This post was originally published on this site

Usually, the corporate bond markets of the U.S. and Europe move in tandem.

That’s logical. The U.S. is a major market for most European companies, and the reverse is true to an extent as well. While the U.S. economy has been consistently stronger than its eurozone counterparts, bond investors are less concerned about the magnitude of economic growth than whether economies are strong enough for their companies to meet debt obligations at all.

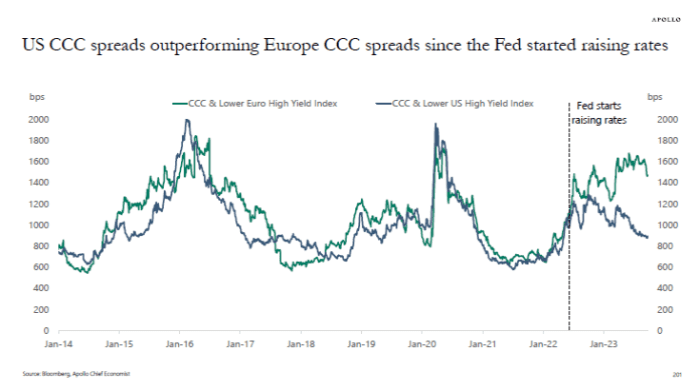

But that relationship has broken down. Torsten Slok, the chief economist at Apollo Global Management, points out that spreads for CCC-rated securities are much tighter in the U.S. than in Europe since the Fed began lifting interest rates. That is even though both regions are grappling with inflation, and the odds of a recession in the U.S. (60%) are actually higher than eurozone recession odds (50%).

“The bottom line is that there is an inconsistency in pricing of lower-rated corporate credit in the U.S. and Europe. We cannot both have that everything is fine and at the same time we are going into a recession,” says Slok.

He speculates that, in the U.S., there may be a yield-level mirage, as investors focus more on the levels of yields than the spread between them and the benchmark government debt.

“Given the relationship changed after the Fed started raising rates maybe the reason is what could be called a yield-level illusion in U.S. lower-rated credit, where investors focus more on the levels of yields than on the underlying fundamental credit risks of Fed hikes and permanently higher costs of capital,” said Slok.