This post was originally published on this site

Alan Greenspan, left, and Jerome Powell

Getty Images

Ah, memories.

For investors old enough to remember — or who otherwise know their turn-of-the-century stock-market history — the selloff in tech stocks that picked up speed in the past week inevitably prompted some reminders of the final stages of the dot-com bubble that saw tech stocks and the Nasdaq Composite COMP, -0.60% and Nasdaq-100 NDX, -0.59% accelerate to all-time highs before collapsing.

Technical analyst Jeff deGraaf, founder of Renaissance Macro Research, has argued that there are some valid comparisons to be made between the aggressive actions taken on the monetary and fiscal front six months ago and the Federal Reserve’s intervention to flood the financial system with liquidity in 1998 after the collapse of Long Term Capital Management, deGraaf wrote, noting that six months ago the economy was similarly strong with record low unemployment and a pickup under way in neglected sectors, such as housing.

The Fed’s intervention in 1998, after an emerging markets debt crisis brought down the high-profile hedge fund, was credited with helping to propel financial assets to their 2000 peak. DeGraaf said that episode led him to wonder if the monetary and fiscal boost provided in March as the COVID-19 pandemic brought the U.S. and global economy to a near-halt could do the same again.

Using the LTCM collapse in September 1998 as one benchmark and March 23, 2020, as a COVID-19 benchmark, he noted similarities, as well as a “glaring difference.”

There was a stretch of nearly 18 months between the LTCM crisis and the Nasdaq-100 peak, he said. “Today, we’re five months into the COVID aftermath. By the time the NDX peaked (in 2000), the Fed had begun removing stimulus, today there’s little consideration, let alone talk, of stimulus removal.”

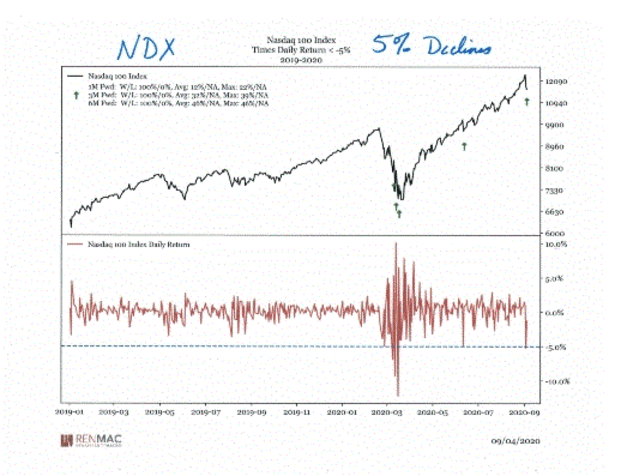

DeGraaf said the recent fall for the Nasdaq-100 had served, in particular, to remind investors of the 2000 peak. He noted that there were some examples of 5%-plus declines in the Nasdaq-100 during the 1999 run-up, which goes to show that momentum-driven markets can suffer brief but meaningful “pressure points.”

Renaissance Macro Research

Another key difference, however, is that market breadth — the number of stocks participating in a move — is far healthier than in 1999-2000, he said.

Back then, tech “was working at the EXCLUSION of everything else,” deGraaf said. “Today, tech is outperforming but not at the absolute exclusion of everything else.”

While the tech-heavy Nasdaq Composite led the charge higher for major indexes following the market’s March 23 pandemic bottom, the S&P 500 SPX, +0.05% pushed back into record territory last month and had set a record high close early last week before the tech-led selloff began. The Dow Jones Industrial Average DJIA, +0.47% had pushed back above 29,000 early last week for the first time since February, before the selloff dragged the blue-chip gauge back into negative territory for the year.

A spike in 20-day lows for tech stocks suggests some stress has developed, but a “firm relative strength line” for the Nasdaq-100 and an improvement in communications equipment suggest that while a “modest shift” may be under way, it’s unlikely to be a “2000-style top.”