This post was originally published on this site

Despite the ongoing pandemic, Ryanair (RYAAY) can weather the current storm, as it has enough liquidity to stay afloat for more than a year in the current environment. Unlike its major competitors, the airline will not require a state bailout and it will be able to fully resume its operations, once the restrictions are eased. However, while Ryanair will not face a liquidity crisis, its growth prospects remain dim. By being a low-cost provider, the airline needs a minimum load factor of 75% to break even, and in some cases, that number is as high as 90%. Since the air traffic is expected to be down 50% to 80% this year, it’s highly unlikely that the airline will make any profit at all in FY21.

Any growth in the next 12 to 18 months will be limited, until we find a proper treatment and a vaccine against COVID-19. As a result, there’s a high chance that Ryanair’s stock will be trading sideways in the upcoming months and no value will be created in the foreseeable future. Considering this, we believe that Ryanair is a solid airline, but in the current environment, it’s better to avoid its stock for the time being, until the air traffic starts to return to its pre-COVID-19 levels.

The Growth Dilemma

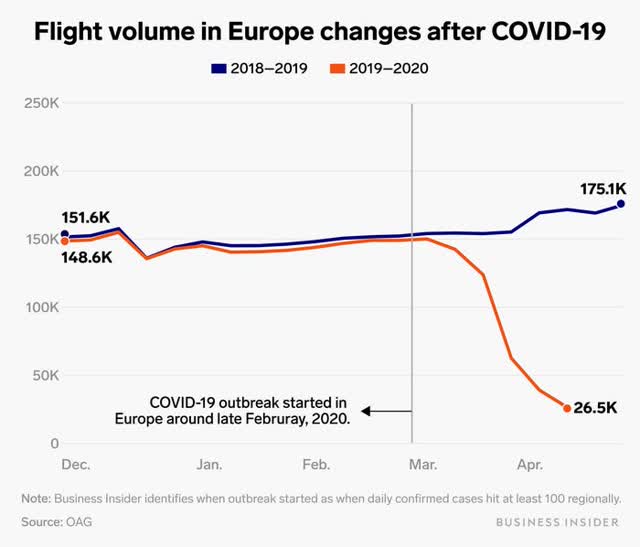

In the last two months, the spread of COVID-19 all around Europe pushed the continent’s major airlines on the brink of collapse. Germany already injected €9 billion into Lufthansa (OTCQX:DLAKF), while France and Netherlands saved Air France-KLM (OTCPK:AFRAF) from going under by providing much-needed liquidity. At the beginning of April, Europe’s air traffic was still down 84% Y/Y and it will take years for the air travel to recover to its pre-COVID-19 levels.

As one of Europe’s biggest airlines, Ryanair can weather this storm with relative ease. Since 99% of its fleet is grounded and it’s unable to make money, the airline decided to opt-in into the payroll support program that a lot of EU countries offer to decrease its salary expenses for the time being. At the same time, it will not require any additional state aid, as it’s liquid enough to outlive this pandemic.

From January to March, Ryanair’s GAAP EPS was €0.58, while its revenue of €8.49 billion was up 10.3% Y/Y. With a P/E of 17.6x, the company’s stock trades above the industry’s median P/E of 6.58x. However, it also has the best operating and net margins among its peers, and its premium price is justified.

Source: Capital IQ

As cash preservation becomes the major objective of airlines in the current environment, Ryanair shouldn’t worry about it too much. At the end of April, the company had €4.1 billion in cash on its balance sheet, while at the same time it managed to decrease its weekly expenses from €200 million to only €60 million. If needed, the airline will be able to raise additional liquidity, as it owns 331 Boeing 737 planes and could use them as collateral.

While liquidity is not an issue here, Ryanair’s growth prospects are. By being a low-cost provider, the airline needs to have a load factor of more than 75% to break even. If governments decide to impose social distancing rules inside airplanes and force the airlines to leave the middle seat empty, then Ryanair will be losing money on every flight that it makes. Without offering the middle seat, the maximum load factor that Ryanair could have is 66%, and even then, there’s no guarantee that all window and aisle seats will be fully booked at this stage.

Another problem that Ryanair will face in the next few years is unfair competition. Thanks to the bailouts, airlines like Lufthansa, Air France-KLM, Alitalia, and others will have many competitive advantages against Ryanair. With the state aid, they’ll be able to keep their market shares in the air travel industry and not worry much about a cash burn in the long run. By having governments as equity partners, they’ll be able to quickly open new routes and easily get access to new markets once the pandemic is over. This will without a doubt limit Ryanair’s growth potential in the long run, as Europe’s airline business will be unfairly balanced.

At the same time, FY21 growth prospects are also very limited. The airline believes that it can restart 80% of its flights by September. Since the consensus right now is that the air traffic will be down 50% to 80% this year due to a small demand for air travel, Ryanair’s 80% number seems too optimistic. However, even if it manages to restart 80% of its fleet in the next three months, the load factor is still going to be relatively small and it’s unlikely that the airline will make any money at all. The truth is that until we find a vaccine against COVID-19, governments all around the world will continue to implement some form of social distancing, and airliners will suffer the most from it. Considering this, Ryanair’s growth prospects will be very limited and its stock will likely be trading sideways for quite a while. The airline decided not to issue its FY21 guidance, which makes sense, considering how uncertain the current environment is.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.