This post was originally published on this site

Shares of Apple gained ground Thursday toward yet another record, to buck the broad weakness in large-capitalization technology stocks, after Wedbush analyst Dan Ives said his analysis indicates demand for iPhones is currently outstripping supply.

Ives also said he believes Apple will introduce its “highly anticipated” augmented reality (AR) headset, Apple Glasses, next summer, which could add about $20 to the Cupertino, Calif.-based technology behemoth’s stock valuation.

He reiterated the outperform rating he’s had on Apple’s stock for at least the past three years, and kept his price target $200.

The stock

AAPL,

rose 0.3% in afternoon trading, putting it on track for a fourth-straight record close. It has gained 8.4% during the current streak.

Apple’s gains come despite a selloff in the larger-cap tech space, as the Nasdaq-100 Index

NDX,

slumped 1.0%. The tech-heavy index hasn’t reached a record since Nov. 19. The S&P 500 index’s

SPX,

last record close was on Nov. 18.

Japan-based business publication Nikkei reported earlier this week iPhone 13 production fell 20% short of targets in September and October. And in October, Bloomberg reported that Apple would cut production goals.

Wedbush’s Ives said that while various media reports have focused on supply shortages, his checks on Apple stores, supply chain data and iPhone order delays indicates iPhone demand continues to be much stronger than expected. And he believes it is this demand, rather than supply shortages, that will drive the stock going forward.

“The focus of the Street has been on the lingering chip shortage for Apple (and every other tech and automotive player), however, the underlying iPhone 13 demand story for Cupertino both domestically and in China is trending well ahead of Street expectations, in our opinion,” Ives wrote in a research note.

FactSet, MarketWatch

Not only does Ives believe that the chip issues some investors have worried about are “transitory,” he believes investors have underestimated the pent-up demand that will drive a “massive product cycle” that is playing out across the entire hardware ecosystem.

Ives also said Apple’s stock is outperforming the large-cap technology sector, because he believes the risk/reward for investors is still “very favorable” despite the recent strength, making the stock a sort of “safety blanket” tech name.

“To this point, we believe on a SOTP [sum-of-the-parts] valuation Apple is well on its way of being a $3 trillion market cap during 2022 (or sooner) as the Street catches up to this growth story,” Ives wrote.

Apple’s market cap was at about $2.88 trillion at recent stock prices. Based on 16.41 billion shares outstanding as of Oct. 15, a stock closing price at or above $182.86 would give Apple a $3 trillion market cap.

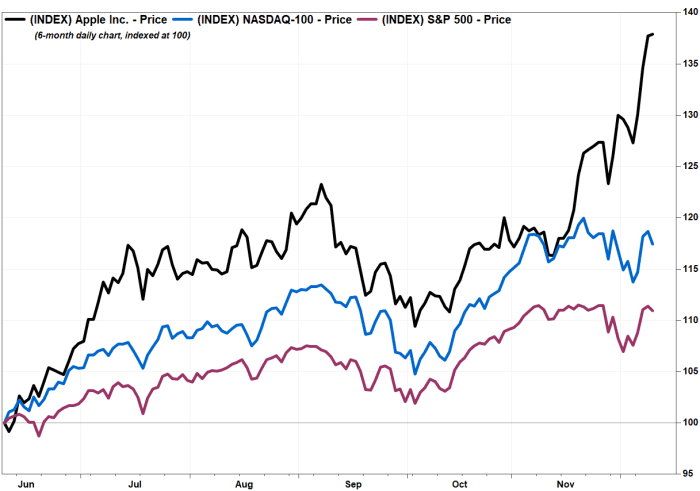

The stock has soared 38.1% over the past six months, while the Nasdaq-100 has gained 17.5% and the S&P 500 has advanced 11.0%.