This post was originally published on this site

Tesla Inc.’s stock has produced the longest winning streak in more than a year, but Wedbush analyst Dan Ives believes it can still rally a lot more given that unit deliveries appear to be trending well ahead of Wall Street expectations.

The prolific analyst said he believes deliveries in China and Europe are tracking more than 15% ahead of consensus analyst estimates. Combined with strength in Model-Y deliveries in the U.S., “Tesla could now be on a 2 million unit run-rate exiting 2022.” The current FactSet consensus for 2022 deliveries is 1.54 million.

Tesla’s stock

TSLA,

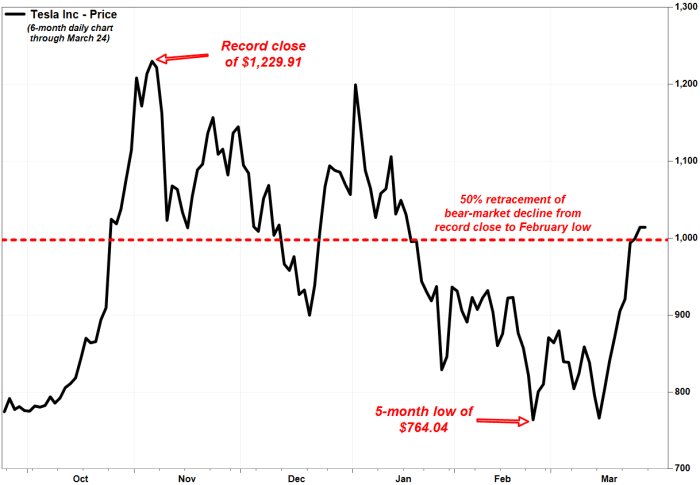

edged up 0.2% in premarket trading Friday, after soaring 32.3% amid an eight-session win streak through Thursday. That’s the longest stretch of gains since the 11-day streak that ended Jan. 8, 2021. It still closed Thursday 17.6% below its Nov. 4, 2021 record close of $1,229.91.

The biggest gain during the latest streak was 7.9% on March 22, after Technoking of Tesla Elon Musk cut the ribbon on its $5.5 billion Gigafactory in Berlin, the EV maker’s first manufacturing facility in Europe.

Also read: Tesla opens ‘Gigafactory’ near Berlin, its first in Europe.

“We continue to believe that Tesla’s stock has been way oversold over the past few months along with the risk-off mentality among tech investors, however, the Street over the past week has started to better appreciate what the seminal launch of Giga Berlin means for the Tesla supply story in 2022 and beyond,” Wedbush’s Ives wrote in a note to clients.

He also believes the recent surge in gasoline prices has accelerated EV demand for many “fence-sitting consumers,” which should disproportionately benefit Tesla, given its EV leadership.

Read more: We calculated how much more gas is costing for every type of vehicle — see how yours stacks up.

Ives reiterated on Friday the outperform rating he’s had on the electric vehicle maker for the past year. He also kept his stock price target at $1,400, which implies about 38% upside from Thursday’s closing price of $1,013.92.

FactSet, MarketWatch

Tesla’s biggest challenge is that overall supply remains “very tight,” Ives said, but he expects Giga Berlin to help alleviate that problem in Europe. He also believes the semiconductor shortage is a “moderating issue” for Tesla, as well as for the rest of the auto industry for the rest of 2022.

Don’t miss: EV market facing tougher uphill from battery costs than vital mineral shortage.

“In a nutshell, Tesla has the high class problem of demand currently outstripping supply for both Model Y and Model 3 around the globe with supply issues the biggest constraint for Musk & Co., and now help is on the way with the launch of the Berlin and Austin flagship factories,” Ives wrote.

The stock’s recent rally has retraced a little more than half (54%) of the 38% bear-market tumble from the record close to the five-month closing low of $764.04 on Feb. 23. It was still down 4.1% year to date through Thursday, while the S&P 500 index

SPX,

has lost 5.2%.