This post was originally published on this site

The first half of 2020 has been a roller-coaster ride for the gold producers given the market turbulence, however, the better names in the sector have emerged from the rubble with a relentless bid underneath them. Endeavour Mining (OTCQX:EDVMF) is one of these names, and the stock managed to finally break out of its multi-year base earlier this month on the back of a blow-out Q1 report across nearly all metrics. Not only did the company see strong gold production in Q1 despite the COVID-19 related challenges, but we also saw a muted escalation in costs, with Endeavour currently tracking in line with FY-2020 guidance. Based on the company’s continued production growth with the integration of Semafo as well as a massive pipeline of projects that could head into production within three years, I would not be surprised to see Endeavour Mining producing 1.3 million ounces of gold by FY-2023. Given the company’s industry-leading costs, improving margins, and improving technical picture, I believe any 15% pullbacks in the stock would provide buying opportunities.

(Source: Semafo Gold Company Website)

(Source: Semafo Gold Company Website)

Endeavour Mining released its Q1 results last week, and the company reported quarterly gold production of 172,000 ounces, a massive jump of 40% year-over-year, helped by the addition of the company’s newest operation, Ity CIL. The intermediate miner’s all-in sustaining costs came in at $899/oz for the quarter, more than 9% below the industry average. Despite a 3% increase in costs year-over-year, it was all-in sustaining margins that were the real stand-out in the quarter. The company’s all-in sustaining margins soared from $375/oz in Q1 2019 to $647/oz in Q1 2020, up 73% year-over-year, bolstered by a much higher average realized gold price of $1,546/oz. It’s worth noting that the company should enjoy an average gold price above $1,600/oz for Q2 2020, meaning that all-in margins are likely to expand further in the remainder of FY-2020. Let’s take a look at the company’s primary operations below:

(Source: Company News Release, Company Website)

(Source: Company News Release, Company Website)

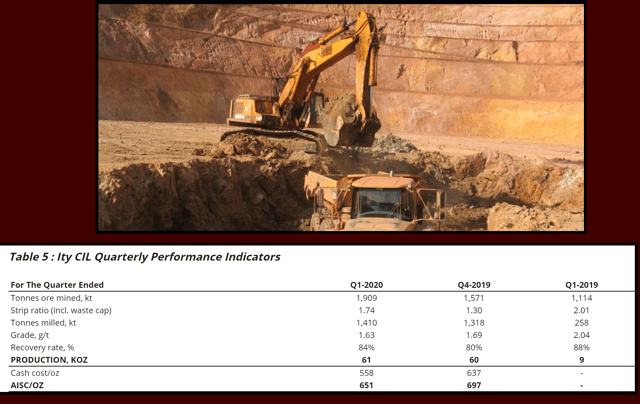

Beginning with the company’s Ity CIL Mine in Cote d’Ivoire, the company had an exceptional Q1, with quarterly gold production of 61,000 ounces at all-in sustaining costs of $651/oz. While production was flat sequentially from the 60,000 ounces produced in Q4 2019, recovery rates jumped to 84%, up 400 basis points, and costs were down 6% sequentially to $651/oz. Meanwhile, quarterly throughput came in at 1.4 million tonnes, up 7% sequentially as a result of increased utilization of larger mining trucks and less rainfall related impact. Ity CIL continues to be Endeavour’s lowest-cost operation in its portfolio and is now its most significant contributor to its annual gold production. Given the smooth ramp-up we’ve seen since commercial production began in Q2 of last year, it’s not surprising that the company has seen all-in sustaining costs improve on a company-wide basis.

(Source: Company News Release, Company Website)

(Source: Company News Release, Company Website)

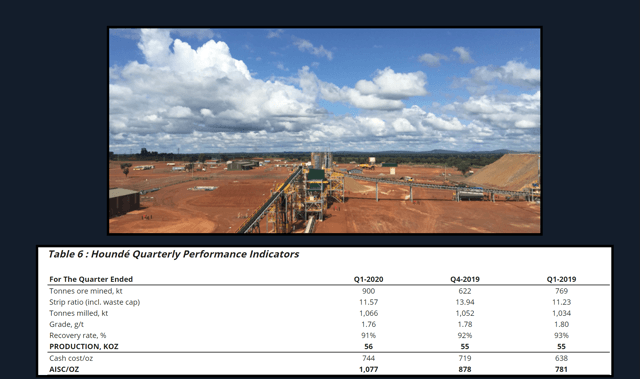

Moving over to the company’s Hounde Mine in Burkina Faso, we also saw a solid quarter, with gold production coming in at 56,000 ounces, and up 2% sequentially from Q4 2019. While all-in sustaining costs were much higher from Q4 2019 levels at $1,077/oz, this was mainly due to much higher sustaining capital in the quarter, with sustaining capital coming in at $11.8 million vs. $3.0 million in Q4 2019 due to waste capitalization efforts in Q1. In Q1, the company focused on mining the Vindaloo Main and Bouere Pits, with gold recoveries suffering a little sequentially, dropping 100 basis points due to the higher proportion of Bouere ore processed. However, even with a much more capital intensive quarter, margins were barely affected due to the increased gold price. Endeavour noted that gold production should increase in the back half of 2020 with potential access to the high-grade Kari Pump deposit at the end of the year and higher-grade areas of Hounde. It’s also important to note that despite the higher costs in Q1 at Hounde, the company reiterated its guidance for all-in sustaining costs of $880/oz for FY-2020.

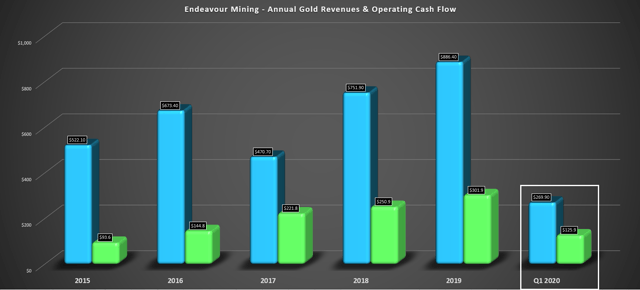

Given the solid start to the year we saw from the company’s two primary operations, it’s no surprise that revenues and operating cash flow continue to climb, with a massive quarter for Endeavour in Q1. As we can see from the chart above, annual gold revenues and operating cash flow have been rising at a steady pace since FY-2015, but we’ve seen a surge in both to begin FY-2020. This was helped by near-record gold production at the highest gold price the company has enjoyed in years, and the chart above shows that both revenues and operating cash flow are expected to hit new records in FY-2020. In Q1 alone, Endeavour’s operating cash flow came in at $125.9 million, more than half of the operating cash flow generated in all of FY-2019, with the company on track to deliver more than $525 million in operating cash flow for FY-2020. Meanwhile, gold revenues surged to $269.9 million, on track to top $1 billion for FY-2020, assuming a gold price of $1,550/oz or higher. Given the recent gold price strength, I would not be surprised to see annual gold revenues top $1.12 billion if the company’s guidance is met. These are exceptional growth metrics, and the 18% return in April for the stock can likely be attributed to this robust financial performance.

(Source: Company Presentation)

(Source: Company Presentation)

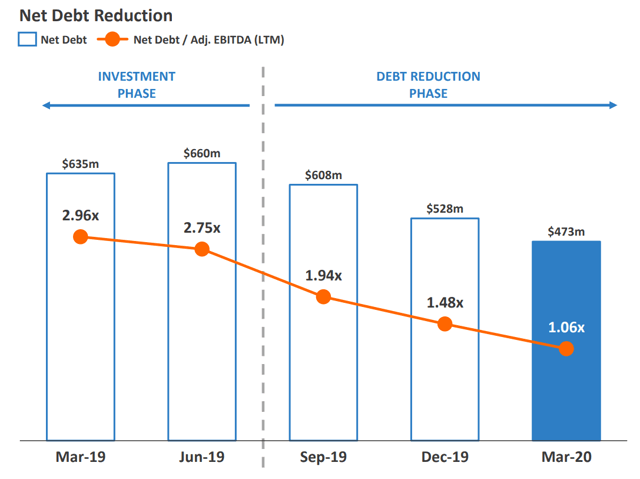

From a de-leveraging standpoint, we’ve also seen massive progress, with net debt down to $473 million to finish Q1 2020, and $55 million in debt paid down in Q1 alone. Based on the significant cash flow Endeavour is generating, the company could finish FY-2020 with less than $350 million in net debt, and at a Net Debt to adjusted EBITDA ratio of less than 0.75x. Already, we’ve seen massive progress in this ratio, with Net Debt to Adjusted EBITDA dropping 64% in just a year, from the 2.96x in Q1 2019. From a balance sheet standpoint, Endeavour is also in a great position to weather this storm, with the company’s cash balance sitting at $375 million to end Q1 2020 after drawing further on the company’s credit facility. Therefore, if we were to see a second wave of this virus or a massive increase in infections in Africa that did derail operations temporarily, Endeavour is not a company that will suffer much. This is because Endeavour solid balance sheet gives the company room to hunker down if it needs to for a quarter or two, without the risk of having to raise capital and dilute shareholders, a risk that’s present among the weaker balance sheet miners like McEwen Mining (MUX).

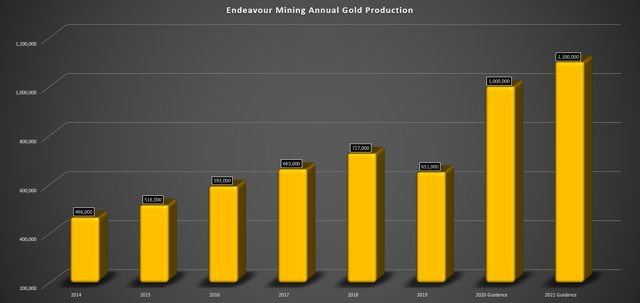

Finally, from a production standpoint, we can see that we’ve got massive growth on the horizon, with annual gold production expected to sky-rocket to 1 million ounces per year after the company acquired Semafo Gold (OTCPK:SEMFF). The company’s FY-2020 inclusive of Semafo’s integration is 1 million ounces of gold production in FY-2020 and 1.1 million ounces of gold production, translating to more than 30% growth from the prior record gold production of 727,000 ounces achieved in FY-2018. Meanwhile, Endeavour has growth potential with Kalana, acquired from Avnel in 2017, an extremely low-cost mine projecting all-in sustaining costs below $750/oz and over 150,000 ounces of annual gold production with up-front capital just shy of $200 million. Therefore, if Endeavour can use its growing free cash flow to bring either Kalana or another project online by FY-2023, a 1.3 million-ounce annual production profile is not out of reach at all.

(Source: Company Presentation)

(Source: Company Presentation)

Given that Endeavour is benefiting from a higher gold price, lower costs, and further diversification, a further re-rating is certainly possible over the next 12 months. However, this assumes that we see a smooth integration, and Semafo’s Boungou Mine does head back online without further security issues in the future. For investors unfamiliar with Boungou, it was Semafo’s lowest-cost mine with all-in costs below $800/oz, whose production was moved offline by a tragic incident last year. Based on this growth potential and continued de-leveraging as well as significant growth in operating cash-flow, I believe Endeavour Mining has moved into the top-5 African gold producers, with names like B2Gold (BTG) and Caledonia Mining (CMCL). Therefore, I think dips in Endeavour’s stock should provide buying opportunities, and I would view any pullbacks to the C$29.00 level as low-risk entries.

Disclosure: I am/we are long GLD. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Disclaimer: Taylor Dart is not a Registered Investment Advisor or Financial Planner. This writing is for informational purposes only. It does not constitute an offer to sell, a solicitation to buy, or a recommendation regarding any securities transaction. The information contained in this writing should not be construed as financial or investment advice on any subject matter. Taylor Dart expressly disclaims all liability in respect to actions taken based on any or all of the information on this writing.