This post was originally published on this site

Quick Take

Pliant Therapeutics (PLRX) intends to raise $90 million from the sale of its common stock in an IPO, plus another $10 million in a concurrent private placement, according to an amended registration statement.

The company is developing treatments for fibrosis, cancer and other serious medical conditions.

PLRX has produced very promising trial results, is well capitalized, has a strong collaboration and investment partner in Novartis (NVS) and the IPO appears to be reasonably priced.

Company & Technology

South San Francisco-based Pliant was founded to advance a pipeline of drug candidates to treat fibrosis (scarring) conditions, cancer and muscular dystrophies.

Management is headed by CEO and Director Dr. Bernard Coulie, who has been with the firm since February 2016 and was previously co-founder of ActoGenix N.V. and previously held various senior positions at Johnson & Johnson Pharmaceutical Research and Development Europe.

Below is a brief overview video of a brief presentation by Pliant:

Source: Pulmonary Fibrosis Foundation

The company’s lead candidate is PLN-74909, a dual selective inhibitor of TGF-Beta.The drug is currently in Phase 2 trials for idiopathic pulmonary fibrosis and is entering Phase 2 trials for primary sclerosing cholangitis.

However, the firm’s new focus will be on treatments for cancer and muscular dystrophy.

Below is the current status of the company’s drug development pipeline:

Source: S-1

Investors in the firm have invested at least $238.3 million and include Third Rock Ventures, Eventide Asset Management, Redmile Biopharma, Cowen Healthcare and Novartis (NVS).

Market & Competition

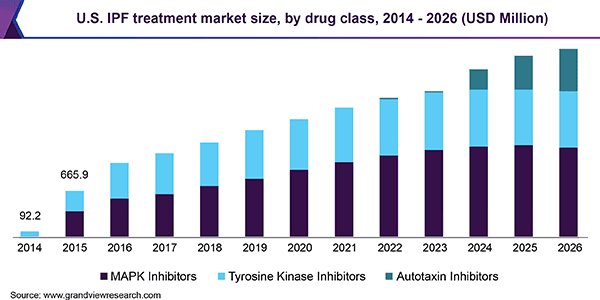

According to a 2019 market research report by Grand View Research, the market for idiopathic pulmonary fibrosis treatment was approximately $2.0 billion in 2018 and is expected to grow at a CAGR (Compound Annual Growth Rate) of 12.7% from 2019 to 2026.

Key elements driving this expected growth are a growing prevalence of the disease as a result of an aging global population.

In addition, cigarette smoking is a leading indicator of susceptibility for contracting the disease.

Below is the historical and projected future growth of the U.S. treatment market size through 2026:

Major competitive vendors that provide or are developing treatments include:

Financial Status

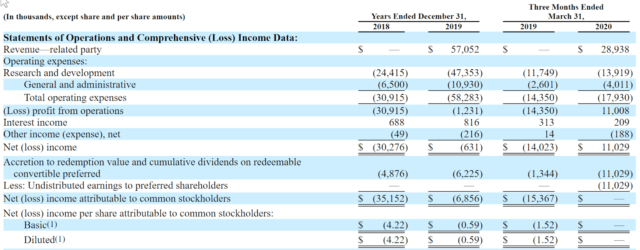

Pliant’s recent financial results are a bit atypical of most biopharmas in that the firm has reported substantial revenue in 2019 and Q1 2020 from its lead programs.

Below are the company’s financial results for the past two and ¼ years (Audited PCAOB for full years):

Source: Company registration statement

As of March 31, 2020, the company had $141.4 million in cash and $10.5 million in total liabilities. (Unaudited, interim)

IPO Details

PLRX intends to sell six million shares of common stock at a midpoint price of $15.00 per share for gross proceeds of approximately $90.0 million, not including the sale of customary underwriter options.

Existing shareholder and collaboration partner Novartis has indicated an interest to purchase shares of up to $10 million at the IPO price. This is a positive signal as to both valuation and scientific validation.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO would approximate $358 million.

Excluding effects of underwriter options and private placement shares or restricted stock, if any, the float to outstanding shares ratio will be approximately 19.2%.

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

We intend to use the net proceeds from this offering and the Concurrent Private Placement to fund the clinical development of our lead product candidate, PLN-74809, the preclinical development of our programs in oncology and muscular dystrophy, and the remainder, if any, for additional early-stage research and development activities, for business development activities, working capital and other general corporate purposes.

Management’s presentation of the company roadshow is available here.

Listed underwriters of the IPO are Citigroup, Cowen, Piper Sandler and Needham & Company.

Commentary

Pliant is seeking a slightly larger than usual IPO size plus an additional $10 million concurrent private placement with collaborator Novartis.

For its lead candidate, PLN-74809, the company is in or entering Phase 2 trials for pulmonary fibrosis and primary sclerosing cholangitis.

For its second clinical stage candidate, PLN-1474, the firm is collaborating with Novartis to treat stage F3/F4 liver fibrosis associated with NASH.

Early results have shown that PLN-1474 is ‘able to decrease the expression of pro-fibrotic genes such as COL1A1, the gene associated with the production of the most abundant type of collagen produced in fibrosis.’

The next data readout for the Phase 1 trial of PLN-1474 is expected by the end of 2020.

The market opportunities for various types of fibrosis conditions is large and growing significantly as global populations age resulting in increased incidence of fibrosis.

As to valuation, management is asking investors to pay an enterprise value of approximately $358 million (pro forma), which is in the middle of the typical range for biopharma IPOs.

Pliant is well capitalized, has an impressive investor partner and collaborator with Novartis and the IPO is reasonably valued.

Expected IPO Pricing Date: June 2, 2020.

Gain Insight and actionable information on U.S. IPOs with IPO Edge research.

Members of IPO Edge get the latest IPO research, news, and industry analysis. Get started with a free trial!

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.