This post was originally published on this site

Stock-market fear is on the rise, with individual investors becoming the most bearish since 2009, according to BofA Global Research.

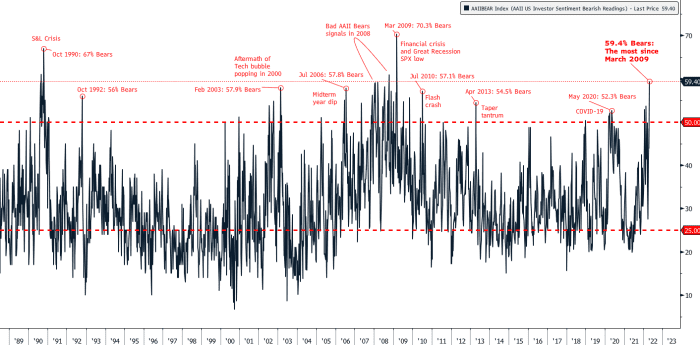

“Individual investors are running scared,” said Stephen Suttmeier, technical research strategist at BofA, in an April 29 note. A bearish sentiment measure by the American Association of Individual Investors has “a capitulation reading of 59.4%, the highest since March 2009,” or around the time the stock market bottomed amid the global financial crisis, the note shows.

BOFA GLOBAL RESEARCH NOTE DATED APRIL 29, 2022

An ugly April for the U.S. stock market has deepened this year’s losses for major benchmarks as investors fret over soaring inflation and rising interest rates. The Cboe Volatility Index

VIX,

was high Monday afternoon at more than 35, well above its 200-day moving average of around 21.6, FactSet data show, at last check.

While bearish sentiment may have some investors looking for the S&P 500 to “bounce,” Suttmeier warned in the BofA report that indicators such as weakened credit-market indexes point to the potential for it to see new lows this year of around 3,800 to 4,000.

“This suggests that any rallies should be sold,” he said in the report.

The S&P 500

SPX,

was down about 1.4% in Monday afternoon trading, after entering correction territory for the second time in 2022 on Friday, when it closed at 4,131.93, according to Dow Jones Market Data.

A correction is commonly defined as a pullback of at least 10% — but not more than 20% — from a recent peak. An exit from that territory occurs after a rise of at least 10% from a correction low.

The S&P 500 and Dow Jones Industrial Average also booked their worst April performance since 1970, while the technology-laden Nasdaq Composite

COMP,

saw its ugliest April since 2000, the year the dot-com bubble burst.

The bond market has suffered this year as well.

Shares of the iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

and iShares iBoxx $ Investment Grade Corporate Bond ETF

LQD,

were down in afternoon trading Monday, FactSet data show, at last check. The share price of the iShares iBoxx $ High Yield Corporate Bond ETF fell 4.6% in April while the iShares iBoxx $ Investment Grade Corporate Bond ETF dropped 6.9%, FactSet data show.

Read:Why high-yield ETF outflows made this Jefferies strategist ‘a little nervous’

Meanwhile, spreads in the junk bond market widened last month, according to data from the ICE BofA US High Yield Index Option-Adjusted Spread cited on the website of the Federal Reserve Bank of St. Louis. High-yield spreads were nearly 4 percentage points over comparable Treasurys at the end of April, compared with around 3 percentage points at the start of 2022, the data show.

“Investors aren’t used to seeing dramatic losses in their bond portfolios, particularly when equity markets are also declining sharply,” said Saira Malik, chief investment officer at Nuveen, in a note Monday. “We don’t foresee such simultaneous selloffs becoming the norm, but less predictable correlations could become more frequent as the Fed continues its policy normalization and liquidity conditions tighten.”

The Federal Reserve is aiming to combat high inflation by tightening its monetary policy this year through rate increases and a reduction of its massive balance sheet. Investors expect the central bank to announce another rate hike after the conclusion Wednesday of its two-day policy meeting.

Read: Farewell TINA? Why stock-market investors can’t afford to ignore rising real yields.

“Bulls among individual investors have become an endangered species,” said BofA’s Suttmeier.