This post was originally published on this site

The basic retail property problem

As I’ve pointed out before now the essential retail property problem in the UK is the internet. The UK has one of the world’s highest penetrations of online sales (some 20%) and this means that the past built estate of retail properties is somewhat surplus to requirements. Some estimates say that 20% of British retail property is empty and it’s pleasing to see the symmetry there.

It is also true that the companies specialising in retail property had/have gearing. Borrow against the property valuations in order to return capital to investors and run on a capital light model. Why not? Well, the not is what happens when valuations fall? That equity value in the real estate falls, the debt burden does not and so the company hits the required equity to debt ratios. Those covenants that the bankers insist upon writing into the debt agreements.

At which point the company has three choices. Refinance the lendings, presumably at much higher rates. If any one will that is. Raise equity capital if anyone will pay in. Or go bust.

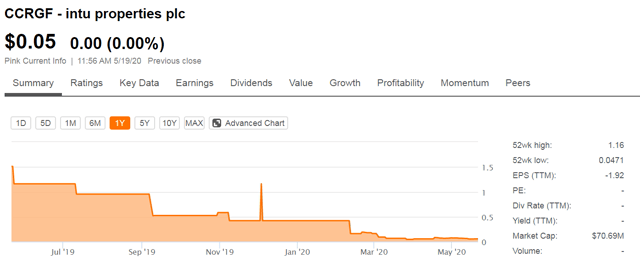

(Intu Properties stock price from Seeking Alpha)

(Intu Properties stock price from Seeking Alpha)

We’ve looked at Intu before, here, here, here and here. Those explain the background to the retail sector, the peculiarities of the English leasing system, Intu’s attempts to wriggle free and so on. The long story short is that Intu has fallen into this very problem. The valuations of the properties have been falling, substantially, as a result of the internet irruption. They’ve not been able to refinance to escape the covenants, at least not yet. They tried but failed to get an equity raise away. And so, well, not formally or officially or anything but they’re bust, dead men walking.

At which point we get this:

Intu Properties, one of Britain’s biggest shopping centre operators, is seeking standstill agreements from its lenders as it battles for survival after a collapse in rent payments from retailers.

The company, which owns Manchester’s Trafford Centre and Lakeside in Essex, said it was likely to breach its debt commitments at the end of June as the stock market turmoil and downturn in the property market made it impossible to raise new funds.

And this:

The heavily indebted owner of the Trafford Centre in Manchester and Lakeside in Essex wants to avoid further breaches or defaults by striking deals with its lending banks and bond market investors that halt all covenant testing and debt repayments until the end of next year.

The reason being of course that the lockdown has made retail property worth even less – and reduced rental income – and the weirdness here is that this could be the saving of them.

Game theory

The intuition here comes from game theory. If this person does this then the opponent or collaborator does that and then the first person does this third thing and so, how does the pathway of decisions go?

So, in normal times, a property company breaches its covenants on debt to equity ratios, can’t raise more equity, can’t refinance and, well, the lenders end up owning the properties, don’t they? England doesn’t quite have Chapter 11 and Chapter 7 but an administration is closer to the first, liquidation the second. And an administration where the lenders end up with all the equity in the new structure is not unknown. Nor, obviously is a liquidation where the assets are sold for whatever they can get.

That’s roughly what we would have predicted for Intu as things slowly and progressively got worse. But that’s not what did happen, instead there was a leap from this will probably happen to things being very much worse indeed at which point why would anyone want it to happen?

That is, the situation has leapt from where the lenders would get all their money back, probably, by cutting Intu off at the financial knees to one where they’re not going to get it all back even if they liquidate. Who wants to buy shopping centres right now? The firesale price is some fraction of the currently outstanding debt.

So, why would they do that?

The lenders’ best chance

Given that the equity value achievable is now well below the outstanding debt – OK, that’s an assumption I’m making but I think it fair – then the impulse to insist upon those covenants rather goes away. It actually becomes, possibly at least, in the lenders’ best interests to allow Intu to stumble along just in case something turns up. Maybe an equity provider can be found at some level? Maybe the likely coming negative interest rates from the Bank of England will make a difference? Could some stimulus finds help? Who the heck knows?

But the decision is not longer about insisting upon covenants and so gaining the lending back. It’s how big is the loss going to be on those loans and what’s the best way of reducing the losses?

At which point why not agree to a standstill and see what happens?

Which is what interests me here. I think it’s possible, given the lockdown, that the lenders will agree to a standstill. Because I can’t see them gaining anything from not doing so. Any liquidation value is going to be ludicrously low at present. And why put it into administration with all those costs when simply waiting a few months to see what happens would work just as well?

My view

I think the lockdown changes the game here. There’s no advantage, any more, to insisting upon the covenants. Valuations have leapfrogged downwards as a result of the lockdown. Thus there’s a chance – and it is only a chance – that Intu will be left alone to see what happens.

The investor view

Sure, this all depends upon that game theory and there’s significant risk in doing that. But where I thought a few months back that Intu was gone now I think it might survive that 18 months as a result of a standstill. Which makes the stock – at option value only, as it is – worth perhaps a small flutter.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.