further. The question is, is this a buying opportunity?

Kontoor’s Fundamentals

The best long-term investments tend to be simple, predictable, and profitable. Kontoor is about as simple as they come. They sell Lee and Wrangler jeans, primarily through wholesale channels. They own a third of their manufacturing capacity and contract out the rest. This makes the company relatively asset light, with 15-20% returns on tangible equity the last two years.

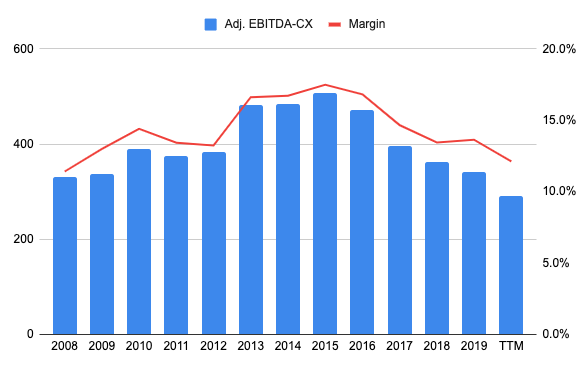

Historically, Kontoor has also been predictable and profitable. Sales only fell 10% between 2008 and 2009 because Lee and Wrangler are always priced for value. Since 2008, the company has generated consistent free cash flow, as shown below.

Source: Author, Data from Company Presentation and 10-K

EBITDA less capex (“EBITDA-CX”) is a reasonable proxy for Kontoor’s free cash flow and was stable though the ’08-’09 financial crisis.

Since 2015, results have slipped for a variety of reasons. One was neglect under V.F. Corp.’s management. V.F. Corp.’s management and shareholders are growth focused and milked Kontoor’s cash flows for reinvestment elsewhere.

Now that Kontoor is independent, its management is incentivized to rationalize and improve its operations. The pandemic has muddied evidence of their progress, but green shoots of improvement are there if you look closely.

Kontoor first implemented a “quality of sales” initiative. This meant getting ride of low-margin sales that were more trouble than they were worth. This weighed on top line growth by 2-3%. Retailer bankruptcies, such as Sear’s, further weighted on the top line.

Now, Kontoor is focused on increasing distribution. In Q3, 2,000 new locations will begin selling Lee and 400 will begin selling Wrangler. This should help to regain some of the sales lost last year and at a higher margin to boot.

Digital was strong in Q1, growing 41%, but from a very small base. Kontoor is still dependent on its US wholesale channel which runs through retailers like Walmart. The good news is that these retailers are still open and selling, which mitigates some of the pandemic’s impact versus other apparel companies. There’s no doubt, though, that more retailer bankruptcies (like J.C. Penney’s) will cancel out much, if not all, of Kontoor’s growth elsewhere.

One piece of good news is that Kontoor owns about a third of its manufacturing. This lets it more tightly control inventories and will allow it to ramp up quick when the time is right. In Q1, inventories grew $30 million or 7%. However, some context is needed. Working capital and inventories are usually lowest in Q4 following holiday sales. They build in Q1 and peak in Q3 as Kontoor ships holiday product. This quarter’s inventory build was in line with history and actually smaller than 2019’s 10% build. This is a subtle, but not insignificant, sign that Kontoor is managing reasonably well through this downturn.

Dividend

Shortly after drawing down $475M of its $500M revolver, Kontoor asked for temporary relief from its debt covenants. Kontoor’s forecasts showed that under some scenarios, it could breach its 4.0x net leverage limit.

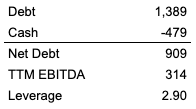

At the end of Q1, Kontoor’s leverage was only 2.9x, so management’s actions are precautionary. I think this is the right move: there’s no reason to bet the company on a V-shaped recovery.

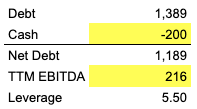

Source: Author, Data from 10-Q & 10-K

The amended credit agreement allows Kontoor’s leverage ratio to run as high as 5.5x in Q2 and Q3. The maximum leverage ratio then dips to 5.0x in Q4, 4.5x in 2021 Q1, and 4.0x in 2021 Q2. The temporary relief period ends in June 2021, meaning the old covenants kick back in. The new covenants also call for a minimum of $200M of liquidity.

To hit its adjusted covenants, cash would have to drop by nearly $300M and EBITDA would need to decrease by a third. Anything is possible, but that should provide breathing room. I’ll discuss liquidity in more depth later.

Most likely Kontoor will skip dividends until at least Q2 or Q3 2021. That’s when the temporary relief measures expire. If Kontoor makes it until then without depleting its liquidity too much, it will want to resume dividends to signal that it is back on track.

Theoretically, Kontoor could pay a dividend sooner. Per the amended credit agreement, Kontoor could pay a dividend:

- In Q3, if leverage < 5.00x and liquidity > $400M.

- In Q4, if leverage < 4.75x and liquidity > $400M.

- In Q1, if leverage < 4.00x and liquidity > $400M.

At the moment, Kontoor’s leverage is 2.9x and liquidity is nearly $480M, so as of now, Kontoor could pay a dividend. But, EBITDA will probably decline meaningfully in Q2 and will probably be negative (it was $7M in Q1). Working capital will build, further consuming capital.

Management’s actions have been conservative, so I’d expect them to hold off on a dividend for a few quarters so that they can be sure the recovery is really happening. They won’t want to pay a dividend only to suspend it a quarter or two later.

Kontoor’s Qualitative Advantages

Kontoor has a few qualitative features that make it more resilient than your run-of-the-mill clothes company.

First of all, Kontoor’s product and inventory are largely evergreen. They don’t have much fashion risk. What doesn’t sell this year can be sold next year.

Kontoor does have seasonal inventory, however. Some of that will need to be liquidated. Fortunately, Kontoor owns its own outlets which it can use to liquidate this product. Kontoor’s outlets will allow it to recover more value than if it liquidated through the same channels every other retailer will be cramming product through.

Second, brands matter in denim, and those brands have staying power. Case in point: Levi, which has been around for 167 years doing essentially the same thing. Lee was founded in 1889 and Wrangler in 1904. These brands have already survived two world wars, the Great Depression, inflation, deflation, booms and busts. Kontoor’s strong brands allow it to earn reasonably high returns on its tangible equity.

Finally, there is anecdotal evidence that consumers are turning towards tried and true brands amidst the pandemic’s uncertainty. That could help incumbents like Lee and Wrangler, especially because they are sold at approachable price points.

Valuation

Kontoor’s 12-year mean and median EBITDA-CX margins are 14.4% and 13.6%. Let’s assume they’re 14% in a normalized environment. Margins were 14.7% in 2017, 13.4% in 2018, and 13.6% in 2019, so I’m anticipating some reversion to the mean here.

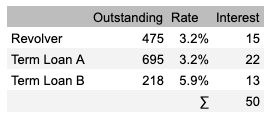

It seems reasonable that sales will recover to 2019 levels after a few years, which would be $2,500M. Interest expense will run about $50M per year on their current debt and taxes should be about 22%.

Source: Author, Data from 2020 Q1 10-Q

Putting this all together, Kontoor looks capable of earning $235M on a normalized basis. When they pay down their revolver, they’ll save about $10M per year in interest.

Source: Author, Data from 10-K and 10-Q

Kontoor should be capable of growing a few percent per year, but I wouldn’t call it a growth stock or necessarily even bet on it. Using a 10% discount rate and no growth suggests capitalizing Kontoor’s earnings at 10x. This would value Kontoor shares at about $41, which is where they traded before the pandemic.

Kontoor’s goal was to pay out 60% of earnings as dividends. It used to pay $2.24 per year, which is about 55% of my estimate of normalized earnings. This is a good double check for reasonableness with management’s expectations.

At $14 per share, Kontoor is worth $800M, which is only 4x normalized earnings. This is much too low if Kontoor is going to survive and provides a wide margin of safety if my assumptions about normalized earnings power prove too rosy.

If shares re-rate from 4x to 10x over five years, investors will earn 20% annually. If SDY dumps its shares next week and Kontoor’s stock price tumbles, investors who buy into the weakness could do even better.

Liquidity

Kontoor’s earnings power is worthless if it can’t survive long-enough to see a normalized environment. Management has announced it cut salaries, furloughed employees, and removed positions. They didn’t explain exactly how much this could save or what EBITDA might look like in Q2. Most likely, they have no idea how much cash Kontoor will consume either. Thus, assessing liquidity is difficult at best. Nevertheless, I’ll give it a shot.

Q1 EBITDA was $7M versus $34M in Q1 2019. Q1 is usually weak, so this wasn’t too bad of a result. I anticipate Q2 and possibly Q3 EBITDA to go negative. Kontoor has reduced headcount, which may mitigate some of this. However, working capital will likely also build. All in all, the company will likely build capital in Q2 and Q3. I imagine that they will get back to breakeven cash flow (or better) by Q4 when holiday sales kick in.

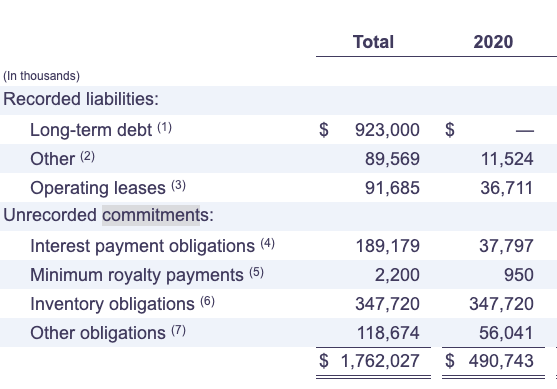

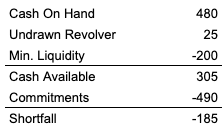

Kontoor has $479M of cash on hand and TTM EBITDA of $314. The cash on hand represents one year of commitments, per its 2019 10-K.

Source: 2019 10-K

Kontoor needs to maintain $200M of liquidity which means it needs to earn about $185M in EBITDA-CX this year. Last year, they earned $341M, so they can weather a 45% decline. Reductions in SG&A might give them a little more room. Kontoor will also probably be able to reduce some of its 2020 commitments, which would help a little more.

If Kontoor did breach its $200M liquidity debt covenant, it would likely amend its credit facility again rather than go into default. Banks don’t want to make and sell jeans unless they absolutely have to.

This doesn’t give me a warm and fuzzy feeling. It’s not a death sentence, but it is also not a foregone conclusion that Kontoor survives unscathed. The stock is a levered bet on a reasonable recovery.

Risks

The bear case is that Kontoor is simply too leveraged to survive this downturn. Its digital channels are growing quickly but represent less than 10% of sales. Kontoor is highly dependent on its US Wholesale channel. The longer the pandemic rages, the fewer of these retailers will be left standing. My valuation assumed sales eventually stabilize at 2019 levels, but sales may be lower if fewer retailer are left to carry Lee and Wrangler.

Kontoor’s high leverage will make its stock act increasingly like an option on a recovery. Management has not given specific enough guidance on potential cash burn rates to be absolutely sure Kontoor will survive to 2021.

The mitigant is that Kontoor’s brands are well known, well regarded, and offer value. People still need jeans, whether there’s a pandemic or not. I expect 2020 sales to dip more than their 10% decline in 2008, but they’re unlikely to completely crater. One or two poor quarters won’t ruin the company.

Summary

Kontoor is a simple, historically predictably, cash-flow generative business that’s cut its dividend as a precautionary measure. The dividend was the main reason its shareholders held the stock, and as a result, I’d expect the shareholder base to turn over. The SPDR S&P Dividend ETF owns almost 17% of shares and, per its prospective, will sell all of those shares by the end of May. That will likely put even more pressure on Kontoor’s already battered shares and could provide an attractive entry for long-term investors. The stock appears highly levered to an economic recovery. At 4x normalized earnings, the stock offers substantial upside if it re-rates to a reasonable 10x earnings.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.