This post was originally published on this site

Shares of many U.S.-listed Chinese stocks tumbled Thursday after the Securities and Exchange Commission put out an update about foreign companies using accounting firms or branches that cannot be adequately inspected.

Per the Holding Foreign Companies Accountable Act, which became law in late 2020, overseas companies need to use accounting firms or branches that the Public Company Accounting Oversight Board is able to fully inspect and investigate. Companies that are noncompliant with the rule for three years can be delisted from U.S. exchanges.

It is currently the SEC’s job to identify issuers using accounting firms that have used auditors that don’t meet the PCAOB’s criteria, and this week the SEC put out a list of five such issuers: BeiGene Ltd.

BGNE,

Yum China Holdings Inc.

YUMC,

Zai Lab Ltd.

ZLAB,

ACM Research Inc.

ACMR,

Hutchmed (China) Ltd

HCM,

Those five companies were provisionally identified by the SEC on March 8 and have until March 29 to provide evidence that disputes their classification on the list.

While only five names were listed, the notice appears to be causing jitters for investors in U.S.-listed China stocks more broadly given simmering tensions over recent years.

Don’t miss: Opinion: Chinese stocks cut $600 billion from U.S. markets in 2021, and are just getting started.

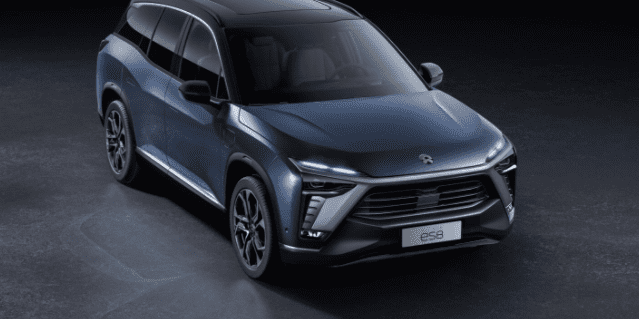

Big decliners Thursday include U.S.-listed shares of Nio Inc.

NIO,

iQiyi Inc.

IQ,

Bilibili Inc.

BILI,

and Pinduoduo Inc.

PDD,

all of which were off more than 10% in the session. U.S.-listed shares of Alibaba Group Holding Ltd.

BABA,

dropped 9.6% Thursday, while shares of JD.com Inc.

JD,

which reported earnings earlier in the day, tumbled 17.7%.

The KraneShares CSI China Internet ETF

KWEB,

was down 9.7%, while the S&P 500 index

SPX,

slipped 1.2%.