This post was originally published on this site

Investors in fitness equipment and media company Peloton are getting their arms around four big developments: (1) its CEO and founder, John Foley, is stepping down, (2) former Netflix and Spotify CFO Barry McCarthy is taking over the reins, (3) revenue for the year will be $3.7 billion-$3.8 billion, down from an estimated $4.4 billion-$4.8 billion just a month ago (and an estimated $5.4 billion a few months ago), and (4) it will be cutting 20% of corporate staff.

I view these developments, overall, as being very healthy for Peloton’s

PTON,

business. Business has weakened relative to expectations, primarily driven by customer acquisition and retention dynamics. Now this weakness is now more realistically incorporated into the company’s revenue guidance and cost structure.

I can also think of no better person to run this business than McCarthy (no relation!), who is more likely than Foley to make the hard decisions necessary to set the company on a path to survive and even thrive as an independent company. However, exactly what McCarthy has in mind has yet to be revealed, so it will be very important to pay close attention to what he does in his first few months on the job.

I’ll dive into where the company is now, then turn to factors to watch for as we move beyond this earnings cycle.

Acquisition versus retention: bad and good

I’ve said it before and I’ll say it again: the dramatic downward revisions to guidance at Peloton is because of very weak new customer acquisition.

In all likelihood, the pandemic is not pushing prospects to buy bikes and treadmills anymore. Many prospects bought a year ago when they could not go to the gym, so those who haven’t bought yet are likely to be that much harder to convince, especially in the near term. The fact that a lot of demand was pulled forward will be a significant headwind for hardware sales, which is bad news for Peloton, because hardware sales represent 70%-80% of overall revenue right now.

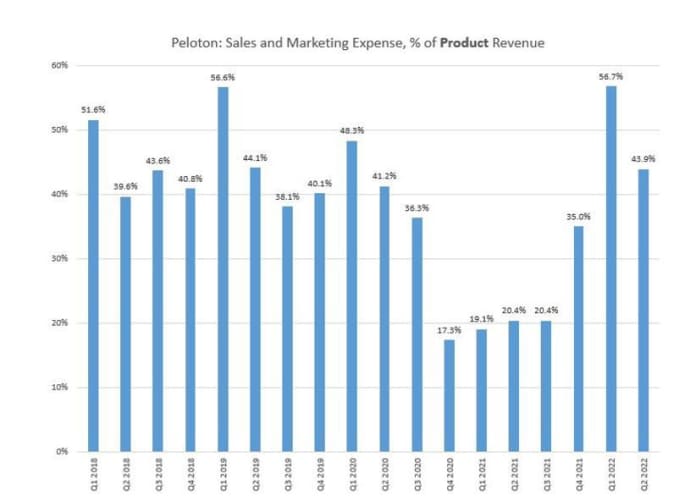

This is especially striking given that Peloton is spending more than 40% of its product revenue on sales and marketing to entice prospects to buy. It is a lot harder (and more expensive) than Peloton had anticipated, even three months ago, to get consumers to dip their toes in the water:

Peloton

What’s worse, cutting the price of the bike isn’t spurring greater customer adoption. Peloton did not see any major uptick in demand for its hardware after they cut prices last year, and as a result raised prices again less than a month ago.

All of this suggests that the total applicable market (TAM) for this business as currently structured is not large. John Foley had envisioned a business with much broader, more general appeal. This translated into a big hardware acquisition, lot of overhead, a lot of research and development spending, and a lot of expensive sales and marketing. As this vision is being questioned, it is no surprise that investors and executives are looking at these expenses with sharper eyes as well.

In contrast, we are seeing no weakness in customer churn. Indeed, this past quarter’s monthly churn rate was 0.79%, which is very low in an absolute sense and lower than what we have seen over the last two quarters.

We should have expected this. As I had analyzed in detail in a recent research paper, the pandemic’s effect upon customer adoption is generally transitory, while its effect upon existing customers – those who had adopted before the pandemic began – is much stronger and more likely to persist into the future.

Two things to look for

So where does Peloton go from here? Here are two crucial factors to pay close attention to:

Digital-only (or analogous) as a mass-market driver? I could not think of a better person to lead Peloton than McCarthy, as he has a record of success at content-driven subscription businesses. That being said, Peloton today is a much more niche business than Netflix

NFLX,

and Spotify

SPOT,

ever were, and as noted earlier, price cuts and marketing do not appear to be cards he can play to change that.

Does the new CEO have other ideas in mind for significantly broadening the base?

One possibility could be to lean more heavily on the digital-only subscription offering. The company has not historically marketed it, as its lower monthly price point, worse retention profile, and lack of hardware revenue imply that it cannot economically sustain a high customer acquisition cost. But the TAM is significantly larger for this offering than for Peloton’s traditional offerings.

I would keep a close eye on McCarthy’s vision for this business (or another like it that is geared toward broadening the base), as it would dramatically change the economics of the business.

Following through on cost reductions. Peloton got ahead of itself and built to satisfy peak demand. Despite that it continues to grow (albeit more slowly), its adjusted EBITDA loss, even after adding back one-time expenses, has been greater than 20% of revenue for the past two quarters.

This needs to be fixed, but Peloton must do so in a way that does not jeopardize the long-term revenue growth potential of the business. This is a tough needle to thread, so exactly how the company plans on threading it will be very important.

While Tuesday’s news is a lot to digest, I now feel much better about this business than I have in a long time. Its stock price has fallen by upward of 85% from its pandemic peak to trough, and even Tuesday’s 25% surge only puts the stock back where it was in mid-December, still well below the 52-week high just above $155. It has an excellent, highly capable CEO at the help. It is taking the tough actions required to make this business healthier over the long run. All of this is very good news.

But pay close attention to the new CEO’s strategic vision and what it may suggest for Peloton’s TAM, customer acquisition cost, retention and margin profile before declaring Peloton out of the woods. McCarthy has inherited a unique problem that may require a different playbook to overcome.

Daniel M. McCarthy is an assistant professor of marketing at the Goizueta Business School at Emory University in Atlanta and co-founder of Theta, a valuation analytics company.