This post was originally published on this site

The president of the Philadelphia Federal Reserve predicted “a series” of increases in a key short-term U.S. interest rate this year and said he is “very open” to a half-point hike as the central bank moves to tamp down the worst outbreak in inflation in 40 years.

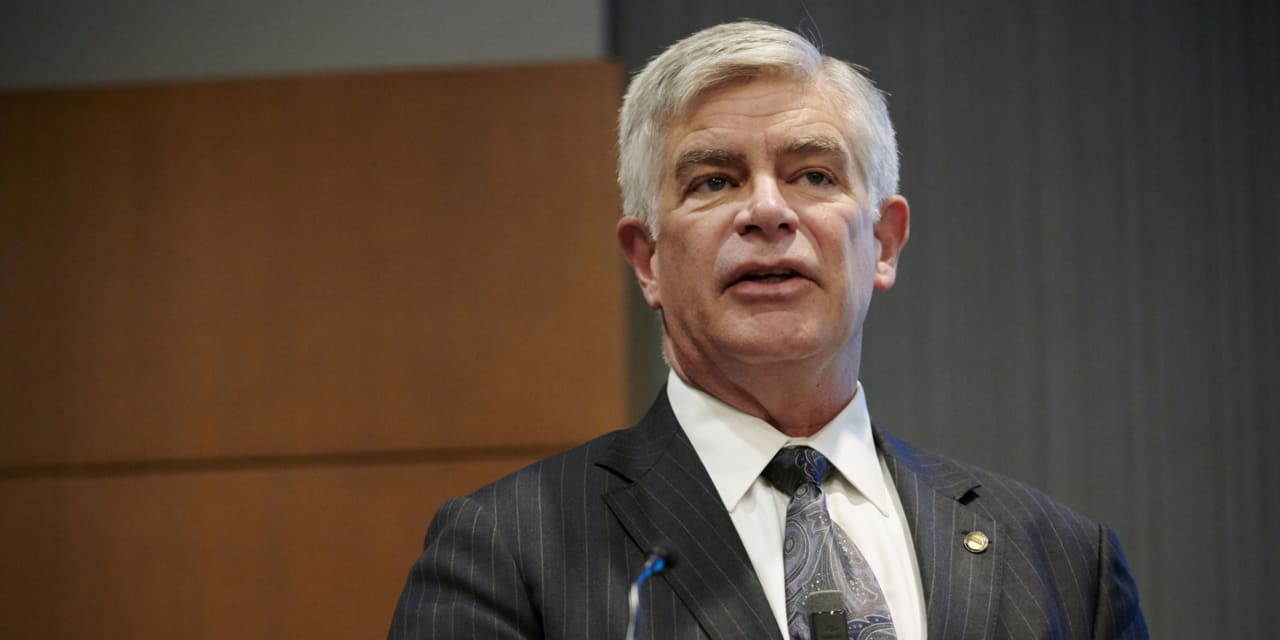

“I expect a series of deliberate, methodical hikes as the year continues and the data evolve,” Patrick Harker said Tuesday.

“I also anticipate that we will begin to reduce our holdings of Treasury securities, agency debt, and mortgage-backed securities soon,” he said.

Harker previously penciled in seven quarter-point rate increases in 2022, but he said he is “very open to going faster” and “wouldn’t take a 50-basis point increase off the table for the next meeting.”

He would not commit to supporting half-point hike, however, given a high level of uncertainty about the future path of the U.S. economy.

He pointed to the war and Ukraine and lockdowns in China that could exacerbate supply-chain bottlenecks and worsen inflation.

The Fed also increased its balance sheet to a record $9 trillion during the pandemic to put bring down long-term rates such as mortgages and auto loans in an effort to prop up the economy.

Harker suggested a “autopilot” step-by-step reduction — he threw out a $3 trillion figure as an example — would also help mitigate inflationary pressures.

Harker made his remarks in a speech to the The Center for Financial Stability in New York. He is not a voting member of the Fed’s interest-rate setting board this year.

Harker acknowledged the government and the Fed played a role in the surge in inflation to the highest level since 1982. The cost of living climbed 7.9% in the 12 months ended in February.

“The bottom line is that generous fiscal policies, supply chain disruptions, and accommodative monetary policy have pushed inflation far higher than I — and my colleagues on the FOMC — are comfortable with,” he said. “I’m also worried that inflation expectations could become unmoored.”

Still, Harker predicted inflation would fall from around 4% at the end of 2022 to the Fed’s target of 2% by 2024.

Yet he cautioned: ” “All of these forecasts are freighted with uncertainty.”