This post was originally published on this site

Yields for the benchmark 10-year Treasury on Tuesday climbed to around their highest level in about two months, as the government debt market faced some selling pressure in the first session after U.S. markets were closed in observance of Labor Day.

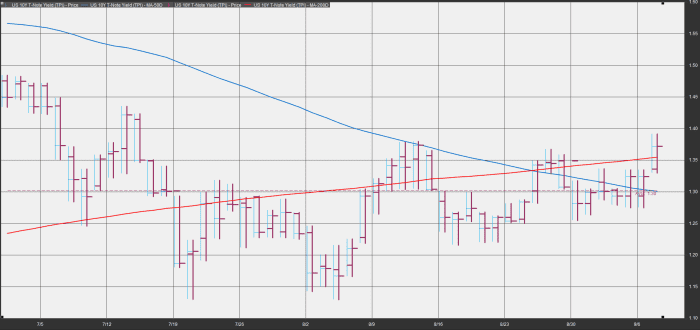

The 10-year Treasury note yield

TMUBMUSD10Y,

was around 1.371%, compared with 1.322% on Friday at 3 p.m. Eastern Time. The benchmark debt on Tuesday had hit an intraday high around 1.39%, which would mark its loftiest level since July 14, FactSet data show.

Yields rise as prices fall.

FactSet

The rise in yields also saw the 10-year rate climb above its 200-day moving average, which currently stands at 1.355%.

Tuesday’s yield climb followed a monthly jobs report released on Friday that came in far weaker than expected, producing 235,000 new jobs, falling well short of economists’ forecast for a 720,000 increase.

Still, the Labor Department report was broadly seen as keeping the central bank on course to announce a tapering of its $120 billion in monthly bond purchases in 2021, even if a September announcement remains a matter for debate, analysts said.

Selling in benchmark bonds on Tuesday came as the Dow Jones Industrial Average

DJIA,

and the S&P 500 index

SPX,

slumped, while the yield-sensitive Nasdaq Composite Index

COMP,

was edging higher toward a fresh record.

Tuesday’s moves were a bit unusual because stock prices and yields for debt usually move in the same direction and rising rates for yield-sensitive sectors like the Nasdaq often pull back as rates advance, suggesting rising borrowing costs for companies focused on growth.