This post was originally published on this site

Shares of DraftKings Inc. bounced sharply Wednesday off a near two-year low, after Morgan Stanley analyst Thomas Allen turned bullish, saying the price plunge has created “too big an opportunity” for long-term investors to ignore.

The upgrade comes as the stock’s

DKNG,

price chart has flashed some upbeat technical signals in recent weeks.

Allen raised his rating on the digital sports entertainment and gaming company to overweight, after resuming coverage at equal weight in early November. He kept his stock price target at $31, which implies about 39% upside from current levels.

The stock soared 15.7% in morning trading, which puts it on track for the second-biggest-ever one-day gain, and the biggest since the record 17.3% rally on Sept. 14, 2020.

On Tuesday, the stock had closed ($19.32) at the lowest price since April 28, 2020. It had tumbled 29.1% since mobile sports betting went live in New York on Jan. 8, had plunged 56.8% since the company reported a wider-than-expected third-quarter loss before the Nov. 5 open and had plummeted 73% since closing at a record $71.98 on March 19, 2021.

The company’s next quarterly report is due out mid-February.

Morgan Stanley’s Allen said data released by New York last week acted as a reminder that sports betting and the iGaming is likely to be a “very large profitable market” in the U.S., with eventually only a handful of market share winners.

“We expect [DraftKings] to be one of them, and with sentiment at an all-time low on near-term loss concerns, we see now as a good time to invest for the long-term,” Allen wrote in a note to clients.

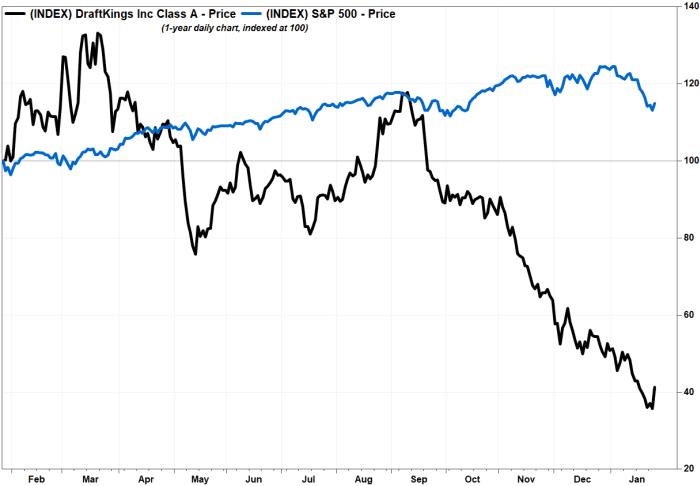

FactSet, MarketWatch

While the company isn’t immune to competition, Allen noted the high barriers of entry, as the high levels of marketing and promotional spending needed has driven a “very concentrated” market that only players of scale can really compete in. He said every state that releases market share data indicates that the top five operators combined have at least 82% market share.

And although barriers to entry are lower in the online betting market than for in-person betting, he said “gambling in general is a profitable business.”

Among some of DraftKings’ competitors, shares of Caesars Entertainment Inc.

CZR,

rose 2.4% on Wednesday; Rust Street Interactive Inc.

RSI,

climbed 6.3%; and the U.S.-listed shares of Flutter Entertainment PLC

PDYPY,

FLTR,

which owns a 95% stake in FanDuel, gained 2.1%. Meanwhile, the S&P 500 index

SPX,

rallied 1.6%.

Bullish technical divergence, ‘doji’ appear in DraftKings’ chart

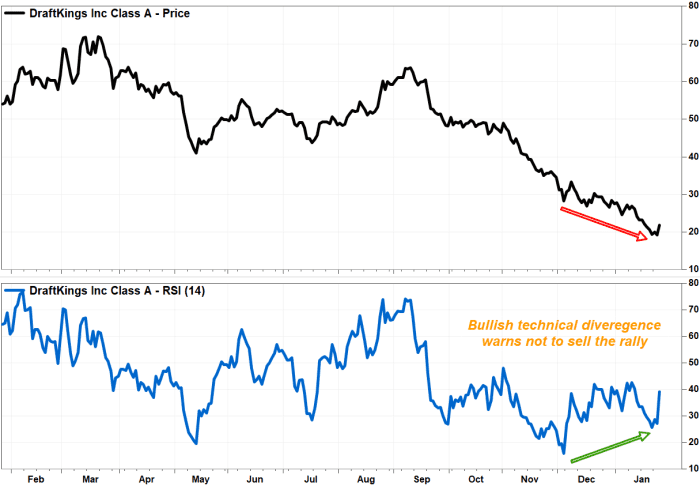

Morgan Stanley’s upgrade of DraftKings added a fundamental element to some of the stock chart’s positive technical signals.

The stock’s Relative Strength Index, which is a momentum indicator measuring the magnitude of recent gains against recent losses, has been rising since it bottomed at a record oversold reading of 16.36 on Dec. 3, according to FactSet, even as the stock kept falling. Many technicians believe this “bullish technical divergence” suggests bears are running out of steam, and an oversold bounce is due. Read more about the RSI indicator.

FactSet, MarketWatch

The divergence in DraftKings’ stock could be classified the strongest “Class A” divergence, as the stock price hit a new low while the RSI’s latest dip hit a higher low. The RSI was at 27.82 on Tuesday, and has climbed to 40.76 on Wednesday.

Bullish technical divergences aren’t necessarily good market timing signals, because they can persist for relatively long periods. But they can act as warnings for investors not to sell into a rally when it does come.

There is also a bullish “doji” pattern that appeared Tuesday, which candlestick chart watchers view as an reversal signal.

A “doji,” which is Japanese for “at the same time,” appears when a stock’s closing price is the same, or very similar, to the opening price. The idea is, when they appear at a low of a long downtrend, they represent indecision at a time bears should still be decisive.

“Dojis” suggest supply and demand has reached equilibrium. A rally the next day indicates the scale has tipped toward the demand side.

Don’t miss: 7 key candlestick reversal patterns.

FactSet, MarketWatch

DraftKings’ stock opened Tuesday at $19.36, traded in an intraday range of $18.73 to $20.28, then closed at a 21-month low of $19.32.