This post was originally published on this site

Every time a company announces a stock split, we hear the same chorus of voices moaning that the splits mean nothing for shareholders.

But in fact, they do.

What detractors mean is that when a company splits a stock, it has the same price-to-earnings (P/E) valuation and the same earnings per market cap. The company fundamentals do not change.

Technically, they are right. But stocks are driven by more than just the cold logic of the detractors. History shows stock splits produce outperformance — both right away and for up to a year. That’s why I like to see them in names I suggest in my stock letter (the link is in my bio, below).

Here are a few recent examples that demonstrate the near-term pop:

Tesla

TSLA,

announced before the market opened March 28 that it intends to do a stock split. From Friday’s close, the stock advanced 8.8% by the March 29 close, compared to 3.2% for Nasdaq

COMP,

and 1.9% for the S&P 500

SPX,

If that’s “nothing,” I’ll take it.

Amazon.com

AMZN,

announced a 20:1 stock split March 9. As of March 29, the stock was up 21.5%, compared to 10.3% for Nasdaq and 8.3% for the S&P 500. The split will be effective June 3.

* Alphabet

GOOG,

announced a 20:1 stock split Feb. 1. Its stock is up 8.3% compared to 3.5% for Nasdaq and 1.9% for the S&P 500. The spit will take effect July 15.

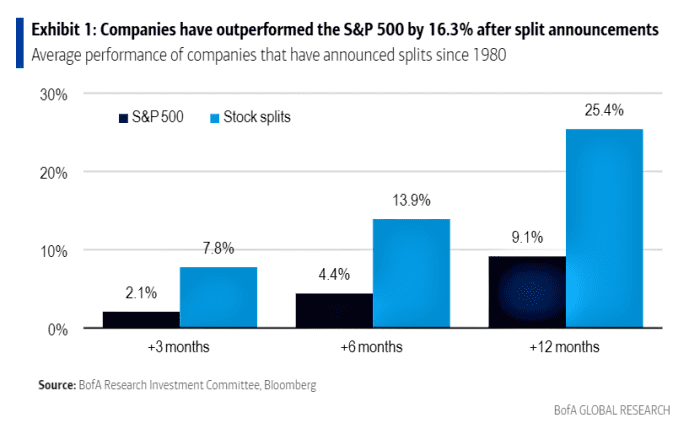

These are not just freak examples — and the effect lasts much longer than a few weeks. Since 1980, the shares of companies that do stock splits are typically up 25% a year later, compared to 9% for the broader market, according to a recent study by Bank of America. They also outperform three and six months out, as you can see in this chart.

Why split stocks outperform

There are two reasons stocks that have been split outperform:

1. Investors view stock splits as a sign of confidence by management. This is not off-base, because splits happen more often in stocks that have bullish momentum behind them. That momentum is usually caused by powerful trends inside companies. The momentum simply continues, post-split.

“Companies that announce splits have typically seen sustained market outperformance and expect that outperformance to continue,” says Bank of America. “Underlying strength in the company is a primary driver of elevated prices.”

2. Splits increase liquidity by making shares more accessible to a wider range of investors, something Amazon acknowledged when it announced its split. Post-split, its stock will go for around $170 a share instead of $3,386. Not everyone has a brokerage account that offers partial share purchases, though they are getting more common. Even staid Vanguard will announce this as an option shortly, says one source inside the company.

Not all splits are equal

Performance is not always positive after a split. Stocks see negative returns about 30% of the time 12 months later. But gains are more common and larger than losses, on average.

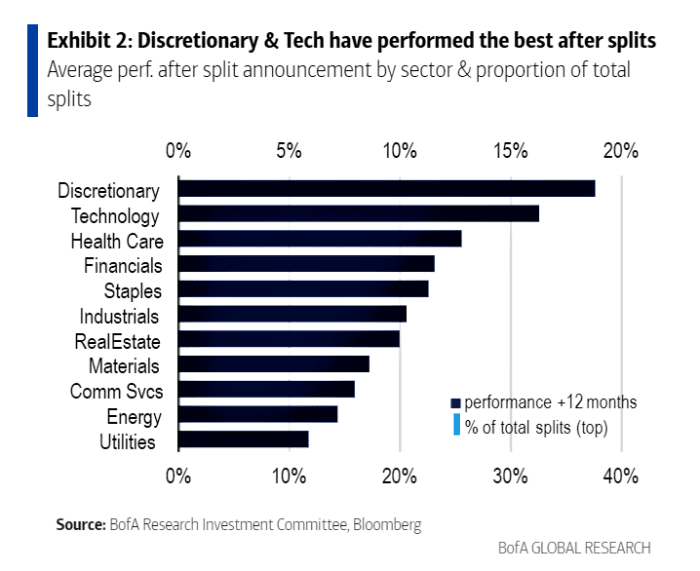

If you want to tilt your portfolio toward stocks that might get a lift from a stock split announcement, use these tactics. First, go with names that have high stock prices, of course, above $500. Next, favor names in consumer discretionary, tech and health care, where splits precede the best results. The gains for these groups average 26%-38% in the 12 months after split announcements. That’s probably because these are growth and momentum sectors.

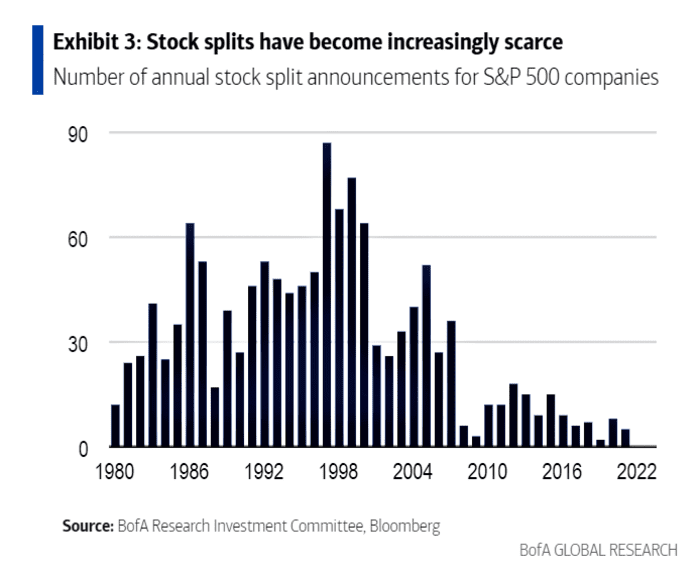

Unfortunately, stock split announcements have become increasingly seldom over the past decade. There were just 28 stock splits in the past five years compared to 346 during 1996-2000.

But that could change. The recent market rewards for split announcements at high-profile companies like Amazon, Alphabet and Tesla may encourage other companies and spark a wave of splits, says Bank of America analyst Justin Post. Since splits attract inflows and support prices, they may be better for companies than more costly share buybacks.

Five stock-split candidates

Besides owning Tesla, Amazon.com and Alphabet for more outperformance ahead, as signaled by their recent stock split news, consider owning or watching these names for potential split news. They all have high stock prices, good growth, decent stock price momentum and buy ratings from Bank of America.

NVR: One of the largest homebuilders in the U.S., NVR

NVR,

makes single-family detached homes, townhomes and condominiums. NVR also has a mortgage-banking and title-services business. I include recent or projected sales and earnings trends, to demonstrate the growth angle.

NVR posted 19% revenue gains last year to $8.95 billion, and a 37% increase in net income to $1.24 billion. Though interest rates are rising, demand for homes should remain strong because of pent-up demand and the scarcity of supply. NVR’s stock trades for a split-worthy $4,748 per share.

Booking Holdings: This online-travel company helps its customers book flights, hotels, restaurants, cruises, tours and car rentals. Booking

BKNG,

is known for its user-friendly website and search features. It operates under the brands Booking.com, Priceline, Agoda, Rentalcars.com, Kayak and OpenTable. All of this makes Booking a reopening play as Covid continues to recede, which I believe will be the case.

Fourth-quarter gross travel bookings advanced 160% compared to the year before, to $19 billion. Revenue grew 141% to $3 billion, and net income per share was $14.94, compared with net loss per diluted share of $4.02 the year before. Booking’s stock seems ripe for a split, because it goes for around $2,370.

TransDigm: This company designs and sells highly engineered proprietary aircraft components to plane manufacturers and airlines. It does a significant amount of repeat, aftermarket business in replacement parts. TransDigm

TDG,

typically sells higher margin specialized parts like motors, batteries, power controls and cockpit systems.

The company posted 8% sales growth in the first quarter, to $1.2 billion. Net income from continuing operations advanced 226% to $163 million, and it posted earnings per share of $1.96 compared to a loss of 42 cents per share the year before. Like Bookings, this is a reopening play given its exposure to the airline sector. At $684 per share, TransDigm stock looks ready for a split.

Lam Research: This company provides wafer-fabrication equipment and related services to the semiconductor industry. Its products help chip makers build better-performing smartphones, personal computers, servers, wearables, cars and data-storage devices.

Lam Research

LRCX,

reported a 2% sales decline to $4.23 billion in the fourth quarter and diluted earnings per share rose only 2% to $8.44. Like most companies in the chip space, this one was hit by supply-chain issues.

But those will get worked out, putting Lam Research back on a growth path. “We expect wafer-fabrication-equipment investments to again increase in calendar year 2022, leading to another strong growth year for Lam,” CEO Tim Archer said when the company announced earnings in January. The stock could use a split, since it goes for $569.

ServiceNow: This company’s Now Platform helps companies, universities and governments work more efficiently by digitizing their workflows.

ServiceNow’s

NOW,

sales grew 29% last year to $5.9 billion, but earnings per share advanced just 2.5% to $6.07, as the company continued to plow money back into the business. ServiceNow thinks annual sales will grow at least 20.5% over the next five years, reaching more than $15 billion in 2026. Its stock looks due for a split, since it trades for $598 per share.

Even if these companies don’t split their shares, the stocks stand to do well because of bullish end-market trends.

Michael Brush is a columnist for MarketWatch. At the time of publication, he owned TSLA, GOOGL and AMZN. Brush has suggested TSLA, GOOGL, AMZN NVR, TDG and NOW in his stock newsletter, Brush Up on Stocks. Follow him on Twitter @mbrushstocks.