This post was originally published on this site

Futures on Friday suggest the S&P 500

SPX,

may pop its head through the 4,200 level again, looking to decisively break above the 400-point trading range in which it has twitched for nearly seven months.

Easing angst over U.S. regional banks and the government debt-ceiling, combined with calmer conditions in bond markets as traders welcome cooling inflation and a Federal Reserve rate-hike pause, are all underpinning sentiment.

We even have a fresh structural paradigm for bulls to feast on. Hopes for an AI bonanza have helped push the Nasdaq Composite

COMP,

to its highest since August.

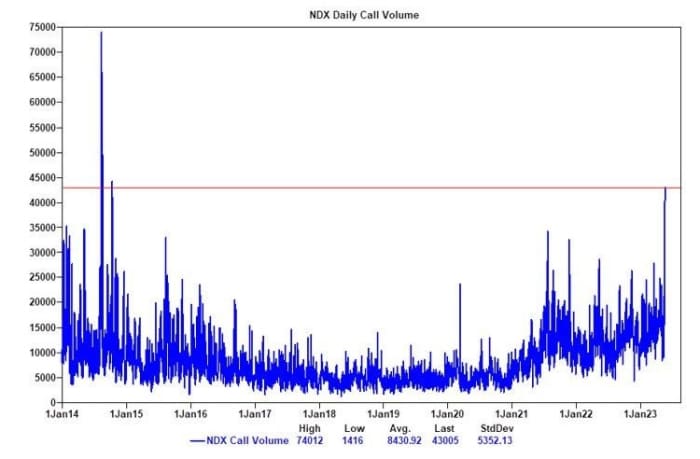

Just look how optimistic people are! Nasdaq 100 call option volume has hit its highest since 2014:

Source: Goldman Scahs

But hold on. All this is all happening while people say they are downright miserable about the market. Even those who are active investors reflect sentiment at depressed levels.

That’s fine, because the dichotomy in fact implies further market gain, says George Smith, portfolio strategist at LPL Research.

According to the latest weekly data from the American Association of Individual Investors (AAII) the percentage of individual investors who are bullish about short-term market expectations is 23%, down from 29% last week.

“This marks the lowest level since the end of March and is well below the long-term average of 34%,” says Smith. The percentage of investors who are bearish decreased week-on-week to 40%, but was still well above the long-term average of 32%, he adds. This puts the spread between the bulls and the bears at minus 17%, versus a long-term average of plus 2%.

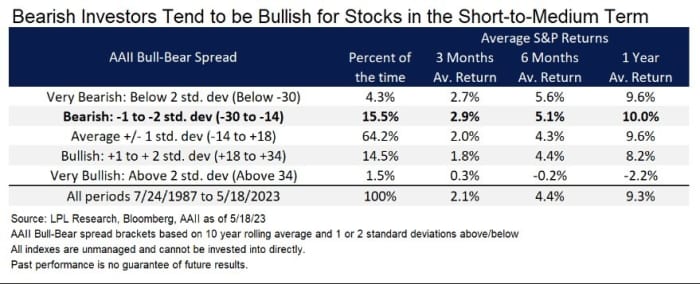

As the chart below shows, investor sentiment, as measured by the spread between bulls and bears in the AAII data, is more than one standard deviation below its long-term average.

Source LPL Financial.

“While the concerns that are feeding into the individual investors’ ‘wall of worry’ [lingering inflation, higher interest rates and recession fears] are valid, the negative sentiment they have built up is, from a contrarian perspective, a potential catalyst for positive forward returns,” says Smith.

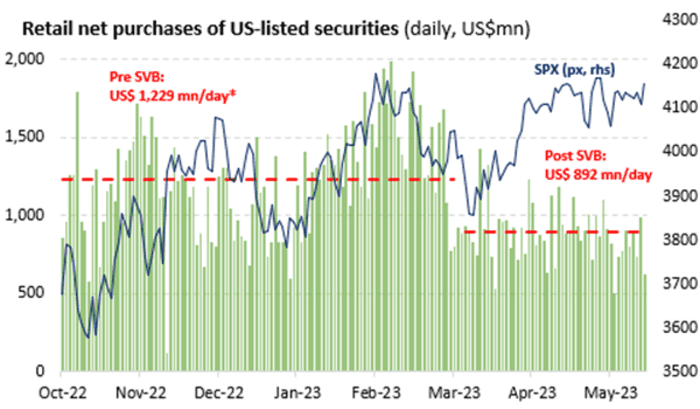

Indeed, this chart from Vanda Research shows how retail investors in particular have reduced stock purchases since SVB went bust.

Source: Vanda Research

In other words there is support for stocks, as many potential buyers wait in the wings for current worries to subside, says LPL’s Smith.

“Extremes in pessimism in the AAII data are, on average, bullish for near-term stock market returns (and extreme investor optimism tends to be bearish for the near-term outlook). When the bull-bear spread is around where it is now (between 1 and 2 standard deviations below average), we have seen the strongest S&P 500 returns three months and 12 months out, and the second strongest returns six months out,” says Smith.

Source: LPL Financial.

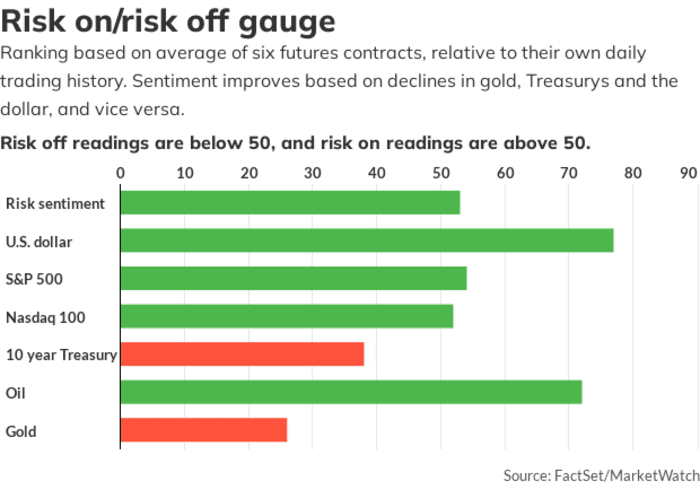

Markets

Stock index futures

ES00,

NQ00,

are higher and Treasury yields

TMUBMUSD10Y,

a touch softer. The dollar

DXY,

is weaker, helping gold prices

GC00,

firm while crude futures

CL.1,

are also gaining ground.

Try your hand at the Barron’s crossword puzzle and sudoku games, now running daily along with a weekly digital jigsaw based on the week’s cover story. To see all puzzles, click here.

The buzz

Apple

AAPL,

is reportedly restricting the use of ChatGPT among its workers on concerns over leaks.

Federal Reserve Chairman Jay Powell and former Fed chair Ben Bernanke will take part in a panel discussion at the Thomas Laubach Research Conference in Washington, D.C, starting at 11 a.m. Eastern.

Japan’s Nikkei 225

NIK,

hit its highest level since 1990. Inflation in the country re-accelerated in April to 3.4%, data released Friday showed. Inflation has been above the Bank of Japan’s 2% target for about a year, but new Governor Ueda said Friday he will continue with the ultra-loose monetary policy, which includes market support.

Meanwhile, Germany’s DAX 40

DAX,

is close to a record high.

Stock in Deere

DE,

the heavy equipment maker, are up 6% after profit and sales beat expectations by a wide margin.

Shares of Farfetch

FTCH,

are rallying nearly 18% in premarket action after the luxury fashion company reported a narrower-than-expected quarterly loss and sales that were above Wall Street views.

Applied Materials shares

AMAT,

are slipping nearly 2% after the chip-making equipment provider’s earnings topped Wall Street expectations, but its outlook wasn’t as robust as expected.

Best of the web

What if San Francisco never pulls out of its ‘doom loop’?

I asked ChatGPT to control my life, and it immediately fell apart.

Treasury bills seen as reasonable alternative to stocks for first time in 14 years.

The chart

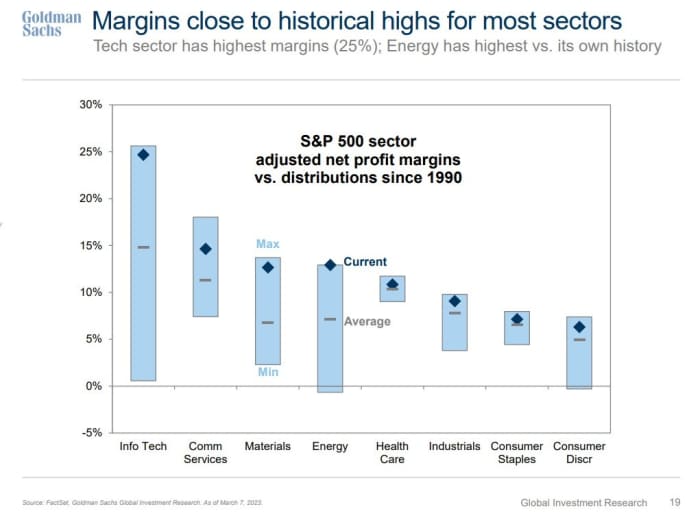

If contrarianism is your thing, then here’s one for the bears. The chart from Goldman Sachs shows how margins are close to historical highs for most sectors. Can that really continue during any economic downturn?

Source: Goldman Sachs.

Top tickers

Here were the most active stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

NVDA, |

Nvidia |

|

PLTR, |

Palantir Technologies |

|

BABA, |

Alibaba ADR |

|

AAPL, |

Apple |

|

AMC, |

AMC Entertainment |

|

AMZN, |

Amazon.com |

|

BUD, |

Anheuser-Busch InBev ADR |

|

NIO, |

NIO |

Random reads

Earliest recorded kiss may date back 1,000 years earlier than expected.

Office brainstorms are a waste of time. Who knew!

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton