This post was originally published on this site

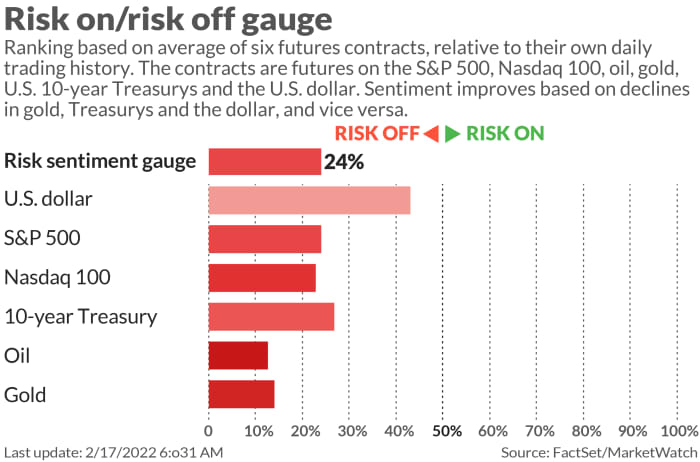

Stocks are pointing south as markets continue to get knocked around by Russia-Ukraine headlines and the will-they-won’t-they invade questions. Gold investors are set to have a pretty decent day at least.

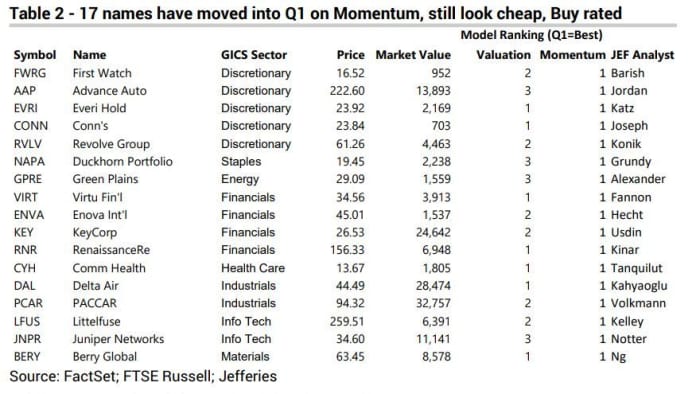

Our call of the day comes from Jefferies strategists, who offer up more than a dozen small-cap stock picks that they say have momentum and valuation factors on their side.

Smaller companies are in a bit of a tight spot these days, with the Russell 2000

RUT,

down over 7% on a 12-month basis, versus a 13% gain for the S&P 500

SPX,

though both have lost ground year-to-date. Prospects for higher interest rates and inflationary pressures can be headwinds for domestically focused companies.

Earlier this month, Goldman Sachs warned that the small-cap index would continue underperforming the S&P this year. Over the last 20 years, those stocks have “lagged behind on average in periods when the yield curve was flattening, economic growth was strong but decelerating, or financial conditions were tightening,” said the bank.

Goldman suggested investors look for companies with fast growth, high profit margins, and moderate valuations.

Back to Jefferies, where equity strategist Steven DeSanctis and his team say “growthier” small-cap stocks are still pricey and they don’t see any outperformance coming from those in the near term.

“We sliced ‘growth’ stocks into a few buckets and found that, despite having been hammered, they are not cheap. The underperformance ranks as some of the darkest these stocks have seen since ’00, but they tend to take time to rebound,” he said, adding that value and cyclical names have better tailwinds.

What has worked? Combining momentum and valuation factors to find some small-cap gems, a strategy that DeSanctis and the team said has worked well in the past year or so. “Valuations have been a real driver of performance, while momentum has been gaining momentum,” he said.

Jefferies looked for names that moved up the ranks in the first quarter based on an overall momentum rating, and still look cheap. That group of “buy” rated stock picks include companies such as First Watch

FWRG,

Advance Auto

AAP,

and Delta Air Lines

DAL,

Here’s the team’s chart with the rest:

The buzz

NATO says Russia is misleading the world, and instead of pulling troops has added about 7,000, backing up claims from a U.S. official. And Russian-backed separatists in Luhansk say Ukrainian forces opened fire on that territory several times overnight, violating a cease-fire.

Read: Here’s the technology being used to watch Russian troops as Ukraine invasion fears linger

Walmart

WMT,

stock is up after the retailing giant sales outlook, earnings and revenue all beat forecasts. Also ahead is Palantir Technologies

PLTR,

followed by Roku

ROKU,

Shake Shack

SHAK,

Dropbox

DBX,

SolarWinds

SWI,

and Fiverr

FVRR,

after the market closes.

DoorDash shares

DASH,

are up over 20% after record orders and more than 25 million active users reported by the food-delivery app.

In the chip sector, Nvidia

NVDA,

is dropping, after a strong forecast and record sales failed to impress investors, while Applied Materials shares

AMAT,

are rising on record sales and an in-line revenue forecast. Elsewhere in tech, Cisco stock

CSCO,

is up after forecast-beating results and upbeat guidance.

Amazon

AMZN,

and Visa

V,

have settled a fee-payment spat, with the credit card now accepted across the e-commerce giant’s sites and stores.

Weekly jobless claims, housing starts and building permits, along with the Philadelphia Federal Reserve manufacturing index, are all due ahead of the market open. Later, we’ll hear from St. Louis Fed President James Bullard and Cleveland Fed President Loretta Mester.

No fan of cryptocurrencies, Berkshire Hathaway

BRK.A,

BRK.B,

chairman and storied investor Charlie Munger said the asset class was like a “venereal disease,” and warned over U.S. inflation.

The markets

Stock futures

ES00,

NQ00,

are slipping, with bond yields

TMUBMUSD10Y,

also falling. Oil prices

CL00,

BRN00,

are tumbling on reports of progress over Iranian nuclear talks. Gold

GC00,

and the dollar

DXY,

are firmer. Elsewhere, the Nikkei

NIK,

bucked a mostly positive Asian session and European stocks

SXXP,

have drifted south.

The chart

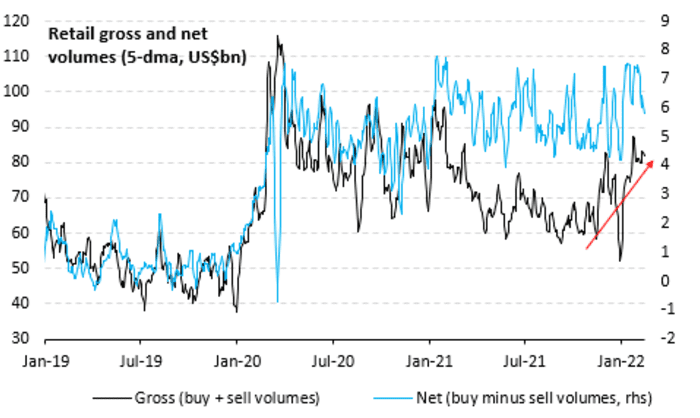

Are retail investors ready to swing their weight around again? Vanda Research’s senior strategist Ben Onatibia and Giacomo Pierantoni, head of data, offered up the following chart:

VandaTrack Weekly

They said it shows how retail investors have been consistent net buyers of equities since the COVID-19 pandemic, but that gross volumes — the sum of all buy and sell orders — have been trending lower since the first quarter.

“As volumes decreased, so did retail investors’ influence on the market. Recall that retail investors were the marginal price setters in a lot of assets in 2020 (EVs, clean energy, tech), but became liquity providers in 2021. As retail volumes rise in 2022, institutional investors will be wise to keep a close eye of these flows,” said Onatibia and Pierantoni.

The tickers

These were the top-searched tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

NVDA, |

NVIDIA |

|

NIO, |

NIO |

|

PLTR, |

Palantir |

|

FB, |

Meta Platforms |

|

AAPL, |

Apple |

|

SPCE, |

Virgin Galactic |

|

AMD, |

Advanced Micro Devices |

Random reads

Thousands of Saudi women apply for 30 jobs to drive bullet trains.

Take a peek inside Legoland Florida’s new “Peppa Pig” theme park.

U.K. gets a rare “red alert” warning over Storm Eunice and a potential sting jet.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.