This post was originally published on this site

It is always fun to look at Vanguard’s most recent edition of “How America Saves.” And it is particularly interesting to get the numbers for 2020 — a year when COVID-19 shut down the economy and the stock market soared.

Everything we have seen would suggest a positive report because people with 401(k)s were generally not the ones laid off; the young and the low paid took the hit.

And, indeed, the Vanguard report shows a substantial increase in median and mean balances. Median balances rose from $25,775 to $33,472, and mean balances from $106,478 to $129,157. The big difference between the median and the average is due to a small number of accounts that have really big balances. Average balances are more typical of long-tenured, more affluent participants, while the median balance represents the typical participant. Vanguard attributes the bounce primarily to the 18% increase in the U.S. equity market.

Read: When should I claim Social Security? How do I sign up for Medicare?

Moreover, 401(k) holders were not raiding their accounts. The Coronavirus Aid, Relief, and Economic Security (CARES) Act, passed in 2020, allowed retirement savers to withdraw up to $100,000 from their retirement plan penalty-free until Dec. 30, 2020. Less than 6% of eligible participants took coronavirus-related distributions. Interestingly, hardship withdrawal activity in 2020 was down 29% compared with 2019, and non-hardship withdrawal activity was down 16%.

Read: Which retirement investments look great and which will be duds?

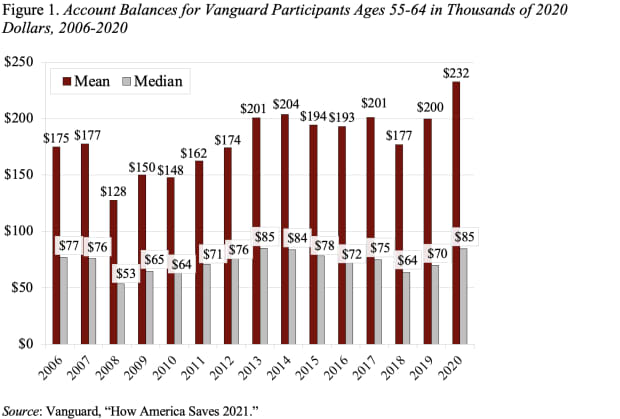

Even though 401(k) holders flourished in 2020, the balances still look puny. Consider the holdings of those approaching retirement, ages 55-64. As one would expect, these balances are much larger than those for the full participant population. But still the median is $85,000, which means that half of participants have less than this amount and half more (see Figure 1 below). Moreover, Vanguard tends to administer larger plans, so the plans are better designed than average and participants have higher incomes. In other words, it presents the best face of the 401(k) system.

So, the news from the new Vanguard report is twofold.

On the positive side, 401(k) participants were relatively unaffected by the shutdown of the economy and benefited significantly from the surge in stock prices. On the discouraging side, we still have not made a lot of progress in terms of 401(k) saving. A median of $85,000 for participants approaching retirement is simply not very much money. Even if they have rolled some 401(k) balances over to individual retirement accounts (IRAs), the 2019 Federal Reserve Survey of Consumer Finances reported the median 401(k)/IRA holdings of working households ages 55-64 were $144,000. If a couple uses their $144,000 to buy a joint-and-survivor annuity, they will receive $570 per month.

Retirement accounts appear to serve as a meaningful source of saving only for the upper two quintiles of the income distribution.