This post was originally published on this site

Municipal bond defaults have been on a steady climb since 2018, and look set to continue that trend in 2021, a worrisome sign given that credit conditions are likely to only worsen from here, according to an analysis published October 6.

There have been 47 defaults so far this calendar year, according to that analysis, a weekly summary of default trends from muni-market stalwarts Municipal Market Analytics, and recent history suggests the fourth quarter will see at least 13 more, putting the annual at 60. That would be the highest yearly total, other than 2020, since 2016.

It’s important to note that none of the defaults discussed here impact bonds issued by state and local governments and secured by tax revenues. Bonds issued by Puerto Rico, which is in the midst of a major restructuring process, are also excluded.

Senior living facilities are by far the biggest offender, with 27 defaults so far in 2021, followed by charter schools. Nearly all the defaults of the past few years fall into what MMA terms a “risky” sector, also including jails, student housing, and parking.

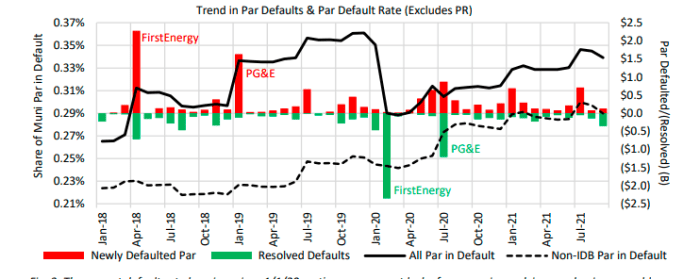

One of the biggest drivers of the surge of defaults in 2020 was the “industrial development bond” category, a sector also sometimes called “industrial revenue bonds.” That category was elevated in 2018 and 2019 as well, reflecting two high-profile issuers, FirstEnergy and PG&E, MMA notes.

“If IDBs are removed from the calculation, the adjusted current default rate trend is not only smoother but also more concerning, tacking steadily higher since 4Q18,” MMA analysts write. “This is another concerning takeaway: an apparent lack of material progress in restructuring/resolving the tide of broken financings created by the pandemic, despite the most aggressive, most borrower-friendly high yield lending conditions these entities are likely to experience.”

Demand for municipal bonds, including those considered “high yield,” also sometimes called “junk bonds,” has been so strong, and supply so low, that some funds have closed to new investors, as previously reported.

See: Municipal-bond inflows are smashing records in 2021

All this suggests that the defaults in certain sectors may point to “failing business models,” MMA notes – because access to capital clearly isn’t a problem.

And with the Federal Reserve likely getting ready to start tightening monetary policy in the coming months, credit conditions will likely only tighten.

“It implies that, if lending conditions begin to weaken even slightly, a new cohort of peer credits may fall into impairment or default situations that will also not be easy to correct,” they added.