This post was originally published on this site

No, it has not all of a sudden become easier to beat the market.

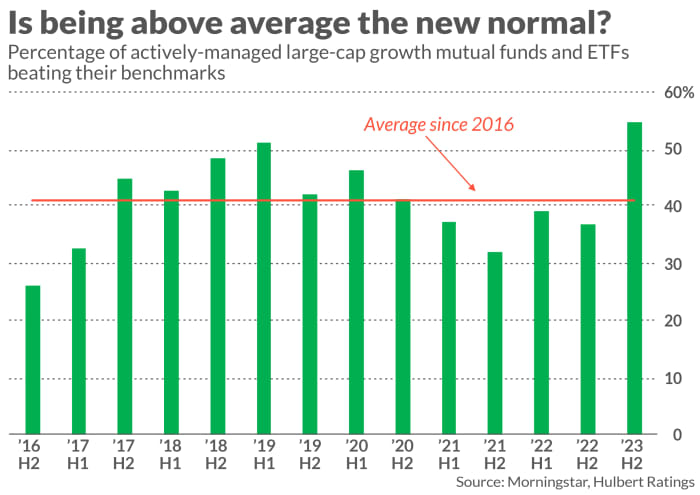

Keep that in mind as you come across recent arguments to the contrary. It’s always tempting to believe you can beat the market in your 401(k)s, IRAs, and other retirement portfolios. But this temptation becomes irresistible when—as a recent report suggests—well more than half of actively managed funds and ETFs are beating their benchmarks.

The report to which I refer, recently published by Morningstar, finds that 57% of actively managed funds and ETFs beat their benchmarks in the first half of 2023. Some specific style categories did especially well, furthermore: Morningstar calculates that 74.7% of funds/ETFs in the “U.S. Small Blend” category—nearly three out of four, in other words—beat their benchmarks. These percentages are far higher than what we have become used to over the years.

The true picture is a lot less rosy than what this recent report suggests, however. That’s not because Morningstar’s calculations aren’t accurate. But if one group of active managers is beating the market, then it must be the case that another group is lagging. And once transaction costs are taken into account, the average market-weighted return of all active managers must—of necessity—be below the return of the market as a whole.

So it’s not the case that the market has become easier to beat.

This in essence is the argument advanced in a seminal article in the January/February 1991 issue of the Financial Analysts Journal by William Sharpe, the 1990 Nobel laureate in economics. In the article, “The Arithmetic of Active Management,” Sharpe showed that active managers, on average, must lag broad market indexes. He furthermore showed that this conclusion depends “only on the laws of addition, subtraction, multiplication and division. Nothing else is required.”

Sharpe’s analysis counters the many arguments that many are making about why so many funds and ETFs have beaten the market so far this year. One is that because index funds have come to represent such a large share of all mutual funds, the stock market has become less efficient—and therefore more easily beaten. Another argument is that managers are smarter and more sophisticated than they were in the past. Still others assert that artificial intelligence is enabling everyone who bothers to beat the market.

Sharpe’s arithmetic-based argument does allow for this or that individual manager beating the market, especially over the short term. But for every active manager who comes out ahead, of necessity another active manager must be lagging the market. That’s because beating the market is a zero-sum game before transaction costs, and a negative-sum game after transaction costs. That’s why, as you can see from the accompanying chart, the percentage of large-cap growth funds beating their benchmarks averages is well below 50%.

Given what I’ve learned from my 40+ years in this business, I doubt many of you will be persuaded by Sharpe’s argument, and will instead continue to believe the odds are in your favor when trying to beat the market. One good solution, which both recognizes your belief and takes Sharpe’s argument to heart, was proposed decades ago by the late Harry Browne, editor of a newsletter called Harry Browne’s Special Reports.

His advice was to create two separate portfolios—one Permanent and one Speculative. The former would contain the bulk of your assets and would be invested in index funds and held for the long term with little or no change. The Speculative portfolio would contain your play money in which you try your hardest to beat the market.

Browne’s advice is shrewd because it recognizes both the arithmetic truth of Sharpe’s argument and the psychological reality that you probably believe you’re above average. Since most of your assets will be in the Permanent portfolio, you’re not risking your retirement financial security by trying to beat the market—and (almost certainly) lagging the market over the long term. But with your Speculative portfolio you will get to indulge that part of your psyche that believes you’re above average.

There will be times, like this year for actively managed mutual funds and ETFs, when your Speculative portfolio will outperform your Permanent one. However, I’m willing to bet that over the long term the latter will come out ahead. But, provided you structure your two portfolios correctly, there’s no harm in trying to prove me wrong.

Mark Hulbert is a regular contributor to MarketWatch. His Hulbert Ratings tracks investment newsletters that pay a flat fee to be audited. He can be reached at mark@hulbertratings.com.