This post was originally published on this site

Investing.com — Amid all the ballyhoo about Apple’s new 5G-enabled iPhones, investors are also giving it up for the company that made them possible.

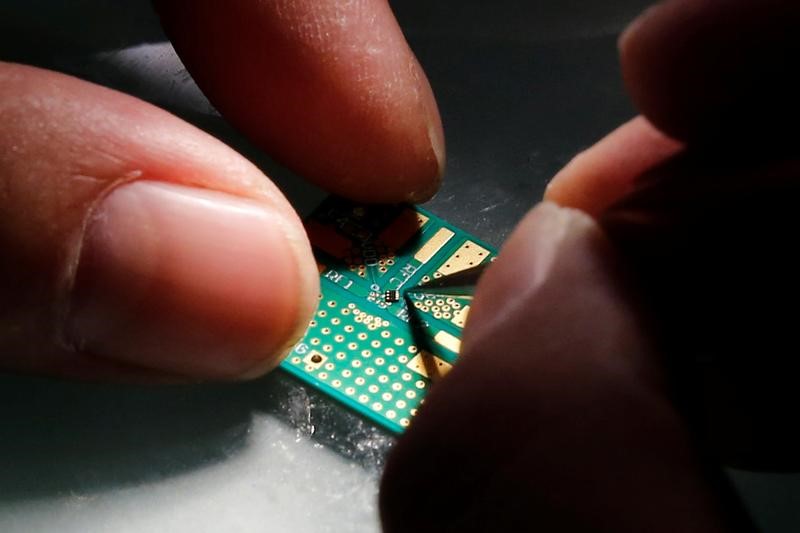

ASML (AS:ASML) is the Dutch company that makes the machine that prints the circuitry on the new iPhones’ chips, at the cutting edge of what’s known as the “five nanometer process”. Its proprietary technology, embedded in machines that cost over $120 million each, allow the transistors on the new chips to be shrunk to a width of five billionths of a meter. That means many more of them can be packed on to a single chip, greatly increasing its overall computing power. Right now, it’s the only company in the world that can make such machines.

Thanks to the Apple (NASDAQ:AAPL) marketing machine, ASML shares are flying again. They’re up 10% over the last three weeks as the hype around the new iPhones had cranked up, even though they fell 1.2% on profit-taking after the company’s third-quarter results, which were published on Wednesday.

Chief financial officer Roger Dassen indicated in a video accompanying the results that the company may not quite meet its full-year guidance for delivering the so-called EUV (Extreme Ultraviolet) machines that make the new chips but still said he expects ASML to “approach” the 4.5 billion euros ($5.3 billion) in EUV revenue it has guided for. He added that he expects EUV revenue to rise another 20% next year.

Otherwise, the results contained few surprises in themselves, with net sales up by around one-third over the last three months and up 25% over the first nine months of the year. Net profit nearly doubled from the third quarter of 2019 and was up by half over the first nine months. That’s a more than respectable performance in a year when many manufacturing companies have flirted heavily with disaster. It pays to be making the product of the future.

So far so healthy. But there’s a reason why the shares underperformed in September. The U.S. imposed sanctions on Chinese chipmaker SMIC on national security grounds, as part of its wider battle for global control of high-performance technology. SMIC is understood to be ASML’s biggest customer in China, a country that is on course to account for over 1 billion euros in sales this year – more than 10% of the group total.

Dassen said that the company will be able to ship its less sensitive Deep UV technology machines to China from the Netherlands without an export license, but the cutting-edge EUV systems, developed and manufactured in San Diego, Ca., will be subject to license restrictions that – at present – look unlikely to be relaxed whatever the outcome of November’s presidential election.

That matters because the market for 5G phones is likely to be a lot stronger in China in the foreseeable future than anywhere else in the world, simply because China has a big lead in rolling out 5G networks. In the long term, that could mutate into a significant shrinkage of ASML’s total addressable market, if the U.S. and China insist on dividing the world up into technological spheres of influence. For now, however, ASML can still reap the considerable rewards of global market leadership.