This post was originally published on this site

Goldman Sachs is dredging up some old new terms in a bid to accurately describe a changing global economic order.

The word deglobalization has been on the lips of many economists, who see a looming breakdown of decades of free movement of goods and people in the wake of the pandemic, a U.S.-China trade war, and now the biggest and most devastating ground war on European soil since WWII.

Read: War in Ukraine will lead to a significant slowdown in global economy, IMF says

Weighing in, a Goldman team led by its chief economist Jan Hatzius sees something deeper going on. “We take a longer perspective and ask if globalization—the growth in cross-border movement of goods, capital, people, technologies, data, and ideas—has already started to reverse,” they wrote in a note from Wednesday.

They say so-called slowbalization — slowing growth in cross-border movement —- better describes trends for goods, capital and people over the past 10 to 15 years than does deglobalization.

Under that slowbalization umbrella, they discuss how cross-border flows of direct and equity portfolio investment have fallen sharply relative to global economic growth since the 2000s. And immigration flows for advanced economies have been trending down over the past decade, though the number of those born abroad is a little higher. Global tourism was trending higher right up to the pandemic, notes Goldman.

And exports of computers and communication services as a share of GDP are steadily gaining, while cross-border flows have climbed. In Hatzius’s view, deglobalization — outright declines in cross-border flows and stocks — is simply less accurate.

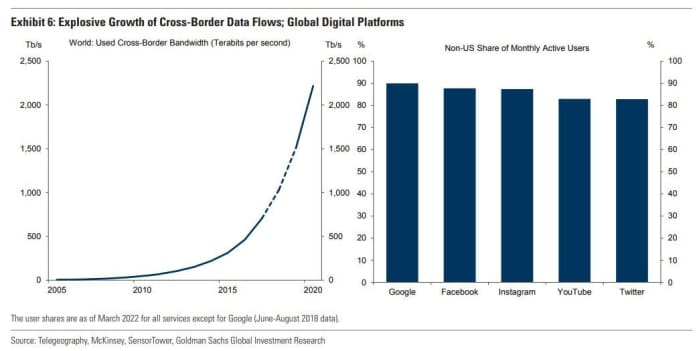

A surge in digital cross-border activity also supports another term they toss about — newbalization, which is slowing globalization in tangible areas, but acceleration in intangibles. For example, used cross-border internet bandwidth is 115 times bigger than it was in 2008, with content providers such as Google

GOOGL,

Facebook

FB,

Instagram or Netflix

NFLX,

in the driver’s seat, according United Nations Conference on Trade and Development data, they noted.

Uncredited

The term slowbalization seemed to be trending in 2019 and then popped up during the pandemic, so Goldman didn’t exactly make it up. In its outlook for 2021, Vanguard predicted a slowbalization — or a gradual slowdown in trade — from the pandemic, rather than what it saw as a more pessimistic deglobalization. Newbalizing, however, may just be Goldman’s own term, based on Google searches.