This post was originally published on this site

It hasn’t been a great year for investors to own stocks in the utilities sector – the worst-performing part of the U.S. stock market so far in 2023 – but that could be coming to an end.

The S&P 500 Utilities Sector

XX:SP500.55

has stood its ground in September as a batch of mixed economic data and fears of higher interest rates have rattled financial markets, especially technology stocks. The utilities sector has advanced over 3% so far in September and is by far the best-performing group in the S&P 500 after the energy sector

XX:SP500.10,

according to FactSet data.

The utilities sector has also outperformed the information technology sector

XX:SP500.45,

which has fallen by 4.3% this month, by the widest margin since December 2022, according to Dow Jones Market Data.

“Utilities are very oversold right now,” said David Wagner, portfolio manager at Aptus Capital Advisors. “It seems that given this oversold nature that the rubber band is so stretched so far in one direction that one ought to always be on guard for some type of abrupt flip to the script.”

Utility stocks got slammed earlier this year when higher interest rates made the sector less attractive compared to Treasury bills and money-market funds.

Unlike fast-growing technology stocks, utilities stocks are often considered dividend-income investments or defensive holdings, especially during economic downturns or recessions. The companies that provide electricity, water and gas utilities usually offer investors stable dividends, as well as less volatility compared with the overall stock market.

The utilities sector is expected to pay a dividend yield of 3.3% this year, more than twice the 1.6% of the S&P 500

SPX,

but well below the 4.321% yield of the 10-year Treasury bill

BX:TMUBMUSD10Y

and the 5.03% yield of the 2-year Treasury note

BX:TMUBMUSD02Y,

according to FactSet data.

“It’s a normal connotation that when rates go higher, utility stocks tend to underperform, and obviously utilities tend to be a defensive, interest-rate sensitive sector,” Wagner told MarketWatch in a phone interview. “During a risk-on rally [this year], utilities underperformed, so you’ve had a perfect storm for the underperformance of utilities year-to-date.”

That is why investors could benefit from the utilities sector that is “already cheap” compared to technology companies which are usually considered high-risk investments but are now among the most overvalued after an artificial intelligence-driven rally earlier this summer, said Irene Tunkel, chief U.S. equity strategist at BCA Research.

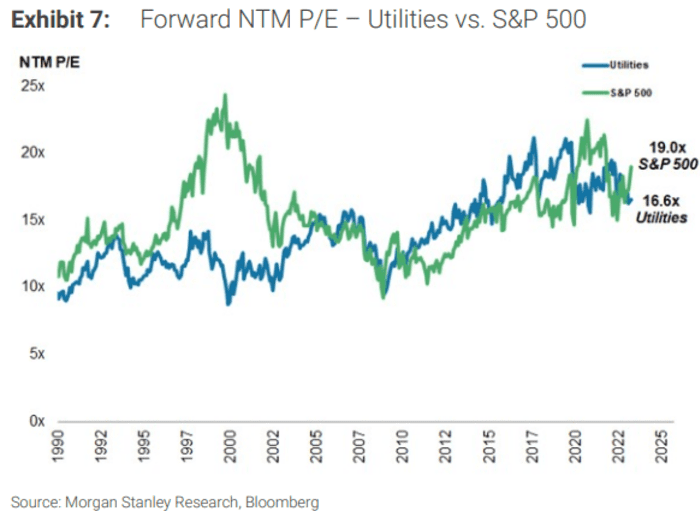

The S&P 500 Utilities Sector is trading at 17.4 times its estimated earnings for the following 12 months, while the broader S&P 500 is trading at 19.4 times its expected earnings and the S&P 500 Information Technology Sector is trading at 27.8 times its projected earnings for the same period, according to FactSet data.

See: Opinion: For better gains in tech stocks from here, look beyond the ‘Magnificent Seven’

However, market analysts think “an abrupt snap-back” in utility stocks may also point to some “risk-off” trades or deeper anxiety about the U.S. economy.

“The consensus view is that the yields will come down as they’ve already topped out,” Tunkel told MarketWatch via phone on Friday. She said the economic growth will slow down in the absence of “surprises” which have been moving the markets in 2023, and the “economic-surprise trade” will come to an end.

“Many people are now looking at different sectors because they think that rates will come down because economic growth was too slow — they’re actually looking for defensives,” Tunkel said.

Strategists at Morgan Stanley forecast the 10-year Treasury yield to retreat to 3.35% by the second quarter of 2024 in their base case. They said the market is vulnerable both to a slowdown in growth and cooling of inflation amid healthy growth — two outcomes that investors do not seem prepared for.

“This could be supportive of utility performance over the next several quarters given the correlation between utilities and the trend in rates,” said David Arcaro, executive director of equity research at Morgan Stanley. “We also think utility valuations screen cheap relative to the S&P, relative to the last 10 years on an absolute basis, and inline with the long term relationship vs. bond yields so there could be valuation support over this timeframe.” (See chart below)

SOURCE: MORGAN STANLEY RESEARCH, BLOOMBERG

Key utilities catalysts into year-end

There are other catalysts that Morgan Stanley strategists expect to drive utility stocks’ performance in the near term.

Several stocks in the utilities sector “have meaningful regulatory decisions” coming this year related to project approvals or settlement in electric-rate cases, said Arcaro and his team, in a Thursday note.

For example, the PPL Corporation’s

PPL,

plan to replace 1,500 megawatt of aging coal generation with cleaner energy mix in Kentucky by 2028, is seeking approval from the Kentucky Public Service Commission with a decision expected by November 6, the company said on its second-quarter earnings call. Shares of PPL are up nearly 3% in September.

“We see several opportunities where these regulatory processes have acted as overhangs on the stocks, and where we see a strong likelihood of success and positive rerating as the regulatory decisions are achieved,” Arcaro and his team said.

See: How a conservative group sees a climate-focused energy transition that includes gas and nuclear

Other policy support includes U.S. Treasury guidance on eligibility for the green hydrogen production tax credit (PTC) in the September to October timeframe, Morgan Stanley strategists said. Included in President Biden’s Inflation Reduction Act in 2022, which offers funding, programs, and incentives to businesses and individuals in the largest U.S. effort on climate change to date, the PTC allows taxpayers to deduct a percentage of the cost of renewable energy systems from their federal taxes.

See: Climate winners and losers as the Inflation Reduction Act hits 1-year anniversary

Meanwhile, Arcaro and his team see renewables demand accelerating for some utility stocks such as NextEra Energy Inc.

NEE,

and AES Corporation

AES,

but they remain cautious on climate tail-risk in the near term such as fire and hurricanes.

U.S. stocks finished lower on Friday to cap a losing week for the S&P 500 and the Nasdaq Composite

COMP.

The S&P 500 dropped 0.2% and the Nasdaq declined by 0.4% for the week, while the Dow Jones Industrial Average

DJIA

edged 0.1% higher, according to FactSet data.