This post was originally published on this site

Investors remain anxious about Russia, but the S&P 500 index has minuscule exposure to the country while technology continues to dominate its weightings, according to BofA Global Research.

“The fate of Tech is far more important to the S&P 500 than geopolitics,” BofA equity and quant strategists said in a note on Tuesday. “The S&P’s direct Russia sales exposure is 0.1%”

The S&P 500, which closed in correction territory Tuesday amid fears of a further Russian invasion of Ukraine and the Federal Reserve’s hawkish tilt this year, is still heavily weighted toward technology. The sector’s weight remains near record levels at 28%, “even with Tech’s correction since December,” and is down just 1 percentage point from recent highs, the BofA strategists said in the note.

BOFA GLOBAL RESEARCH REPORT DATED FEBRUARY 22, 2022

Highly valued, high-growth tech stocks have been hard hit this year as the Fed moves toward raising its benchmark interest rate from zero this year, as such equities are viewed as sensitive to rate hikes. Shares of companies with profitability estimated far out into the future are particularly vulnerable to higher rates, which are used to calculate the current value of those expected future cash flows.

Information technology plus communication services, a sector the BofA strategists also referred to as “Tech Media Telecom,” makes up more than 40% of the S&P 500, their note shows. Within tech they said they favor companies with “healthy” free cash flows relative to their enterprise valuations.

“The worst strategy is Tech in the process of derating, which ends up purgatory or ‘dead money,’ and underperforms until rock-bottom valuations are reached,” the strategists wrote. “Today, Tech overall is in ‘Growth Purgatory’ rather than ‘dirt cheap, buy everything’ Tech.”

The tech-heavy Nasdaq Composite Index’s

COMP,

losses of more than 14% so far this year are deeper than declines posted by the S&P 500

SPX,

and Dow Jones Industrial Average

DJIA,

according to FactSet data Wednesday afternoon. The Nasdaq wasn’t far off a 20% retreat from its November record high, a threshold that would put it in a bear market.

Read: The Nasdaq Composite is nearing its first bear market in nearly 2 years. Here is the level to watch.

The strategists said that “higher rates, growth disappointments and a COVID inflection point are being priced in real-time.” Nasdaq earnings have been cut 0.5% since the third quarter, while S&P 500 earnings have gone up 2%, their note shows.

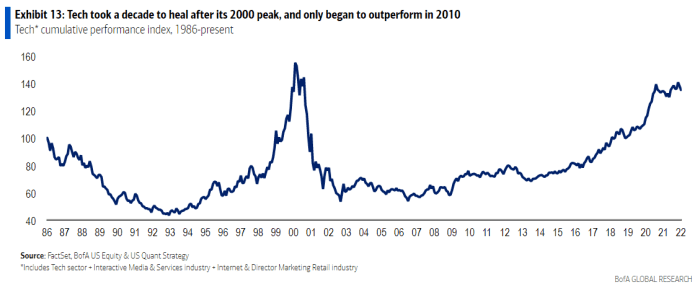

Following the tech bubble that peaked in 2000, it took about a decade for the sector to recover and regain its lead, according to the strategists.

“During that period, many companies went away,” they said. “Those that remained consolidated capacity, repaired balance sheets and began to return capital.”

BOFA GLOBAL RESEARCH REPORT DATED FEBRUARY 22, 2022

“When do you buy all of Tech?” the strategists wrote in their note. “When everyone stops asking when to buy Tech. Before that it might be a falling knife or dead money.”

In a note emailed Wednesday, DataTrek Research looked at future earnings estimate revisions for the top 10 holdings in the Ark Innovation ETF

ARKK,

and found that Wall Street analysts are still cutting estimates on most of them. Two exceptions were Tesla Inc.

TSLA,

and UiPath Inc.

PATH,

whose earnings revisions are up for both 2022 and 2023, wrote DataTrek co-founder Nicholas Colas.

Cathie Wood’s Ark Innovation ETF has plunged more than 33% this year, including Wednesday afternoon trading, FactSet data show.

“This is not to bash Ark or Cathie Wood; we respect what she has built and understand her perspective on disruptive technology,” Colas said in the note. Rather, he used Wood’s Ark Innovation ETF as “a proxy for a basket of troubled tech” stocks and sought to “point out that ‘speculative tech’ names still have not turned the corner in terms of future earnings revisions.”