This post was originally published on this site

As if investors didn’t already have enough to worry about, Friday’s expiry of quarterly options may provoke more volatility, potentially condemning the S&P 500 index to a fourth straight weekly loss.

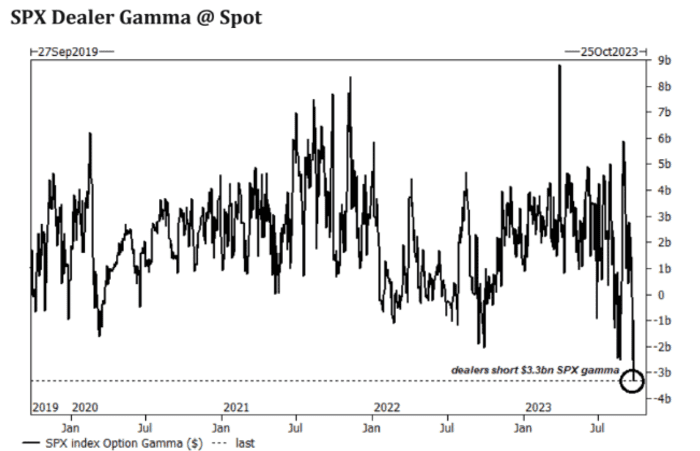

At the top of traders worries is a chart courtesy of analysts at Goldman Sachs Group showing that option dealers were shouldering “short gamma” exposure of $3.3 billion notional heading into Friday. According to the Goldman sales analysts who shared the chart with clients, it’s the largest such position the team has ever recorded.

GOLDMAN SACHS

Being short gamma means dealers are heavily exposed to customers who have been buying put options in particular. Since many of these put options are on the cusp of trading in the money, dealers’ hedging activities could potentially exacerbate intraday swings. So if stocks slide, options dealers could force the market even lower by selling S&P 500 index futures to cover their positions, for example.

To be sure, some options traders have taken issue with the Goldman chart, saying the data displayed by the bank doesn’t offer a complete picture of dealers’ overall exposure, which is very murky and something that almost nobody on Wall Street can accurately track.

“It just doesn’t show the whole picture,” said Noel Smith, chief investment officer at Convex Asset Management, a longtime options trader and former market-maker. “You don’t know what [dealers] are doing in futures, or the [over-the-counter] space, they could have a completely different position on.”

That’s not to say traders should ignore it completely. Dealers’ negative gamma positioning may have come in to play during another options expiry event earlier this month. On Sept. 15, when the quarterly “triple witching” expiry event occurred, the S&P 500 index slumped 1.2%.

Large options positions tied to a structured product managed by JPMorgan Asset Management are another source of concern. The positions, which are rolled over by the bank each quarter, according to analysts who have studied the fund’s prospectus, has come to be known as the “JPMorgan collar.”

The trade, as Smith and others explained, is put on by the JPMorgan Hedged Equity Fund JHEQX, better known by its ticker, JHEQX, which promises to deliver steady returns while minimizing volatility by capping both its downside and upside exposure.

It accomplishes this by buying a modestly out-of-the-money put contract, while selling both a covered out-of-the-money call and another put that’s much further out of the money. The result is that the fund is protected from market turbulence, but would sacrifice some gains if the market were to suddenly surge higher.

In options parlance, a “collar” is a trading strategy involving an out-of-the-money put and an out-of-the-money call to try and profit from a relatively quiescent market.

As trading opens on Friday, traders will be paying close attention to the 4,200 level. in the S&P 500 index. Traders, including the JPM fund, own put options with tens of billions of dollars’ of notional exposure at strike prices at or around this level, according to Smith and other options analysts.

Smith says investors should pay close attention to the 4,210 strike, while analysts at Menthor Q highlighted the 4,200 as a potential “sticky” level for the market due to the popularity of strikes at that level. But if that level is breached and these puts trade in the money, a flurry of selling could follow.

Fortunately for bulls, there’s a silver lining to all this. The market could be poised for a rebound once Friday’s slug of put-option exposure is cleared.

Brent Kochuba, founder of Spotgamma, a provider of options-market data and analytics, said puts with a notional value of about $150 billion are due to expire on Friday. Most are tied to the S&P 500 index, while some are tied to index-tracking ETFs like the SPDR S&P 500 Trust

SPY

the Invesco QQQ Investment Trust

QQQ.

“We could see a sharp bounce to start next week, with Friday’s expiry acting as a catalyst, and falling implied volatility adding fuel to the rally,” Kochuba said in comments emailed to MarketWatch.

U.S. stocks recovered some ground Thursday, with the S&P 500

SPX

up 0.5% at 4,296 in recent trade. However, the index is still down 0.2% on the week, meaning a drop on Friday could cement the S&P 500’s fourth straight week in the red, what would be the longest such streak since December.