This post was originally published on this site

It’s time to discuss a stock I covered in February of this year, right before COVID-19 became an issue. The stock I am talking about, Apple Hospitality (APLE), got hit badly by the virus and is currently down 40% year-to-date. The only thing that gave me hope was that I wanted to buy the stock lower as I mentioned in my article as the virus already started to become an issue. However, I had not expected it would get this bad. In this article I will discuss the company’s latest earnings, its COVID-19 measures, and why I put the stock on my watchlist. So, bear with me as we discuss what was one of the most toxic stocks of the first quarter.

Source: Apple Hospitality

Before we dive into the Q1 numbers, let me quickly show you the part where I introduced the company a short while ago. Unfortunately, the market cap value has changed, but other than that, the core message is still valid.

What’s Apple Hospitality?

Let’s start by mentioning that Apple Hospitality is one of the largest listed hotel REITs in the United States. The company has a market cap of $3.4 billion and IPOed in 2015. As of the end of 2019, the company has 235 hotels in its portfolio, 30,101 guest rooms, is servicing 34 states, 87 markets through 13 brands. The company is 99% room-focused meaning the emphasis is on renting rooms instead of hosting events, entertainment options or gaming/gambling. As I am here just listing things I found on the third slide of the investor presentation, I have to say that there is much more to it.

First of all, the core benefit Apple Hospitality offers its investors is a focus on rooms only as I already briefly mentioned. The company has less square footage to manage, less need for staff, lower maintenance expenses and less complex and volatile operations. Meanwhile, rising consumer demand is immediately impacting the business and rooms are easily renovated. As you can see below, companies operating in a room-focus only segment have higher operating margins on average compared to full-service and combined operators.

Source: Apple Hospitality Investor Presentation (Q4/2019)

Apple Hospitality also benefits from well-known tenants. The company has three major customers: Marriott, Hyatt, and Hilton. These customers operate a number of different brands. These 13 brands include names like Hilton Garden Inn, Homewood Suites, Courtyard, and many more. These tenants are not only well-known operators, but they also give Apple Hospitality a lot of safety. For example, the company has an average weighted TripAdvisor rating of 4.3/5. The company’s large scale also allows for access to performance data to enhance operations. The company benefits from a large sample size in its research and is able to provide unique solutions for its properties. Economies of scale also allow for purchasing discounts and fixed cost efficiencies. In addition to that, the company is diversifying risks hotels are spread across the entire country.

COVID-19 Damage Is Unprecedented

Saying COVID-19’s impact on Apple Hospitality is ‘unprecedented’ might seem like an obvious statement as the company’s IPOed roughly 5 years ago. However, according to Marriott Hotels (NASDAQ:MAR) CEO Arne M. Sorenson, the current situation is worse than anything seen during the Great Financial Crisis or after the devastating 9/11 attacks. As a result, Apple Hospitality’s market cap isn’t $3.5 billion anymore as mentioned in the part above but $2.2 billion after the stock dropped from roughly $16 in February to currently $9.60. Note that this is roughly double the price the stock hit in March when the end of the world seemed to be closer than ever.

While there is good news, let’s first get the bad news out of the way. Unfortunately, that’s pretty much the entire first-quarter report. As of May 15, 2020, all of the company’s hotels were opened after one hotel was temporarily closed due to the impact of a local ordinance prohibiting short-term lodging. Meanwhile, the company and its tenants focused extensively on cost-cutting by suspending some services and amenities. This has resulted in a reduction of 65% in expenditures in April.

Before I show you the other Q1 results, keep in mind that the biggest impact from the virus started in March when large parts of the economy went into lockdown mode. This resulted in a first-quarter adjusted comparable hotel EBITDA of $62.9 million. This is a decline of 40.1%. The adjusted hotel EBITDA margin fell from 35.8% to 26.6%. Occupancy dropped from 73.9% to 60.9%. Comparable hotels RevPAR (revenue per available room) declined by 20.7% to $80.70.

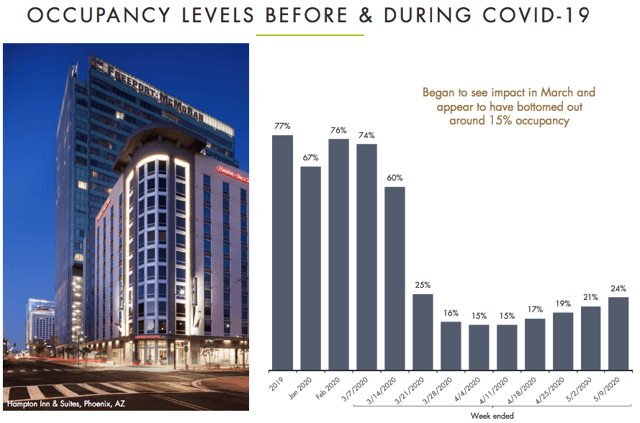

The graph below shows the development of occupancy levels. Note how well the numbers were holding up in February when the virus seemed to be an Asian ‘issue’. Then, when lockdown measures started, occupancy levels dropped below 20% for five consecutive weeks. Right now, occupancy is recovering with roughly a quarter of rooms occupied on May 9.

Source: Apple Hospitality COVID-19 Supplement (May 2020)

Source: Apple Hospitality COVID-19 Supplement (May 2020)

That said, the company paid dividends worth $67.32 million in the first quarter. That’s up from $67.19 million in the prior quarter. This increase is the result of a higher number of shares outstanding as the dividend payment per share has been unchanged at $0.30. Right now, this translates to an implied annual dividend yield of 12.9%. Unfortunately, the company suspended its monthly dividend payments as a measure to preserve liquidity. The same goes for the share repurchase program, which bought back shares worth $14.3 million in the first quarter but has been terminated in March. The company also drew the remaining borrow capacity under its $425 million credit facility for the exact same reason.

As a result of the company’s measure, its balance sheet is actually looking quite good given the circumstances. The company’s current ratio is up from 0.76 in Q4/2019 to 8.83 thanks to additional liquidity. Total liabilities are valued at roughly 40% of total assets. While this is up roughly 700 basis points, it is still a solid number. In the first quarter, EBITDA was covering interest expenses 3.5x with total debt being valued at 0.6x total EBITDA. While the coverage ratio is ‘fine’, the debt/EBITDA ratio is skewed due to the EBITDA implosion. In Q3, this number will be meaningless as there is no way EBTIDA is positive in a quarter that was almost entirely locked down so to speak.

Apple Will Recover Eventually

The biggest bull case right now is a quick economic reopening. The only way the stock is not going to recover over the next 1-3 years if management has to declare bankruptcy. Right now, I am convinced that won’t happen. The economy will not shut down again and business activity is very slowly recovering. Even the secular problem of too much hotel room supply is not important right now as the stock is down 40% year-to-date. Right now, the goal is to buy a beaten-down hotel REIT that will start paying a dividend again in the future. Everyone wants to own a REIT with a dividend yield of more than 10% and sky-high capital gains. Unfortunately, it sounds easier than it is. I believe buying a small number of shares is a good idea. However, keep your initial exposure small as sell-offs could easily push this stock down 10-20% if stocks decide to sell-off again.

I am aiming to start buying below $8 if I get the chance. I am not rushing to get hotel exposure as I already own some cyclical exposure.

Be safe!

Thank you very much for reading my article. Feel free to click on the “Like” button and don’t forget to share your opinion in the comment section down below! My long-term investments are stated in my Seeking Alpha biography.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: This article serves the sole purpose of adding value to the research process. Always take care of your own risk management and asset allocation.