This post was originally published on this site

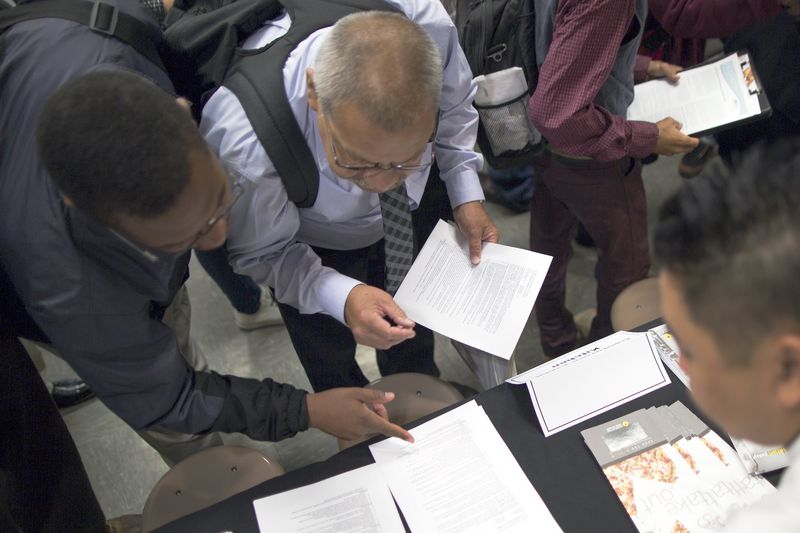

Upstart Holdings (NASDAQ:UPST) shares are down over 4% Tuesday after the company disclosed in a filing with the Securities and Exchange Commission that it has eliminated the jobs of 140 hourly employees who processed loan applications.

The AI lending company that partners with banks and credit unions said it made the decision to lay off the employees based on the challenging economy and a reduction in the volume of loans on its platform.

At the end of 2021, the company had 1,497 employees, growing from 554 at the end of 2020.

Upstart will be reporting its third-quarter earnings on November 8, 2022, after the market close. Analysts, on average, see the company’s revenue declining 25% from last year to around $171 million versus $228.5 million in the same quarter in 2021.

In late October, Mizuho Securities initiated research coverage on Upstart with an Underperform rating and a $17 per share price target, representing a potential downside of about 20%. Mizuho analysts told investors in a note that they expect “more pain in coming quarters” for Upstart.