This post was originally published on this site

Stocks are looking somewhat tepid to start the week as bond yields and oil prices climb, and China’s growth let down. But the real thrills may be in the crypto universe, with expectations for the first bitcoin exchange-traded fund announcement as soon as Monday.

The excitement has pushed Bitcoin

BTCUSD,

to within a few percentage points of a record last hit in April at $64,889. Our call of the day, from James Bianco of Bianco Research, flagged what he termed “one of the most bullish things that has ever happened to crypto,” on his LinkedIn page on Sunday.

“Nearly 50% of the computing power (called hash rate) of the bitcoin blockchain, pulled the plug, packed up, and relocated to another country in a few months. And no one noticed! It signals an incredibly resilient system. I believe this realization is contributing to BTC above $60k again?” he said.

Bianco was referring to China, as this chart shows:

He credited the China pullout to a “catastrophic mistake,” saying that “when cryptos take hold as a legitimate medium of exchange, they will be left behind.” China last month declared all crypto-related transactions illegal.

“Combined with China’s regulatory crackdown in other industries, and why do we have a hard time believing that China is regressing? It seems to be the most plausible explanation,” said the strategist, who noted North America is dominating those hash rates.

“The Chinese handed an incredible opportunity to the U.S. and Canada to now dominate the digital currencies. Let’s not blow it,” added Bianco.

Speaking of mining, Twitter

TWTR,

and Square

SQ,

CEO Jack Dorsey tweeted late Friday that his digital payments group is considering “building a bitcoin mining system based on custom silicon and open source for individuals and businesses worldwide.”

Last word goes to crypto bull Raoul Pal, the chief executive officer of Global Macro Investor and co-founder of Real Vision financial and Crypto TV, who earlier this year predicted an ETF announcement would pave the road for bitcoin $250,000.

He said while a bitcoin ETF “gives people access to the space that couldn’t get access before,” investors should consider the middlemen.

“This vehicle means the arbitrages take their slice, the ETF provider takes their slice, the lawyer who set up the fund takes their slice, the administrator, the auditor. I mean everyone is taking a slice of your pie,” he said in comments over the weekend.

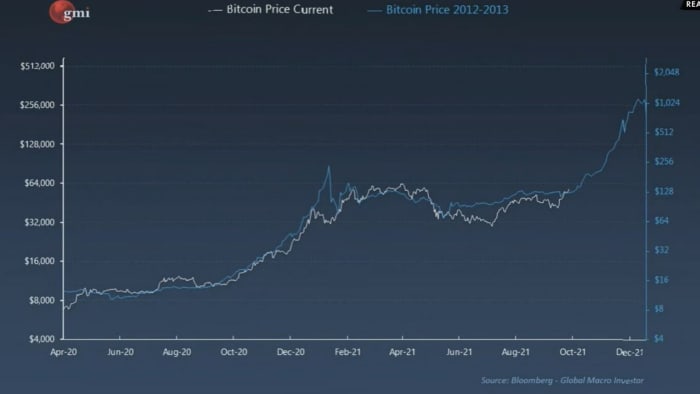

But as for crypto direction, he thinks “everything is about to start breaking out now and we’ve seen it before. We know the pattern…this October, November, December, January, February, March is going to be the point where it’s almost impossible to lose money by owning anything,” he said, pointing to this bitcoin chart:

Bitcoin’s price versus the 2012-13 bull market

Pal said bitcoin could hit $250,00 if that same pattern repeats, but he also sees upside into next year as institutions tend to allocate at quarter-end.

“They would have seen the FOMO [fear of missing out] of this quarter and many will be looking for a new opportunity to invest in 2022,” he said. So those institutions, hedge funds, etc. could be allocating more money toward crypto in January, said Pal.

That said, some investment advisers are “extremely skeptical” about that first U.S. bitcoin ETF.

The buzz

China growth slowed to 4.9% year-over-year growth in the third quarter, from a previous 7.9%, due to a construction slowdown. In the U.S., industrial production for September and the National Association of Home Builders index for October are both due after the opening bell.

State Street

STT,

reports Monday in a week that includes Johnson & Johnson

JNJ,

and Netflix

NFLX,

on Tuesday, Tesla

TSLA,

and Biogen

BIIB,

on Wednesday, and a bunch of others.

Speaking of Netflix, the hit South Korean show “Squid Game” is reportedly expected to rake in nearly $900 million for the streaming group.

Zillow

Z,

shares are tumbling, after Bloomberg reported that the real estate platform will pausing purchasing more U.S. homes to work through a property backlog.

Shares of Valneva

VALN,

surged 40% in Paris, after the French biotech said its COVID-19 vaccine candidate outperformed AstraZeneca’s

AZN,

AZN,

in a late-stage 3 trial.

Listen to the Best New Ideas in Money podcast.

The markets

Stock futures

YM00,

ES00,

are under pressure, led by tech

NQ00,

as bond yields rise, along with oil prices

CL00,

BRN00,

Natural-gas prices

NG00,

are tumbling. The dollar

DXY,

is also up. Elsewhere, it was a mostly weaker day in Asia

000300,

NIK,

after China growth data, and European equities

SXXP,

are stumbling.

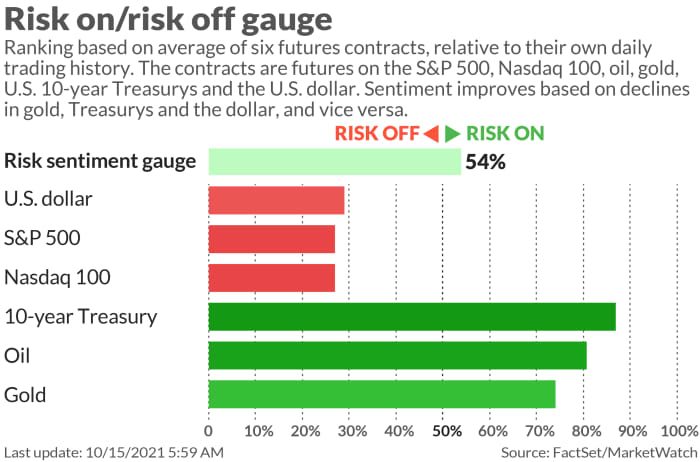

The chart

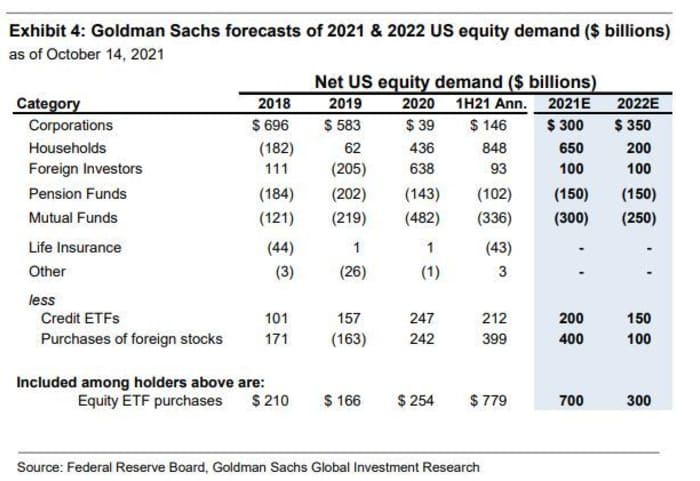

Last week, this column talked about TINA (there is no alternative) as rationale for stock markets to just keep moving higher.

A team of strategists at Goldman Sachs led by David Kostin predicts that a record 52% equity allocation for households, foreign investors, mutual funds and pension funds will keep rising in 2022 given “unattractive alternatives and high cash holdings.” Corporations will lead the charge, the bank said in a note.

Random reads

How singer Phil Collins got mixed up in a “Remember the Alamo” battle.

Crime author Carmen Mola, who just won Spain’s €1 million ($1.2 million) literary prize, is actually three men.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.