This post was originally published on this site

Wall Street is wobbling ahead of Tuesday’s open, as big earnings loom and with ample, gloomy distractions out there.

Fighting has ramped up again in Ukraine as the battle begins for the country’s eastern front. Apart from the tragic humanitarian crisis, the conflict is already causing the World Bank and others to cut their global growth forecasts.

Where to invest against such a volatile backdrop? Our call of the day from Goldman Sachs strategists offer up a group of equities they say can hold their in these uncertain times.

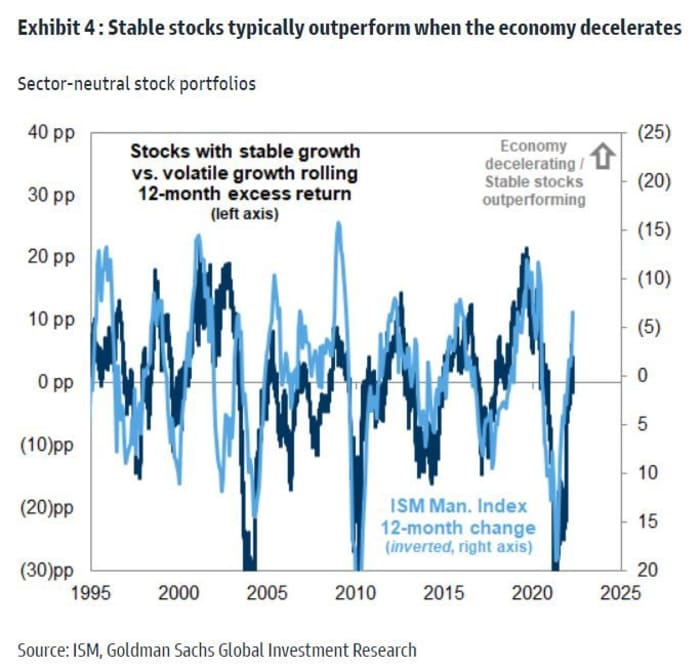

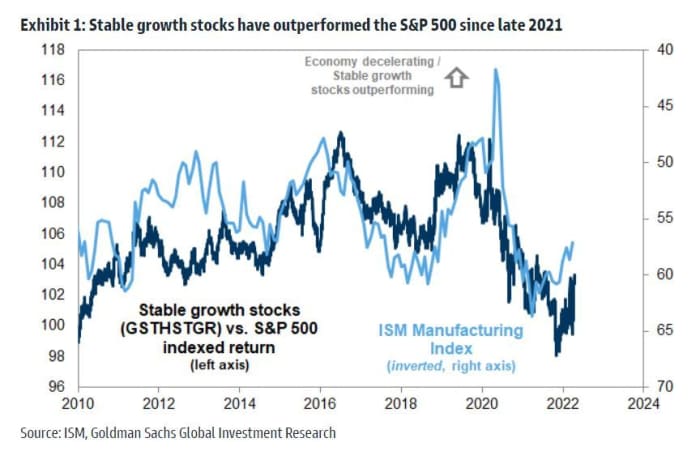

“Stable stocks –- those with low share price and earnings growth volatility -– typically outperform in environments of slowing economic growth and tightening financial conditions,” say a team led by Ben Snider and David Kostin in a note from late Monday.

After lagging dramatically against a strong global economic backdrop for the past two years, their stable stocks basket has outperformed the S&P 500

SPX,

by 5 percentage points over the past six months, with more “room to run,” they say.

Those stocks remain cheap, trading at a price/earnings premium of around 8% versus a 35-year average of 15%. During a similar batch of slowing growth and Fed tightening in 2018, the premium hovered at 20% for that group, they note.

“Despite recent outperformance, stable stocks do not appear to be pricing the slowdown suggested by recent industry rotations or our economists’ GDP forecasts,” said Goldman.

As for the stock names, their stable basket consists of 50 Russell 1000

RUI,

stocks with the most stable EBITDA growth over the past 10 years. Excluded are those whose biggest year-over-year earning fall in the past five years ranked in the bottom 10% of their sector. Stocks in the bottom 10% of their sector based on consensus 2023 EPS expectations are also excluded.

Below are roughly 30 of the 50 stocks Goldman listed:

Financials names include Marsh & McLennan

MMC,

Bank of New York

BK,

Nasdaq

NDAQ,

and Northern Trust

NTRS,

while Sonoco Products

SON,

is the sole materials stock. ResMed

RMD,

Amgen

AMGN,

Johnson & Johnson

JNJ,

and Cerner

CERN,

are among the healthcare names, Verisk Analytics

VRSK,

and Waste Management

WM,

for the industrials names and AmDocs

DOX,

CDW

CDW,

Oracle

ORCL,

Western Union

WU,

Paychex

PAYX,

and VeriSign

VRSN,

are within a huge batch of IT names.

Finally, the bank named American Tower

AMT,

for real estate and Xcel Energy

XEL,

for utilities.

The buzz

Netflix

NFLX,

is in the earnings spotlight, with investors looking for a rebound from the streaming giant’s results, due after the market close. Ahead of that, Johnson & Johnson

JNJ,

stock is down on disappointing results and Hasbro

HAS,

also falling on earnings news. IBM

IBM,

is also reporting late.

Plug Power

PLUG,

shares are climbing on a liquid green hydrogen delivery deal with Walmart

WMT,

American Campus stock

ACC,

is jumping on a WSJ report that Blackstone is close to a $12.8 billion deal for the biggest developer and owner of student housing in the U.S.

United

UAL,

Southwest , American

AAL,

, Alaska Air

ALK,

Delta

DAL,

and JetBlue

JBLU,

are creeping higher after a judge in Florida struck down the national mask mandates for the transportation sector and those companies dropped mask mandates. There was cheering and jeering on some flights:

St. Louis Fed President James Bullard said he wouldn’t rule out a 75-basis point rate hike, with Chicago Fed President Charles Evans and Minneapolis’s Neel Kashkari due to speak Tuesday. Ahead of that, data showed a rise in housing starts.

As G20 finance ministers and central bankers meet in Washington, the International Monetary Fund, followed up the World Bank’s warning that the Ukraine war will take a toll on the global economy.

Russia has issued a new ultimatum to Ukrainian holdouts in Mariupol, as its forces launched a fresh attack on the eastern front of the country in what many see as a new phase of the war.

The markets

Stock futures

YM00,

NQ00,

were steady, while bond yields

TMUBMUSD10Y,

TMUBMUSD02Y,

hold steady. Oil

CL00,

BRN00,

and natural-gas prices

NG00,

are down. Europe stocks

SXXP,

are falling and Asia was mixed, with a 2% tumble for the Hang Seng

HSI,

led by tech despite a supportive move by China’s central bank. Elsewhere, the Japanese yen

USDJPY,

keeps sliding and cryptos are bouncing back with bitcoin

BTCUSD,

back over $40,000.

The chart

“While the close proximity in the timing between the first [Fed] hike and curve inversion perhaps points to a more truncated late-cycle period this time, the current cross-market setup does not point to a return to the correlation between curve flattening and subsequent bearish equity performance that existed during the late-1960s and through most of the 1970s,” said a JPMorgan team led by Jason Hunter.

They see a likely floor for the index at 4,100 to 4,300, and “view the current price action as a consolidation related to the initial removal of accommodative monetary policy.”

The tickers

These were the most-searched tickers on MarketWatch as of 6 a.m. Eastern Time:

| Ticker | Security name |

|

TSLA, |

Tesla |

|

GME, |

GameStop |

|

AMC, |

AMC Entertainment |

|

ATER, |

Aterian |

|

NIO, |

NIO |

|

TWTR, |

|

|

MULN, |

Mullen Automotive |

|

AAPL, |

Apple |

|

NVDA, |

Nvidia |

|

NILE, |

Bitnile |

Random reads

Longtime MSNBC national security analyst joins the fight in Ukraine

The “cash me outside” teen who shot to fame by trying to fight Dr Phil, pays all cash for $6.1 million mansion.

Need to Know starts early and is updated until the opening bell, but sign up here to get it delivered once to your email box. The emailed version will be sent out at about 7:30 a.m. Eastern.

Want more for the day ahead? Sign up for The Barron’s Daily, a morning briefing for investors, including exclusive commentary from Barron’s and MarketWatch writers.