This post was originally published on this site

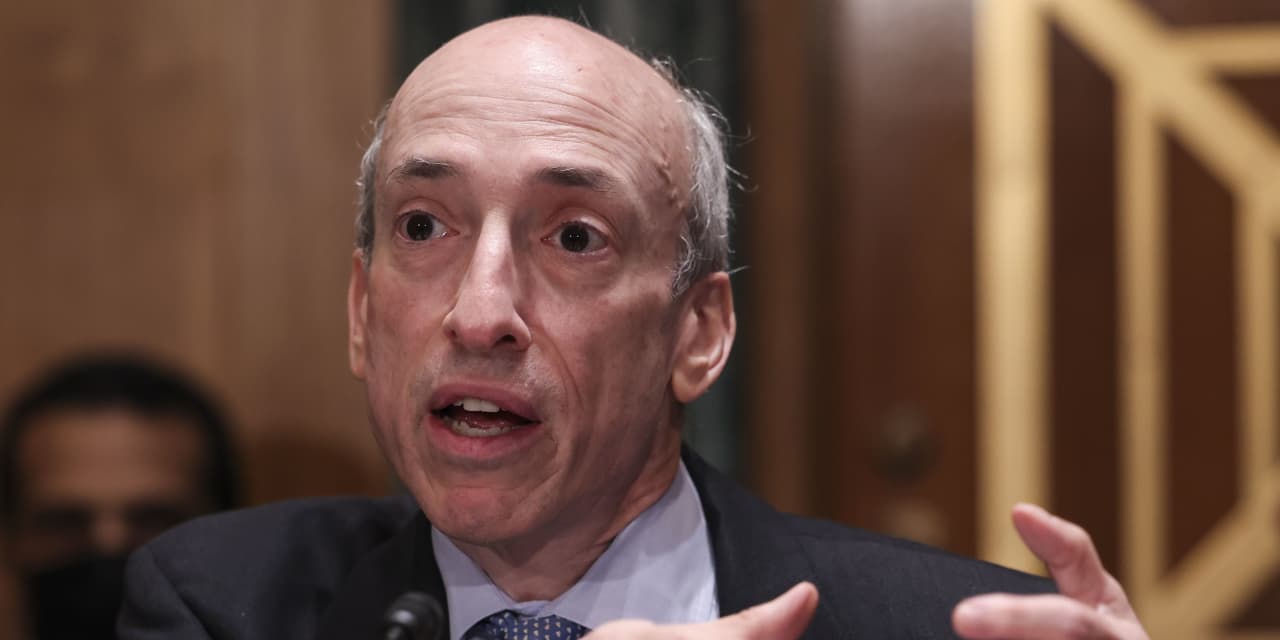

Securities and Exchange Commission Chairman Gary Gensler will face questions from members of the House Financial Services Committee on a range of topics from market structure to cryptocurrency regulation during a hearing beginning at noon Eastern on Tuesday.

“We are blessed with the largest, most sophisticated, and most innovative capital markets in the world,” Gensler will say, according to prepared remarks. “We can’t take our remarkable capital markets for granted, though. New financial technologies continue to change the face of finance for investors and businesses. More retail investors than ever are accessing our markets. Other countries are developing deep, competitive capital markets as well.”

Gensler plans to address the controversial practice of payment for order flow in the stock market, whereby retail brokers sell market makers the privilege of executing their customer orders. In his planned testimony, Gensler will discuss the “conflicts of interest” that the practice presents. Supporters of payment for order flow argue that it has helped reduce trading costs and supports the business model of no-commission trading.

Lawmakers will likely raise the subject of cryptocurrency regulation as well. “Currently we just don’t have enough investor protection in crypto finance issuance, trading or lending,” Gensler’s testimony reads.

Republicans have become increasingly critical of Gensler’s approach to the crypto market, arguing that the agency should do more to provide regulatory clarity on the topic, while Democrats have typically voiced concerns over the industry flouting securities laws.

Gensler also plans to address the SEC’s policy regarding listings of Chinese companies on U.S. exchanges, most of which do not allow the Public Company Accounting Oversight Board to oversee their auditing process, contrary to U.S. law. New legislation passed last year requires that such companies be kicked off U.S. exchanges if they do not become compliant within three years.

The regulator also plans to make a plea for greater resources. He will note that the SEC’s Division of Enforcement has 6% fewer staff than it did in 2016, and that staff at the examinations division has stayed flat despite a 20% increase in registered investment advisors and a 65% increase in these firms’ assets under management.

“As our capital markets have grown and technology continues to shape the face of finance, though, the SEC has not grown to meet the needs of the 2020s,” Gensler’s testimony reads. “As more Americans are accessing the capital markets, we need to be sure the commission has the resources to protect them.”