This post was originally published on this site

Hello! The results for March and first-quarter ETF flows are in, and for this week’s wrap, we take a look at how it all shakes out.

Exchange-traded funds raked in capital last month despite first-quarter losses for stocks and bonds amid jitters over the Russia-Ukraine war and the prospect of rising interest rates. U.S.-listed ETFs saw their third largest monthly inflows ever in March, a rising tide that did not lift “all boats” though like it did in 2021, according to State Street Global Advisors. Scroll down to see where the money flowed—and where it didn’t.

Also in this week’s wrap, MarketWatch spoke with Shannon Saccocia, chief investment officer at SVB Private Bank, about commodity exposure amid inflation worries, as well as John Hoffman, head of ETFs and indexed strategies for the Americas at Invesco, on where he sees money flowing over the past few days amid rising interest rate concerns. In another interview, Blue Horizon Capital, which has an ETF focused on “the new energy economy,” told us the Russia-Ukraine war is “illuminating to the world the need to move away from carbon-based fuels.”

For tips and feedback, reach out to me at christine.idzelis@markewatch.com. You can also follow me on Twitter at @cidzelis and on LinkedIn.

A dismal first quarter for stocks and bonds didn’t stop investors from pouring capital into exchange-traded funds last month, though markets remain under pressure and cracks have formed in some areas of the ETF market, according to State Street Global Advisors.

U.S.-listed ETFs attracted $97 billion of inflows in March, the third highest monthly inflow ever, for a total $195 billion during the first quarter, according to a report from Matthew Bartolini, head of SPDR Americas research at State Street Global Advisors. ETFs focused on U.S. stocks captured $60 billion of inflows in March, or 86% of all equity flows, for a first-quarter total of $113 billion.

Bond funds also had inflows last month, led by broad-based government bond funds and inflation-protected strategies, amid expectations that the Federal Reserve will become more aggressive in combating the surge in the cost of living by raising interest rates and shrinking its nearly $9 trillion balance sheet. But while Treasury Inflation-Protected Securities, or TIPs, are “intuitive,” Bartolini sees “little rationale to buy into government bonds,” according to the report.

“Bond returns are likely to remain under pressure for the next few quarters,” he wrote. “With duration extended on core bonds, higher rates will most certainly lead to negative returns for traditional fixed income exposures – severely restraining the standard 60/40 portfolio’s ability to generate sufficient returns in 2022.”

The standard portfolio, comprising 60% stocks and 40% bonds, is supported on the equity side in part by an increase in earnings-per-share estimates since the start of the first quarter, the report shows. Also, the drawdown seen during the first three months of 2022 has resulted in lower valuations, Bartolini said, but cautioned that price-to-next-twelve-month-earnings ratios remain above the long-term average.

“There are downside risks to be mindful of, and it’s unlikely that equities will witness a linear move up and to the right for the rest of the year,” he wrote. “The Russia-Ukraine War has ushered in the return of episodic volatility, a macro risk environment that will include sharp spikes and declines in volatility.”

While investors poured capital into ETFs in March, there were some signs of cracks in the industry. Only 61% of ETFs had inflows in March, down from about 68% in 2021 and below the long-term median of 64%, according to the report.

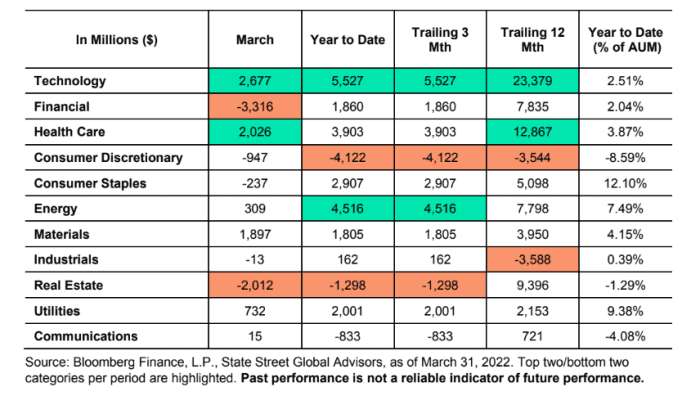

As for areas where investor sentiment soured, consumer discretionary had the biggest sector outflows in the first quarter, amid concern that higher gasoline prices at the pump is hurting consumer spending, the State Street report shows. Technology and energy, by contrast, have seen the strongest inflows among sectors this year.

STATE STREET GLOBAL ADVISORS REPORT

Meanwhile, in corporate debt, high yield bond ETFs had their worst quarter ever during the first three months of 2022, with about $12 billion of redemptions, according to State Street. Rising interest rates generally eat into the value of bonds, with high-yield debt involving more credit risk.

Read: Why high-yield ETF outflows made this Jefferies strategist ‘a little nervous’

But money has kept flowing into another area of corporate debt that’s typically associated with junk-rated borrowers: the bank loan market. Investors poured $781 million of capital into such ETFs in March, marking an 18th straight month of inflows, and contributed $2.4 billion to the funds in the first quarter, the State Street report shows.

Bank loan ETFs invest in leveraged loans, a form of high-yield, high-risk corporate debt with a floating-rate coupon. “With rate hikes on the horizon, loans will likely continue to be sought after,” said Bartolini.

This week, the Invesco Senior Loan ETF

BKLN,

had one of its largest daily inflows over the past year, according to John Hoffman, head of ETFs and indexed strategies for the Americas at Invesco. Recent inflows are a “significant change” for the fund, after suffering outflows earlier in the year, he said by phone.

The Invesco Senior Loan ETF has a “higher skew” toward leveraged loans with a BB or B rating, and unlike competitors, the fund historically has posted “a material underweight” to risky CCC-rated debt relative to the broader loan market, according to emailed comments from Hoffman. He sees the fund benefiting from that positioning this year.

Shares of the Invesco Senior Loan ETF are down about 1.4% this year through Wednesday, according to FactSet data. The SPDR Blackstone Senior Loan ETF

SRLN,

has fallen 1.8% over the same period, while shares of the SPDR Bloomberg High Yield Bond ETF

JNK,

have tumbled 7.2% this year through Wednesday.

‘Parabolic levels of interest’

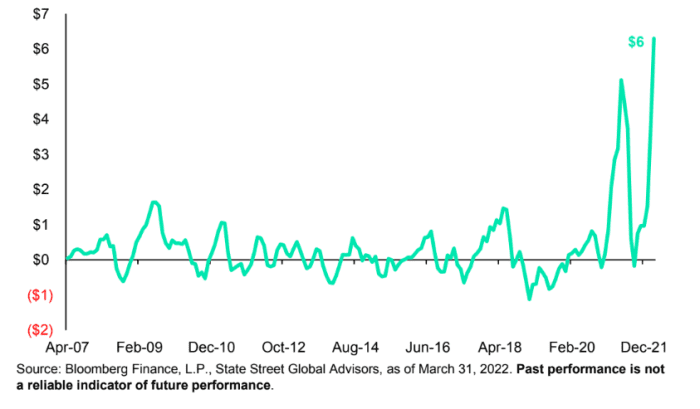

Other areas of the ETF market have received ‘parabolic levels of interest’ this year, said Bartolini. “With volatility elevated, inflation rising, and commodities posting their best quarter since 1990, broad-commodity and gold ETFs” each saw their third highest monthly inflows in March, according to his report.

That helped bring broad-commodity flows to their highest trailing three-month total ever, as seen in the chart below, highlighted in the State Street report. The chart tracks broad-commodity flows in billions of dollars.

STATE STREET GLOBAL ADVISORS REPORT

The war in Ukraine has increased inflationary pressures, pushing up agricultural and energy prices, said Shannon Saccocia, chief investment officer at SVB Private Bank, in a phone interview.

“Inflation is not improving at the pace that we were hoping,” she said. “The painful first quarter in which both stocks

SPY,

and bonds

AGG,

hurt you is likely to persist a little bit longer than anticipated.”

Read: Cathie Wood’s ARK Innovation ETF slides in stock-market selloff Wednesday

The question for investors is how long the recent strength seen in energy and natural resources may continue, according to Saccocia.

The Energy Select Sector SPDR Fund

XLE,

has soared almost 38% this year through Wednesday, according to FactSet data. FlexShares Morningstar Global Upstream Natural Resources Index Fund

GUNR,

which buys stocks in areas such as energy, agriculture and metals, jumped 19% over the same period.

“Our view is that energy prices are going to start to settle,” with West Texas Intermediate crude

CL.1,

settling in the $90s, said Saccocia, after spiking above $100 a barrel during Russia’s ongoing attack on Ukraine. “The energy space in particular is definitely trading on this perception that inflation is not going to improve in the back half of the year, and we do think it will, albeit at a little slower pace,” she said.

Saccocia said “we are more optimistic” about the FlexShares Morningstar Global Upstream Natural Resources Index Fund because it’s more diversified than the Energy Select Sector SPDR Fund. The FlexShares Morningstar Global Upstream Natural Resources Index Fund’s exposure to agriculture, in particular, should help it continue to perform well, she said.

‘Generational trade’

Keeping on the energy theme, Tim Johnston, partner at Blue Horizon Capital and a member of the firm’s investment committee, told MarketWatch by phone that the Russia-Ukraine war is “illuminating to the world the need to move away from carbon-based fuels.” The Blue Horizon BNE ETF

BNE,

which focuses on the transition toward a “new energy economy,” provides broad and diversified exposure to areas including the generation, distribution and storage of energy, as well as “performance materials” such as nickel and e-mobility, according to Tony Fusco, president of Blue Horizon.

Fusco said by phone that the ETF seeks exposure to companies that are investing in renewable energy and a sustainable future. “It’s a generational trade,” he said.

A clean energy fund at BlackRock was among the top performing ETFs over the past week through Wednesday, according to FactSet data.

The good…

| Best Performers | %Performance |

|

WisdomTree India Earnings Fund EPI, |

3.5 |

|

iShares Global Clean Energy ETF ICLN, |

2.9 |

|

SPDR S&P BIOTECH ETF XBI, |

2.8 |

|

First Trust NYSE Arca Biotechnology Index Fund FBT, |

2.5 |

|

iShares Emerging Markets Dividend ETF DVYE, |

2.5 |

| Source: FactSet, through Wednesday, April 6, excluding ETNs and leveraged products. Includes NYSE, Nasdaq and Cboe traded ETFs of $500 million or greater |

The bad…

ETF launches:

-

Neuberger Berman announced Thursday that it is offering three actively-managed ETFs that seek to benefit from megatrends including “technology disruption, digitally connected consumers, and infrastructure-enabling decarbonization.” The new funds, the Neuberger Berman Connected Consumer ETF (NBCC), the Neuberger Berman Carbon Transition & Infrastructure ETF (NBCT) and the Neuberger Berman Disrupters ETF

NBDS,

-1.24% ,

are listed on NYSE Arca exchange.

-

DoubleLine said at the end of March that it was planning to offer its first exchange-traded funds, the DoubleLine Opportunistic Bond ETF

DBND,

-0.17%

and DoubleLine Shiller CAPE U.S. Equities ETF

DCPE,

+0.79% .

Both funds began trading this week.

-

On Wednesday, EMQQ Global announced the launch of the India Internet and Ecommerce ETF

INQQ,

-0.67% ,

which targets the country’s “rapid digitization.”

ETF reads:

Morningstar go studs up on ARK Invest’s flagship ETF (Financial Times)

Value Investing Is Back. But How Do You Choose the Right ETF? (The Wall Street Journal)

SEC Approves Teucrium’s Bitcoin Futures ETF (CoinDesk)

BlackRock Cuts Fees on World’s Biggest Bond ETF and Several More (Bloomberg)

Best & Worst Performing ETFs Of 2022 (ETF.com)