This post was originally published on this site

GlobalFoundries Inc. plans to seek an initial public offering, according to a Monday filing with the Securities and Exchange Commission.

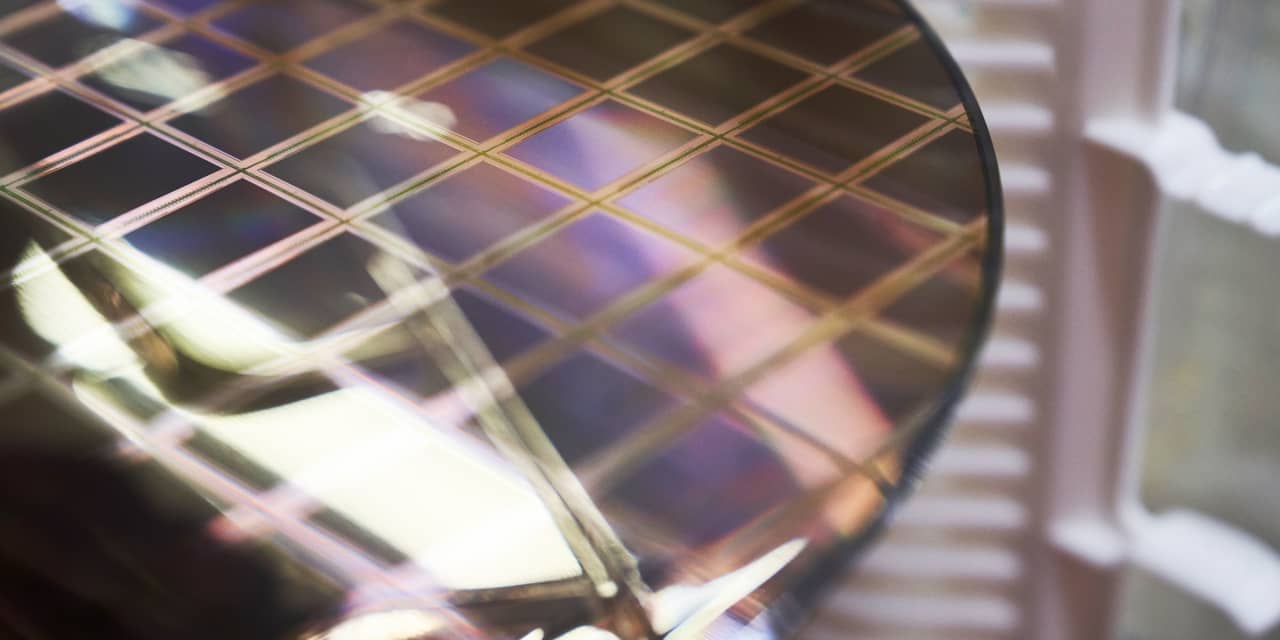

The Malta, N.Y.-based silicon wafer foundry — known as a fabrication plant or “fab” in industry parlance — said the offering would be seek up to $1 billion dollars, but that it will not receive proceeds from an undetermined number of ordinary shares from its primary shareholder.

GlobalFoundries was created in 2009, when Advanced Micro Devices Inc.

AMD,

spun off its fab business. in a deal that then-gave partial ownership to Mubadala Investment Co. , Abu Dhabi’s sovereign-wealth fund. Currently, Mubadala’s subsidiaries own all 500 million shares of the company.

Morgan Stanley, B. of A. Securities, J.P. Morgan, Citigroup, and Credit Suisse are listed among the underwriters. GlobalFoundries plans to list under the ticker “GFS” on the Nasdaq.

GlobalFoundries reported sales of $4.85 billion and a loss of $1.35 billion in 2020, compared with revenue of $5.81 billion and a loss of $1.37 billion in 2019, and revenue of $6.2 billion and a loss of $2.77 billion in 2018. At the end of 2020, the company reported cash and cash equivalents of $908.1 million.

GlobalFoundries reportedly filed confidentially for an IPO valuing the company at about $25 billion in August. The company had reportedly been in merger talks with Intel Corp.

INTC,

a month before that, but the IPO filing was seen as a sign that deal was not going to happen.

Following the offering, the company plans to have 1.3 billion ordinary shares and 200 million preferred shares, according to the filing,

Back in May, AMD committed to buying about $1.6 billion in silicon wafers over the next few years from GlobalFoundries.