This post was originally published on this site

A watchdog for the Internal Revenue Service scrutinized the selection of two top FBI officials for tax audits, and concluded that there was no bias in their selection.

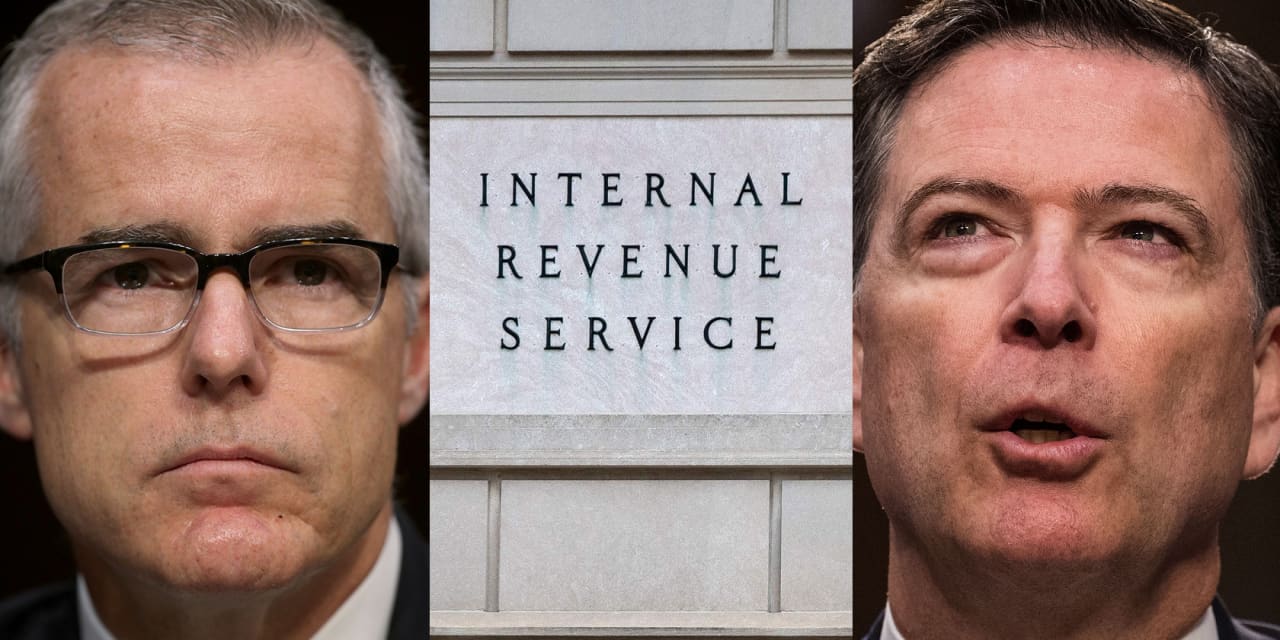

Months after a New York Times story revealed ex-FBI director James Comey and former FBI deputy director Andrew McCabe were both audited by the IRS, the Treasury Inspector General for Tax Administration concluded that the IRS “randomly selected” their tax returns.

In its report, watchdog agency investigators wrote they “did not identify misconduct during our review.”

IRS computer programs “correctly” picked tax returns for inclusion and “did not include malicious code that would force the selection of taxpayers” in the specific auditing program at issue, according to the investigators.

The new report, however, said the sample sizes for potential audit were smaller, but said that happened because of resource constraints inside the IRS.

The investigators heard from Charles Rettig, the IRS commissioner was appointed by President Trump in 2018 and stepped down from his position last month. Rettig came under tough criticism from Democrats — some calling for his resignation — after the New York Times article.

In Rettig’s talk with TIGTA investigators, Rettig said “he had no conversations with the current or prior Presidential administration” about the audit program.

Rettig said he wasn’t involved in the sample selection process and never directed anyone to add or remove particular taxpayers to the audit samples, the report added. Other IRS officials involved in the audit selection process told TIGTA investigators that neither Rettig or other IRS officials told them to pick or remove people in the sample pools.

Rep. Richard Neal, a Democrat and current chair of the House Ways and Means Committee, said the report “alleviates some concerns.” Neal said he requested “a deeper probe into the former president’s use of the IRS against his political enemies and hope to have more from TIGTA soon.”

‘Defies logic’

Both Comey and McCabe were roped into an IRS initiative called the “National Research Program” — a random audit program where the IRS reviews tax returns in an attempt to learn where potential patterns of underpayment could exist among all taxpayers.

Trump fired Comey in May 2017. In 2019, Comey learned of an audit on his Tax Year 2017 return, which ended with a $347 refund, according to the New York Times.

Then-Attorney General Jeff Sessions fired McCabe in 2018. McCabe said he learned in October 2021 of an audit on his Tax Year 2019 information and returns.

“I ended up having to pay a small amount for an oversight. An unintentional oversight,” McCabe said in a CNN interview in which he also said the coincidence of he and Comey being audited “defies logic.”

On Thursday, Inspector General J. Russell George said, “tax compliance and confidence in the fairness of the tax system could decline if taxpayers believe that the IRS targets specific taxpayers for NRP audits for inappropriate purposes.”

The IRS did not immediately respond to a request for comment. But in the wake of the report, it insisted it did not single out anyone for audit.

The IRS, meanwhile, is poised to receive $80 billion over a decade for increased enforcement, and improved customer service and operations. With Republicans gaining the majority in the House of Representatives, observers say the agency is likely going to face increased scrutiny and potential budget fights connected to how it is spending the $80 billion.