This post was originally published on this site

As earnings season kicks off to lofty expectations, with analysts expecting a 64% surge in S&P 500

SPX,

earnings per share in the second quarter, one question is just how long corporations can maintain these heady levels of profit.

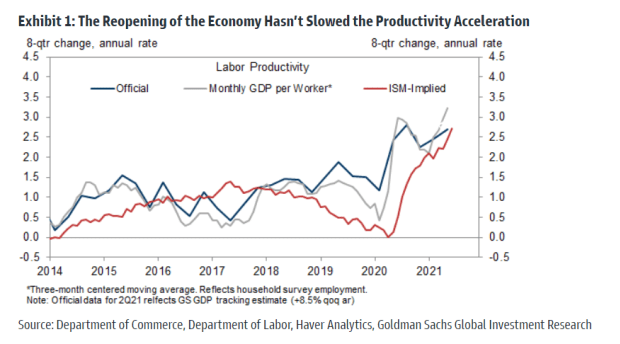

The answer might be longer than you’d think. A new note from Goldman Sachs finds that stronger productivity growth has been one of the silver linings on the COVID-19 pandemic.

Spencer Hill, a Goldman economist, said that productivity gains since the fourth quarter are most pronounced in industries where virtual meetings are feasible and in-person expenses like travel and entertainment have scope to decline, which sounds logical enough. “These efficiency improvements from digitization continued in the first quarter despite the reopening of the in-person economy and the partial return to corporate office buildings,” he said.

More timely data from the retail sector find pandemic productivity gains there, from boosting e-commerce and evolving bricks-and-mortar business models, which persisted even as malls reopened and the stimulus boost faded.

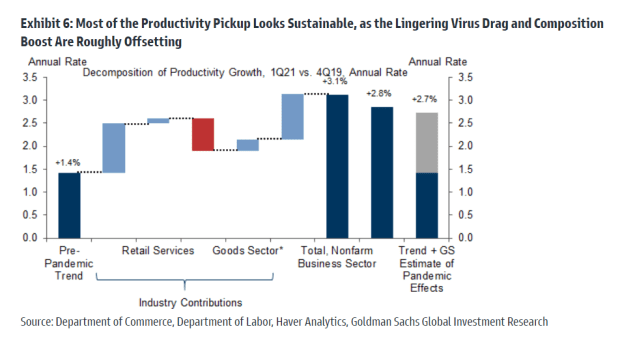

Stripping out the effects of both virus-sensitive categories, as well as the temporary boost from industry composition, and annualized productivity would be 2.8% — double its precrisis pace. And Hill said company data mirror the productivity growth rebound in gross domestic product statistics. This better productivity suggests the ability to “lengthen the runway for expansion as the business cycle matures.”

The improved productivity outlook would have important implications for the Federal Reserve as well, allowing the central bank to run a looser policy, other things being equal. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 1.36% on Tuesday, well below highs this year of 1.75%.