This post was originally published on this site

Wheat futures were among commodity prices taking a hit on Tuesday as traders reacted to news of potential progress over negotiations between Ukraine and Russia, and possibly the beginning of the end of brutal 34-day conflict.

“A ceasefire or diminished hostilities could give markets some comfort that Russian and Ukrainian wheat supplies that were harvested last year, and now trapped in the war zone, could become more accessible to the world,” Sal Gilbertie, president and chief investment officer at Teucrium, told MarketWatch Tuesday.

However, “it is too early to determine long-term impacts of a ceasefire,” he said.

Russia’s deputy defense minister said Moscow has decided to “drastically reduce combat operations” around Ukraine’s capital of Kyiv and the northern city of Chernihiv, BBC reported Tuesday.

Moscow’s lead negotiator in the talks with Ukraine, meanwhile, said that Russia’s promise to scale down military operations in Kyiv and northern Ukraine does not represent a ceasefire, BBC reported.

Against that backdrop, soft red winter wheat for May delivery

W00,

WK22,

slid by 5.6%, down 59 cents to $9.98 a bushel in Chicago, which would mark its biggest one-day drop since March 18, FactSet data show. A settlement around this level would be the lowest for a most-active contract since March 1.

The commodity surged 40% to its biggest weekly gain since 1959 at the start of the month in the early days of Russia’s invasion of Ukraine. Prices remain up nearly 7% for the month so far and trades around 29% year to date.

Corn and soybean futures also saw sharp declines Tuesday.

May corn

C00,

CK22,

traded at $7.14 3/4 a bushel, down 33 3/4 cents, or 4.5% in Chicago. May soybeans

S00,

lost 35 1/4 cents, or 2.1%, to $16.29 a bushel.

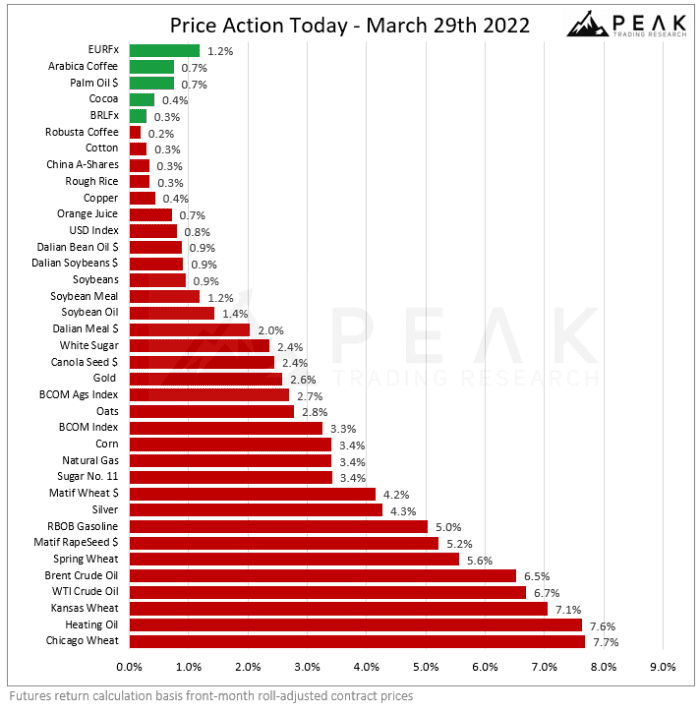

There’s optimism that “commodities will more easily flow out of the Black Sea region and farmers will be able to get more spring wheat, corn, barley, and sunflower crops in the ground over the coming weeks,” analysts at Peak Trading Research wrote in a note Tuesday.

Still, “this situation remains very fluid and headlines are still coming out,” they said.

Grain futures were among many commodities Tuesday that traded sharply lower on apparent progress in the peace talks.

Peak Trading Research

Gold

GC00,

GCJ22,

and silver

SI00,

SIK22,

futures touched their lowest intraday levels in more than a month and U.S. benchmark oil futures

CL.1,

CLK22,

briefly dipped below the $100 a barrel mark for the first time since March 17.

Barbara Kollmeyer in Madrid contributed to this report.