This post was originally published on this site

A partial government shutdown would be “credit negative” for the U.S., Moody’s said Monday, as time was running short to pass a stopgap budget ahead of a key Saturday deadline.

A shutdown “would demonstrate the significant constraints that intensifying political polarization put on fiscal policymaking at a time of declining fiscal strength, driven by widening fiscal deficits and deteriorating debt affordability,” said Moody’s, which has a triple-A rating for the U.S. government.

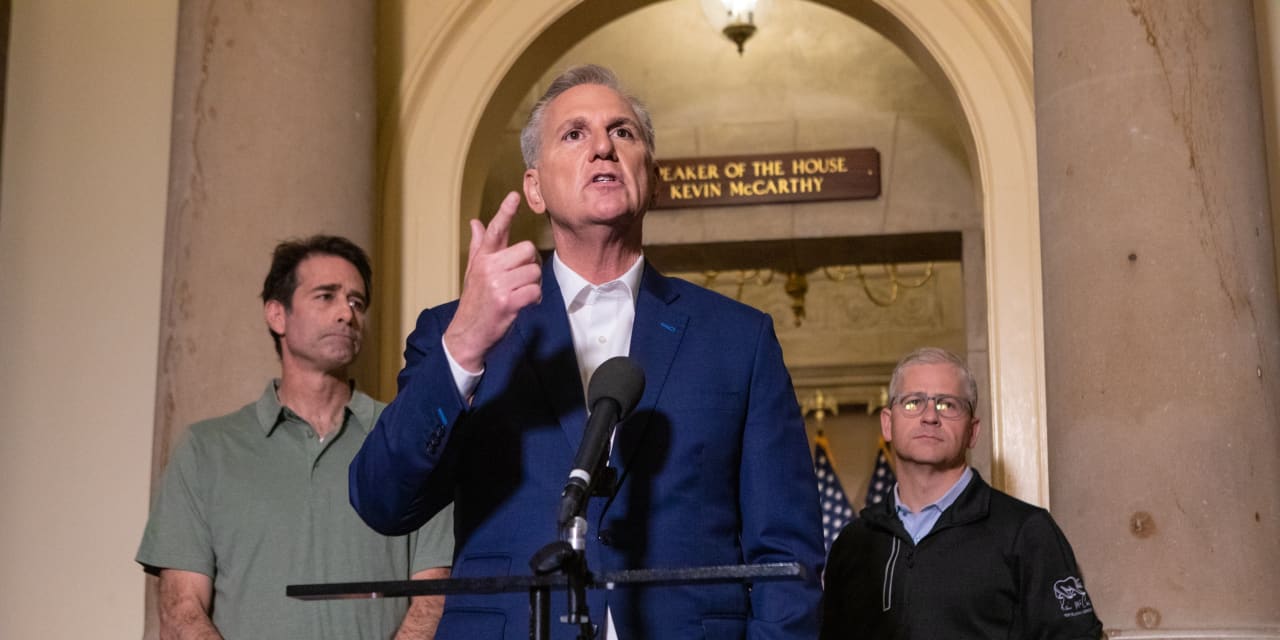

As MarketWatch has reported, hardline Republicans are brawling with House Speaker Kevin McCarthy over spending, and the California Republican may be forced to cut a deal with Democrats to keep the government open past midnight Saturday.

Some House Republicans are seeking spending targets for the coming fiscal year at levels below those in an agreement McCarthy struck with President Joe Biden in May to raise the debt ceiling. The fiscal year begins Sunday, Oct. 1.

If lawmakers don’t act before then, workers’ paychecks and environmental and food inspections would be at risk but the stock market

SPX,

from a historical perspective, would likely not be.

Now see: U.S. government shutdown: Here’s how a partial closure could affect you

Moody’s said the economic impact of a shutdown would likely be short-lived, but added, “the longer the shutdown persists, the more negative the potential impact on the broader economy.

“A prolonged shutdown would likely be disruptive both to the U.S. economy and financial markets.”

In August, Fitch Ratings cut its top U.S. credit rating to AA+ from AAA, pointing to “erosion” of governance and the nation’s expected fiscal deterioration over the next three years.