This post was originally published on this site

Hedge funds this year have struggled, mostly on their big bets on the technology sector, though of late their performance has improved.

An average gain of 4% for equity hedge funds in the last two months has helped pull their performance against the broader market to roughly even for the year, according to an analysis from Goldman Sachs.

HFR, FactSet, Goldman Sachs Global Investment Research

A team of analysts looked at 795 hedge funds’ long positions at the start of the third quarter based on filings as of Aug. 15 and published its 50-strong VIP list of “stocks that matter most” that appear most frequently among the top 10 long holdings within hedge fund portfolios.

| Company | Ticker | Sub-sector | Number of funds with stock as top 10 holding | Total return year-to-date, % |

| Amazon.com Inc |

AMZN, |

Internet & Direct Marketing Retail | 92 | -15 |

| Microsoft Corp. |

MSFT, |

Software | 84 | -13 |

| Alphabet Inc. |

GOOGL, |

Interactive Media & Services | 55 | -17 |

| Meta Platforms Inc. |

META, |

Interactive Media & Services | 51 | -48 |

| Visa Inc. |

V, |

Data Processing & Outsourced Services | 37 | 0 |

| Apple Inc. |

AAPL, |

Technology Hardware Storage & Peripherals | 36 | -2 |

| Uber Technologies |

UBER, |

Trucking | 34 | -28 |

| Mastercard Inc. |

MA, |

Data Processing & Outsourced Services | 25 | 0 |

| Berkshire Hathaway |

BRK.B, |

Multi-Sector Holdings | 22 | +2 |

| ServiceNow Inc. |

NOW, |

Systems Software | 19 | -25 |

| Source: Solactive, FactSet, data compiled by Goldman Sachs Global Investment Research | ||||

Hedge fund of late have cut leverage and shifted back toward growth stocks, buying the likes of Apple and Amazon. The switch came from hedge funds slashing their positions in the energy and materials sector.

NVIDIA topped Goldman’s list of the largest short positions as of the end of July, a prescient call given the company’s profit warning in early August.

Related: Cathie Wood’s ARK Invest cuts its stake in the graphics chipmaker ahead of its results.

Here are the top 10 stocks with the largest short positions:

| Company | Ticker | Sub-sector | Total return year-to-date, % | Value of short interest as of Jul. 29, $ billion |

| NVIDIA Corp. |

NVDA, |

Semiconductors | -36 | 6.1 |

| Amgen Inc. |

AMGN, |

Biotechnology | 14 | 4.3 |

| Occidental Petroleum |

OXY, |

Integrated Oil & Gas | 125 | 4 |

| Exxon Mobil Corp. |

XOM, |

Integrated Oil & Gas | 59 | 3.5 |

| Chevron Corp. |

CVX, |

Integrated Oil & Gas | 39 | 3.1 |

| Pfizer Inc. |

PFE, |

Pharmaceuticals | -16 | 3 |

| International Business Machines |

IBM, |

IT Consulting | 8 | 3 |

| Texas Instruments |

TXN, |

Semiconductors | -3 | 2.9 |

| S&P Global Inc. |

SPGI, |

Financial Exchanges & Data | -18 | 2.9 |

| KLA Corp |

KLAC, |

Semiconductor equipment | -10 | 2.9 |

| Source: FactSet, data compiled by Goldman Sachs Global Investment Research | ||||

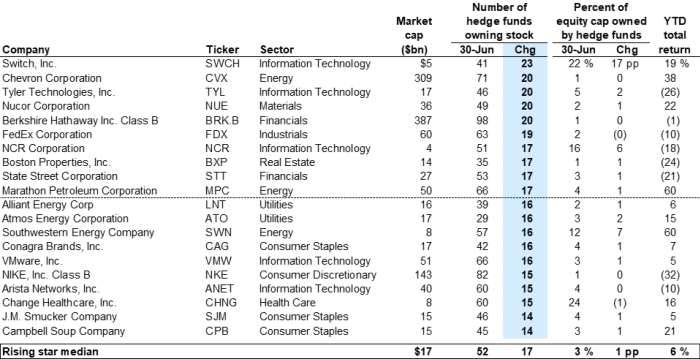

Companies that see large increase in hedge fund holdings, Goldman Sachs says, can be strong signals for future stock performance.

Rising Stars, they call them, have typically ended up outperforming its peers during the quarters following their rise in popularity.

Rising Stars in the report include tech infrastructure company Switch Inc,

SWCH,

which saw 23 hedge funds pour in during the second quarter, and energy firm Chevron Corporation

CVX,

which had 20 more hedge funds own the stock.