This post was originally published on this site

Stock futures are slipping ahead of Tuesday’s open, following more fallout from China’s regulatory crunch, which drove Hong Kong’s Hang Seng index

HSI,

to its lowest since Nov. 4, 2020.

Of course, the Hang Seng also dropped 4% on Monday, and U.S. stock market indexes closed at record highs.

Whether or not investors should worry about what’s happening in the world’s second-biggest economy may be down to a few questions, Sven Henrich, founder of NorthmanTrader.com, tells MarketWatch: “Are they [China] concerned about an asset bubble and they’re letting the air out before it pops hard and does more damage? Or are they the canary that says the recovery has already peaked? Or both? One wonders. If either of these are true, then U.S. equities are at risk of spill over.”

That brings us to our call of the day from The Market Ear blog, which breaks down some potential risks ahead for markets and one possibility — big investors getting hurt by China fallout may end up less willing to take on risk elsewhere.

“The stress we are seeing in Chinese tech is now spreading to other sectors. Sure, for now this is a local problem, but it could potentially become a global problem, and this so mainly from risks in terms of P&L [profit and loss]. The value loss is significant, and the pain is felt globally,” said the blog.

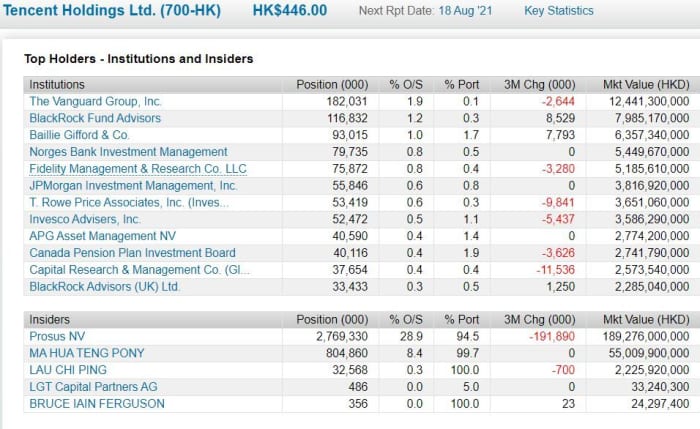

For example, the holders of Tencent

700,

— down 8% on Monday and another 7% Tuesday — are overwhelmingly non-Chinese, as holdings show:

FactSet Research

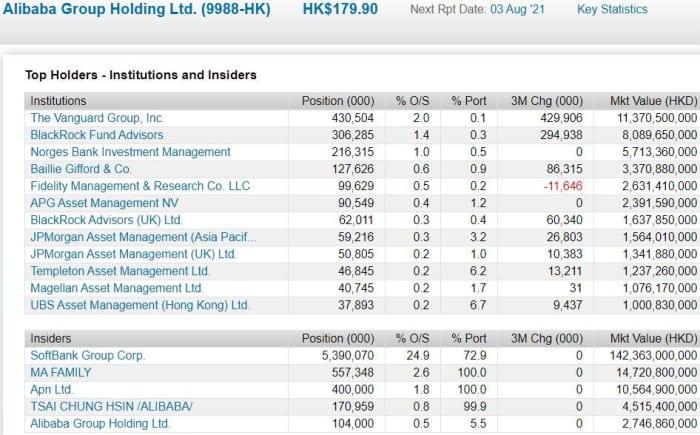

Then there’s Alibaba

9988,

which lost 6% Monday and the same Tuesday.

“BABA’s biggest holder is Softbank

9434,

This is a long term investment, but we all know when you lose big sums in one ‘trade’ you are not overly happy to take on more risk in other areas. There is also the possible effect of that losses in crashing assets is ‘financed’ by selling out profits (a fallacy too many still engage in),” the Market Ear blog said.

FactSet Research

“The latest casualty from last week was the edtech sector. Top 10 holders of TAL Education

TAL,

are all Western names. You get the point. Losses are not only a local problem. And we would not be surprised to see some hedge funds reporting significant losses for the month of July. With moves like these there is most of the time some blood in the water,” said the blogger.

Market Ear finishes off with a little history lesson about a boom in China stocks that began in mid 2014 and ended with a massive 2015 crash.

“During the first phase of the sell-off it was considered a local Chinese stock market bubble imploding. Some 2.5 months later, the [S&P 500] decided to care and developed markets puked big as the second phase of the Chinese equity sell-off resumed,” said the blogger.

Get ready for big tech earnings

Tech giant results are due after the close, as Apple

AAPL,

Google parent Alphabet

GOOGL,

and Microsoft

MSFT,

report results.

Read: Amazon reports after Thursday’s close. Here’s what to expect

Earnings are rolling out, with medical device maker Boston Scientific

BSX,

returning to a profit, package shipper United Parcel Service

UPS,

reporting upbeat results, while among conglomerates, 3M

MMM,

lifted its outlook and GE

GE,

posted a revenue beat. Chipmaker Advanced Micro Devices

AMD,

and coffee maker Starbucks

SBUX,

are also coming after the close.

Tesla

TSLA,

profit topped $1 billion for the first time in the electric car maker’s history and its sales nearly doubled, busting past expectations, though Chief Executive Elon Musk noted a “serious” chip shortage is cutting into output, and has delayed its commercial truck.

Intel

INTC,

shares are slipping after the chip maker unveiled a production schedule stretching to 2025.

Alongside the kickoff of the Federal Reserve’s two-day meeting, Tuesday will deliver data including durable goods orders, the S&P Case-Shiller home price index, the Conference Board’s consumer confidence survey and housing vacancies.

Read: How the 10-year Treasury rate and S&P 500 performed when the Fed tapered in 2013

On the COVID-19 front, U.S. officials issued a ‘do not travel’ order for Spain and Portugal, citing high infection levels.

The markets

Dow futures

YM00,

were down over 100 points, with those for the S&P 500

ES00,

and Nasdaq-100

NQ00,

also were softer. Bitcoin

BTCUSD,

has given up a chunk of its weekend gains after Amazon reportedly denied it was planning to accept cryptocurrencies by the end of the year, speculation fueled by a digital-themed job posting.

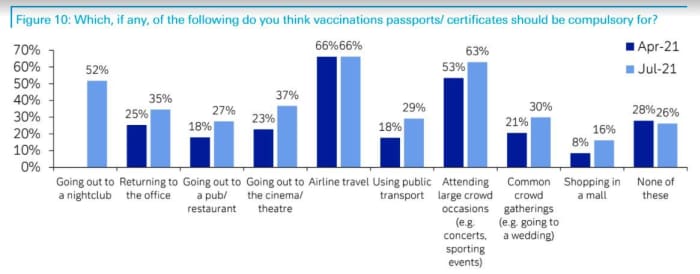

The chart

The results of Deutsche Bank’s July monthly market sentiment survey included plenty of insights into how people are feeling about COVID-19 rules. The below reveals many think airlines, nightclubs and any gathering of big crowds should ask for vaccine certificates.

Random reads

Ernest Hemingway lookalike winner is crowned at Sloppy Joe’s Bar in Florida.

Female weightlifter Hidilyn Diaz wins gold for Phillippines, her country’s first in 97 years. She’ll also get a house and 10 million pesos.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.