This post was originally published on this site

Wall Street is contemplating inflation like it hasn’t in about a decade.

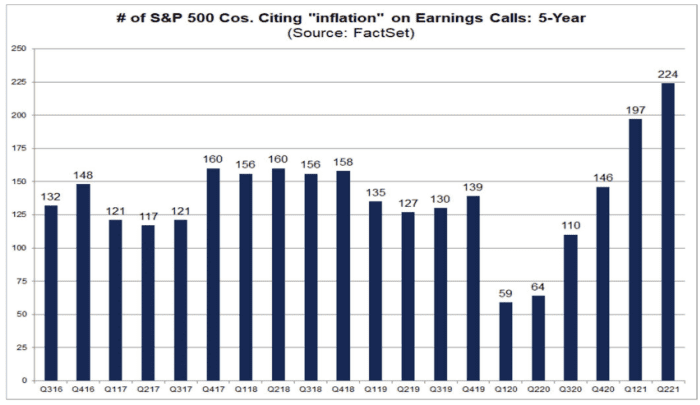

Specifically, the number of American corporations which mentioned the term “inflation” during earnings calls with analysts for second quarter results hit a 10-year high, according to data compiled by FactSet, in a survey of transcripts.

The data provider said that in a review of comments on earnings calls from June 15 to Sept. 14, 224 companies, or around 44% of the entire S&P 500 index universe, referenced the term “inflation” during their earnings calls, marking the highest

overall number of companies citing the term going back to “at least 2010 (using current index constituents going back in time),” wrote FactSet’s senior earnings analyst John Butters, in a Friday research note.

FactSet

The findings from FactSet come as the U.S. economy’s rebound from the pandemic is driving the biggest surge in inflation in about 13 years, though a recent reading for August implied that pricing pressures may be stabilizing.

Inflation is defined as the cost of living rising across the board with purchasing power diminishing. It isn’t uncommon for prices to rise and an increase of about 2% annually is typically seen as appropriate for a healthy economy.

However, price increases have been higher than in recent years in the aftermath of the economic shocks from the COVID pandemic.

The 12-month increase in core consumer prices in the U.S., excluding volatile food and energy, was at 5.4% in July, the highest since 2008. That rate slipped to 5.3% in August, marking the first slowdown since last October, with the cost of groceries and restaurants still rising, amid increased demand and supply-chain bottlenecks.

Aside from a brief oil-driven spike in 2008, consumer prices have risen this year at the fastest pace in three decades. And a new survey by the New York Federal Reserve shows consumers expect inflation to average 5.2% in the next 12 months.

Many members of the interest rate-setting Federal Open Market Committee, which meets next week for two-days starting Sept. 21, have voiced the view that inflation will be short-lived.

However, market participants and corporate executives aren’t clear on the duration of pricing pressures, including wage inflation, and how much of that can be passed on to customers.

Wages are climbing at the fastest pace in more than a decade and companies desperate to hire more workers are raising wages because they can’t find enough qualified applicants.

Read: Half of all small businesses can’t find enough workers to fill open jobs

Concerns about inflation, which had been otherwise quiescent for years, has investors wringing their hands, particularly as the Dow Jones Industrial Average

DJIA,

S&P 500 index

SPX,

and the Nasdaq Composite Index

COMP,

had been mostly trading near record highs.

Despite the mentions in recent earnings calls, however, FactSet finds that inflation worries haven’t yet hurt corporate earnings or the outlook for quarterly results in the near term.

Both the estimated earnings growth rate for calendar year 2021 (42.6%) and the estimated net profit margin (12.4%) for CY 2021 are higher today compared with the estimates back on June 30.

Separately, analysts and companies have been much more optimistic than normal in their estimate revisions and earnings outlooks for the third quarter to date, Butters wrote.

“[S&P 500 companies are] now expected to report the third-highest (year-over-year) growth in earnings since Q3 2010 for Q3,” the FactSet analyst said.

“Analysts also project earnings growth of more than 20% for the fourth quarter

of 2021,” Butters said.